Global stock markets fell on Monday as investors turned their attention to the ever-increasing risk of more aggressive interest rate hikes from the US and Europe, which has pushed the US dollar to a 20-year high and stoked the flames of recession fears.

On Friday, US Federal Reserve chair, Jerome Powell, said the central bank would raise rates as high as needed to stop inflation growth while indicating that once the rates had been increased it would be unlikely they would be decreased soon.

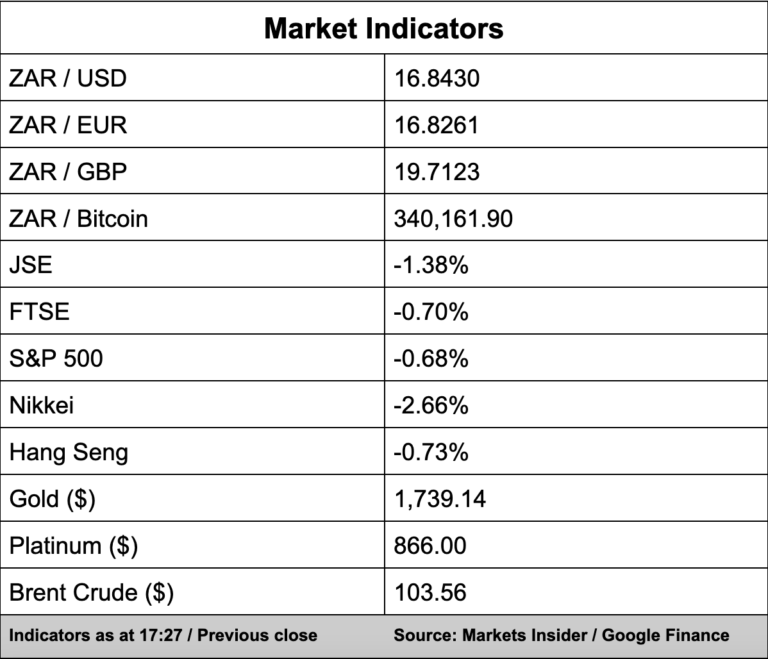

On the local bourse, the JSE slumped nearly 1.5% with the All Share Index closing at 69,207 points.

In its half-year results, released on Monday morning, Massmart reported losses of nearly R1 billion as the retailer continues to struggle following the covid-19 pandemic, the July 2021 unrest and the flooding in KwaZulu-Natal earlier this year.

US retailer and majority owner, Walmart now plan to table a R6.4 billion offer to buy out the minority shareholders of Massmart and take the company private.

Since Walmart bought its initial stake in the company back in 2010, the deal has been disastrous for the US retail giant with the value of its investment slumping some 80%.

Walmart is offering R62 per share in cash, which is 53% higher than Massmart’s closing share price on Friday.

Massmart’s share price surged a massive 44.85% on the back of the news.

Massmart CEO Mitch Slape will step down from his role at the end of the year with Jonathan Molapo becoming the new head of the company.

Sun International (1.00%) said headline earnings per share have doubled to 93 cents for the half-year while income has increased by 37% to R5.2 billion.

Due to the strong performance, the board declared an interim dividend of 88 cents per share, which would be the hotel and leisure company’s first since 2016.

Private education provider, ADvTech, which owns brands like Abbotts College, Crawford College, Vega School, Varsity College and Rosebank College, said revenue increased by 18% to R3 380 million for the six months to the end of June.