The JSE slumped 1.22% as investors took in the US economic data which prompted a ramp-up in bets that the Federal Reserve will introduce further interest rate hikes while the rand slumped to a two-year low against the dollar.

Several top Fed officials have commented in recent weeks that the Fed’s main focus is bringing down inflation from four-decade highs, even if that means sending the economy into a recession, reports AFP.

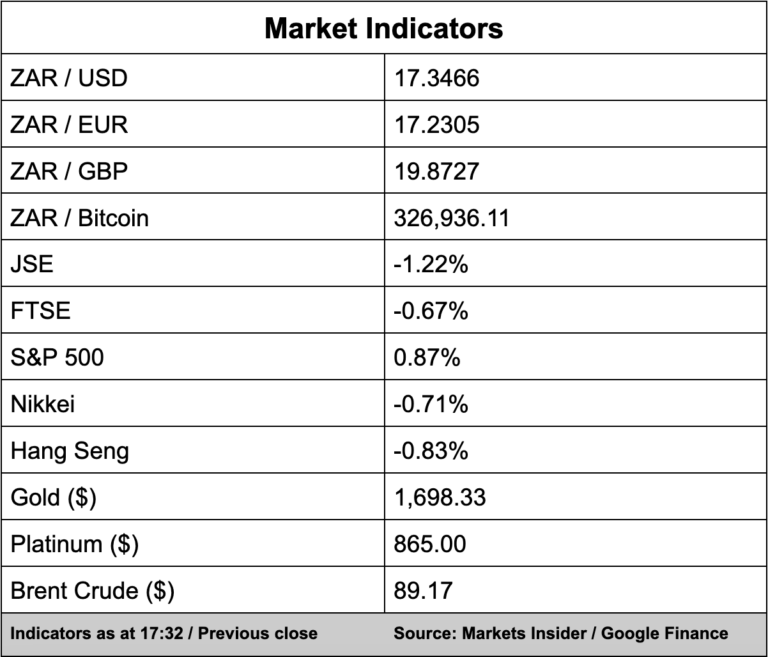

The prospect of sharp interest rate hikes has sent the dollar soaring this year while the rand weakened to its lowest level against the greenback in two years at around R17.34/$.

The All Share Index closed at 66,716 points.

Global stock markets were mixed on Wednesday with European stocks opening in the red while a fresh sell-off hit Asian equities as concerns over a stronger dollar and rising global interest rates added to pressure on capital flows.

Bloomberg reports the MSCI Asia Pacific Index dropped as much as 1.8% to its lowest level since May 2020 with most sectors in the red.

“Tech shares led declines, given the sector’s sensitivity to higher borrowing costs and the global economy. Benchmarks in Taiwan, Hong Kong and South Korea fell the most, with the former two edging toward a 2% slide.”

The MSCI Asia Pacific Index closed 0.65% down.

Back on the JSE, insurer Discovery reported a massive increase in earnings with profits up by three quarters in its year to the end of June. Headline earnings per share jumped 74% to R5.2 billion.

The company has focused on strongly growing its Discovery Bank business to scale, however, for the current year the bank still lost nearly R1 billion while the strongest performing segments are from its South African operations. Discovery Life had a 200% increase in profit to R4 billion while Discovery Health had a profit of R3.6 billion.

The group decided against declaring an ordinary dividend citing a “volatile global macroeconomic environment,” while its shares slumped some 10.11% to R110.70 a share.

Shares of fashion retailer The Foschini Group jumped 3.74% after it cited strong retail sales growth so far in its 2023 year.

Group retail turnover grew 21.6% in the first 23 weeks of the 2023 financial year with TFG Australia’s turnover growing 42.3%.

TFG Africa generated retail turnover growth of 14.7% compared to the same period in the previous year, the group said.