Investors are pulling cash out of exchange-traded products tied to Ether, the world’s second-most-valuable cryptocurrency, ahead of the much-anticipated upgrade of its underlying Ethereum blockchain, which is expected to take place as early as Wednesday.

(Bloomberg) — Investors are pulling cash out of exchange-traded products tied to Ether, the world’s second-most-valuable cryptocurrency, ahead of the much-anticipated upgrade of its underlying Ethereum blockchain, which is expected to take place as early as Wednesday.

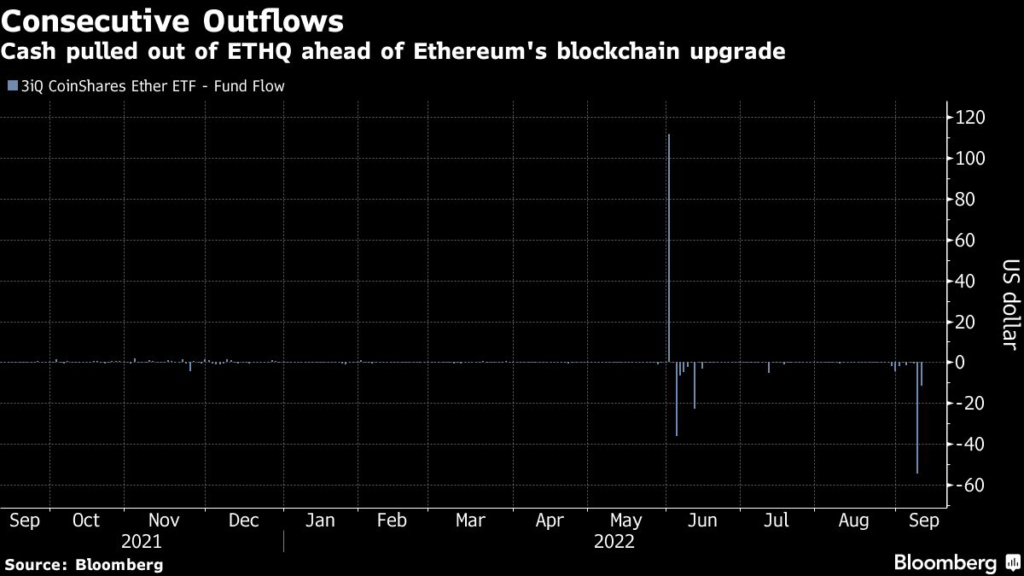

Leading up to the upgrade, dubbed the Merge, 3iQ CoinShares Ether ETF (ticker ETHQ), with nearly $20 million in assets, saw three straight days of outflows to the tune of about $66 million — the largest amount of outflows in one-week among crypto ETPs.

“This is very likely related to the ETH merge,” said Stephane Ouellette, chief executive of FRNT Financial Inc, a crypto brokerage firm. “There are multiple benefits from holding physical ETH ahead of the merge that don’t necessarily exist when holding an ETH product or derivative.”

Funds linked to Ethereum posted outflows of around $105 million in the past month. Meanwhile, Ether is falling for the second straight day, dropping as much as 8.6% to about $1,576 on Tuesday at 12:10 p.m. New York time.

For investors, Ether post-Merge will resemble more of a traditional financial asset that pays interest, like a bond or a certificate of deposit, which could entice hedge funds, asset managers and wealthy individuals who’ve stayed on the crypto sidelines so far.

“It is widely expected that there will be a ‘fork’ where holders of spot ETH will receive both the new POS chain and a POW ‘forked’ token,” Ouellette said, referring to the Merge taking the existing proof-of-work software and shifting it to proof-of-stake creating two different versions of Ethereum.

“With the chain moving to POS, physical holders of ETH tokens will now be able to stake their ETH — which is expected to provide an in-kind yield of about 4%-8%,” he added.

Most derivative products and ETPs are unlikely to give holders exposure to the POW fork or the staked yields post-Merge, Ouellette said. This explains why more crypto traders are shorting Ether in the derivatives market, recent data shows.

“Until we get some stability in the markets, meaning inflation directionally falling, Fed pausing, proof of continued earnings stability, the risk-off sentiment will continue and impact flows into crypto-related funds,” Sylvia Jablonski, chief executive officer and chief investment officer of Defiance ETFs, said. “They are essentially lumped into that high-growth, risk asset profile, and investors are pausing there.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.