The JSE came under immense pressure on Thursday and dropped a further 1.84% to record its fifth straight day of losses hitting a low last seen in early July, amid a global market sell-off while there was a mid-to-small cap blood bath on the bourse as results or future results failed to impress traders.

The All Share Index slumped to 66,022 points.

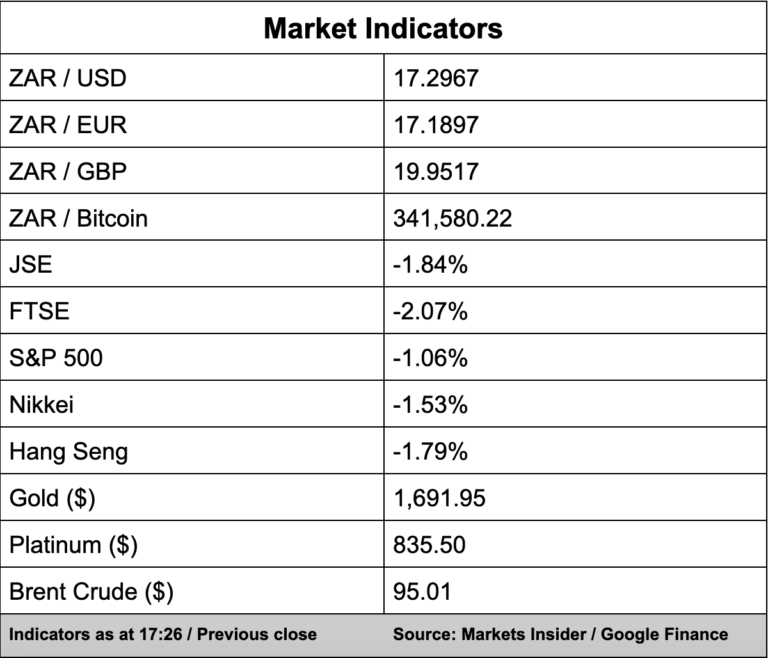

The FTSE global index as well as mainland China’s CSI 300 dropped lower Thursday as Chinese manufacturing data came in lower than expected and Chengdu, an important manufacturing hub, was closed as local authorities fight another outbreak of Covid-19.

In company news, Sea Harvest (-0.34%), Murray & Roberts (-0.56%), Novus (-1.56%), and Cashbuild (-5.72%) are some of the mid-to-small cap listings that took a beating on Thursday.

Insurer Santam (0.08%) said profits were decimated by an unprecedented level of claims in the first half of the year following the flooding in KwaZulu-Natal. The group describe the period as “one of the most challenging underwriting periods in the company’s history.”

The floods cost the insurer R4.4 billion in gross claims alone with total claims paid out for the six months to end June, totalling R14.2 billion.

Impala Platinum (-6.20%) said profit would be down almost a third as the mining company faced lower metal prices and dealt with several operational issues that hampered the business. Profit for the year ended in June came in at R33.13 billion, a decline of 30.8% from the previous year.

Headline earnings fell by 12% to R32 billion while revenue slumped 9% to R118.3 billion.