A proposed merger between two of France’s biggest television companies to better compete with fast-growing streaming services like Netflix Inc. looks increasingly unlikely in the face of regulatory opposition.

(Bloomberg) — A proposed merger between two of France’s biggest television companies to better compete with fast-growing streaming services like Netflix Inc. looks increasingly unlikely in the face of regulatory opposition.

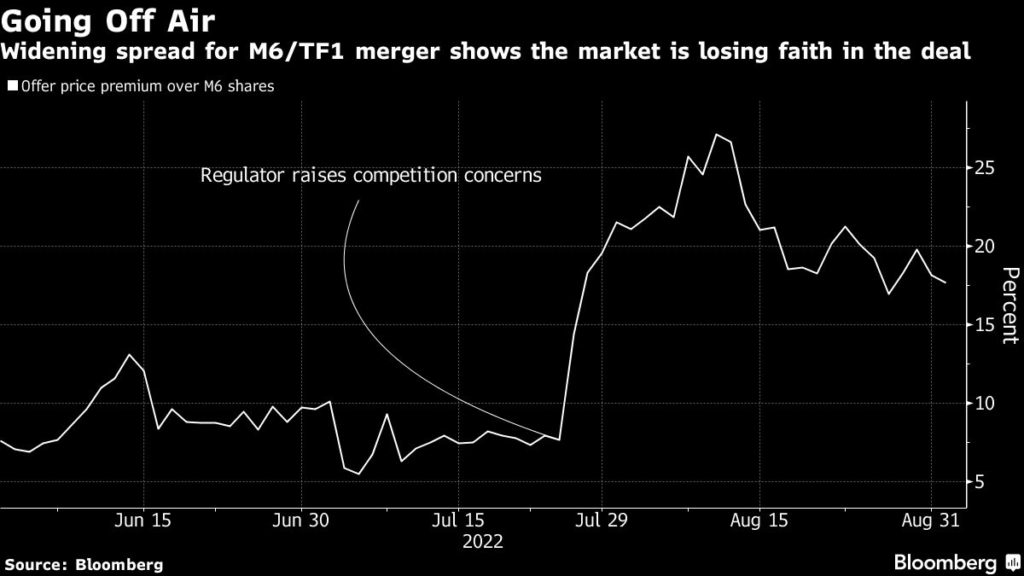

The French Competition Authority raised significant concerns in advertising over a tie-up between Television Francaise 1 SA and Groupe M6 that’s threatening the viability of a deal. The final decision is due by Oct. 17, but M6 is trading 17% below the offer price, signaling that the market sees the merger as unlikely to succeed.

TF1 and M6 are defending the plan in front of the regulator on Monday and Tuesday. They may well bring up recent decisions by streaming giants Disney+ and Netflix to add cheaper subscriptions that include ads to make their case.

“We would be surprised if a deal that effectively gives the combined entity 75% of the advertising market went through without some intervention,” said Graham Simpson, analyst at Canaccord Genuity’s research division Quest. “Some channels would have to be sold to satisfy the commission. However, management have made clear selling the flagship channels is a deal-breaker.”

Representatives from TF1 and M6 declined to comment. The head of M6, Nicolas de Tavernost, made it clear in a Telerama interview last week that he was still willing to convince the authority, saying the French now spend more time on YouTube than on TF1.

There’s a lot riding on the deal for two other companies: French construction and telecom conglomerate Bouygues SA, which is TF1’s biggest shareholder, and German media giant Bertelsmann SE, the largest owner of M6 via publicly traded RTL Group SA. Under the terms of the merger, Bouygues would end up as the controlling shareholder of the combined broadcaster, though it’s agreed to work in concert with RTL.

Aside from being the leader in France in terms of viewership, TF1 broadcasts the most popular news program in the country and hit shows like The Voice and celebrity dance competition Danse avec les stars. M6, the country’s most profitable private TV channel, is known for talent shows like Top Chef and airs popular TV series from the US. The companies compete for viewers with state-owned France Televisions, which operates four channels in mainland France but doesn’t carry advertising after 8 p.m.

Traditional free-to-air TV still accounts for the bulk of viewing time, but most of the growth is in streaming platforms. A tie-up between TF1 and M6 at this stage is seen as a defensive move that would create a stronger player in the market to go up against the likes of Netflix, Disney+ and Amazon.com Inc.’s Prime platform.

“This merger is the most important event in French TV since TF1’s privatization 35 years ago, as it would permanently reshape the domestic landscape,” said Societe Generale SA analyst Christophe Cherblanc. “It would be a setback for France’s TV landscape if the regulator blocks the deal, as the market won’t benefit from a huge player that would have invested in more content.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.