More crypto traders are shorting Ether in the derivatives market, as the underlying blockchain is scheduled to go through its biggest technical upgrade this week, trading data shows.

(Bloomberg) — More crypto traders are shorting Ether in the derivatives market, as the underlying blockchain is scheduled to go through its biggest technical upgrade this week, trading data shows.

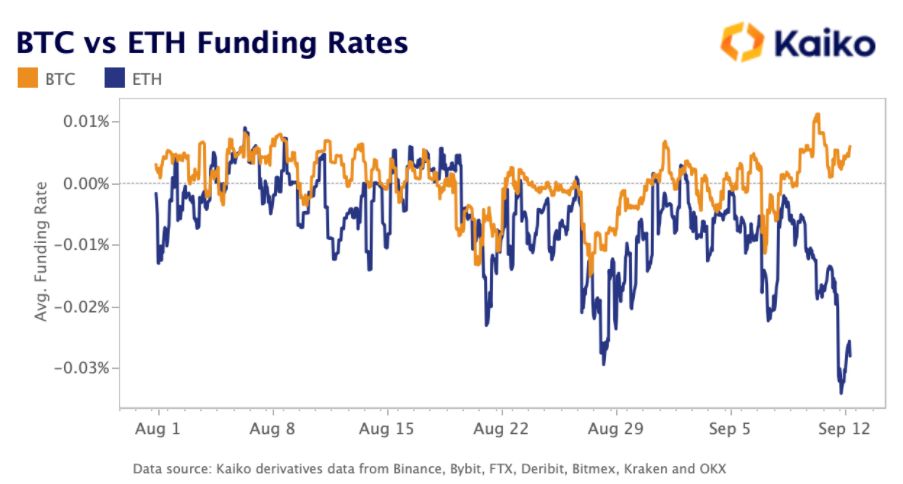

The funding rates of Bitcoin and Ether perpetual futures contracts diverged sharply over the past weekend, according to crypto data firm Kaiko.

The funding rate for Ether dipped to its most negative since July 2021. Exchanges use the funding rate — or the cost to trade — to tether the contracts to their underlying spot price. When the rate is positive, those who hold long positions are paying interest to investors who are short, and vice visa.

Crypto traders tend to favor perpetual contracts — which, unlike traditional calendar futures, don’t expire — in part, because it allows them to keep highly leveraged positions in place.

Ether fell for the first time in six trading sessions on Monday, dropping as much as 3.7% to $1,694.

The growing short interest in Ether is happening as the Merge, the highly anticipated upgrade on the Ethereum blockchain, is expected to take place this week.

The upgrade is set to move Ethereum’s current system of using miners to a more energy-efficient one using staked coins.

“With the Merge happening this week, it could be that folks are hedging as the price of ETH has mostly increased while funding rates have gone negative,” said Andrew Tu, head of growth for crypto algorithmic-trading firm Efficient Frontier.

A lot of investors are hedging their long spot positions of Ether, according to Zaheer Ebtikar, portfolio manager at crypto hedge fund LedgerPrime.

Shorting Ether on the derivatives market is one way to hedge their risk.

Another reason to be long Ether on the spot market, said Ebtikar, is that traders can receive “free money” from efforts by some Ethereum miners to keep a different version of Ethereum running by miners still.

Meanwhile, some traders also expect the Merge will become a “sell-the-news” event for the market.

Ether surge fivefold last year and reached a record high of about $4,866 in November. It has dropped about 50% this year.

“Investors in the perpetual futures market broadly agree that most of Ether’s positive fundamental catalysts have already been priced, with little further upside expected following the Merge,” Gabriel Selby, lead research analyst at crypto exchange Kraken-owned CF Benchmarks, said.

An extreme negative funding rate means that short traders are paying expensive fees to keep their positions open.

“The mentality of a trader is also very different than a long-term investor — in this case they just think for that two-to-three days it’s fine to pay if they think that ETH will go down considerably,” Ebtikar explained.

“If the bet is that this is ‘sell the news’ and that spot ETH will sell off, then it’s worth it.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.