Chinese cars, televisions and smartphones are replacing German and South Korean imports in Russia as its market is reshaped by sanctions and an exodus of brands in the wake of Vladimir Putin’s invasion of Ukraine.

(Bloomberg) — Chinese cars, televisions and smartphones are replacing German and South Korean imports in Russia as its market is reshaped by sanctions and an exodus of brands in the wake of Vladimir Putin’s invasion of Ukraine.

The result is upending trade, with Russia seeking to insulate itself from further disruptions by pivoting to goods from countries that haven’t joined sanctions imposed by the US and its allies. Moscow is also rewriting rules to allow its sovereign wealth fund to invest in the currencies of China, India and Turkey, after penalties blocked euro and dollar purchases.

“Apart from Chinese cars, there is nothing out there at all,” said Vladimir, a metals industry executive who bought a new Chery Automobile Co. Tiggo SUV in Moscow this month. He declined to give his last name.

“Still, there’s a decent amount of choice and, surprisingly, the cars are very good,” he said.

The war has accelerated Russia’s tilt toward Asia, with shifts that had previously taken years happening in months. The transformation draws a line under a process begun near the start of Putin’s more than two-decade rule, with similar changes sweeping the economy from the banking sector to energy sales.

Sales of Great Wall Motor Co. and Geely Automobile Holdings Ltd. vehicles held steady in July, even as the auto market collapsed by 75% compared to a year earlier, propelling their brands into the ranks of best-selling cars. Last quarter, 81% of new car imports were Chinese, compared with 28% in the first quarter, according to Avtostat data.

The Russian central bank said in an Aug. 24 report that business sentiment in the auto trade turned positive for the first time since the February invasion as the market shifted from European producers to Asian cars.

Samsung Dethroned

The smartphone market has also shifted in China’s favor, with Apple Inc. and Samsung Electronics Co. suspending shipments. While their products are available via parallel, or gray, imports that don’t have the manufacturers’ blessing, such sales can put off consumers because they are more expensive and not under warranty.

Xiaomi Corp. was Russia’s best-selling smartphone maker in the second quarter, dethroning Samsung, and three of the top five brands were Chinese, according to Mobile TeleSystems PJSC, the country’s biggest mobile operator.

“There is a redistribution going on,” said Alexey Zaitsev, the head of e-commerce platform Ozon Holding Plc’s telecommunications division. “We are seeing increased demand for Android smartphones of Chinese brands.”

Demand for Chinese television sets nearly doubled after the invasion as Japanese and Korean companies stopped shipments, Izvestia newspaper reported last month, citing online retailers.

The boom comes as retail sales have suffered their worst crash since the coronavirus pandemic, shrinking close to 10% each month on an annual basis in April-June. Spending by households in Russia accounts for more than half of gross domestic product.

Yuan Trading

Trade with Beijing was rising even before the war, and China supplying about 25% of Russia’s total imports last year. Yet the relationship is asymmetrical, with the Russian market accounting for 2.3% of Chinese exports.

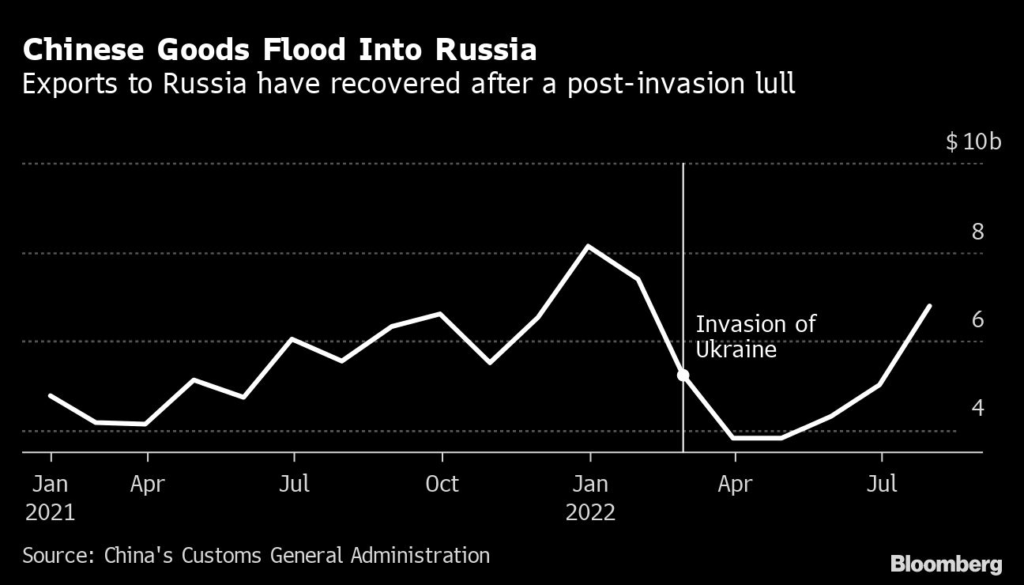

Moscow needs the supplies more than ever as its consumers facing a future with fewer choices. Russia bought $6.7 billion of goods last month from China, up by more than 20% from a year earlier. Bilateral trade, fueled by higher energy prices, could grow by more than a third to $190 billion in 2022, Tass reported Aug. 17, citing a Russian official.

With China an ever-more essential partner, yuan trading has risen more than 40-fold on the Moscow Exchange so far this year and “has now started to dominate trading in other more traditional currencies,” according to Ivan Tchakarov, Citigroup’s chief economist for Russia.

More Chinese companies are figuring out how to import into Russia without running afoul of sanctions, according to Boris Kopeikin, an analyst at the Center for Strategic Research, a Moscow-based think tank.

“The pace is picking up and by the end of the year we will see much wider choice of Chinese goods,” Kopeikin said.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.