Cryptocurrencies traded in tight ranges Thursday as the clock ticked down to a major software upgrade of Ethereum, the most commercially important blockchain in the digital-asset sector.

(Bloomberg) — Cryptocurrencies traded in tight ranges Thursday as the clock ticked down to a major software upgrade of Ethereum, the most commercially important blockchain in the digital-asset sector.

Bitcoin edged up to about $20,000 while Ether, the native token of Ethereum, dipped under $1,600 as of 7:40 a.m. in London. Coins such as Cardano and Solana also posted modest losses. The MVIS CryptoCompare Digital Assets 100 Index has shed some 6% this week.

Ethereum’s revamp — known as the Merge — will make it vastly more energy efficient and over time pave the way for it to scale up and become quicker, according to the network’s developers. They say an update years in the making will go smoothly, though some investors are wary of possible hiccups.

“The market is pricing in a virtually successful Merge to happen,” Teong Hng, co-founder at digital-asset platform Satori Research, said on Bloomberg TV. “For institutional investors, ones who are ESG conscious, they will use this as an opportunity to dip their toes into blockchain, into tokens, into Ethereum.”

Exchanges and lending platforms began temporarily disabling Ethereum-related services before the Merge, which is due to be completed in less than 30 minutes. If all goes to plan, they will later come back online once the revamp is done.

There were indications of substantial Ether inflows into exchanges ahead of the Merge. The exact reasons why were unclear.

Inflows

Alex Svanevik, co-founder and chief executive officer of blockchain research portal Nansen, in a Twitter post cited $1.2 billion of inflows into separate exchanges in two transactions.

“In the short term we will still continue to have some mis-pricing until after the Merge and if the Merge becomes successful then it will be another opportunity set for traders and investors alike,” Satori’s Hng said.

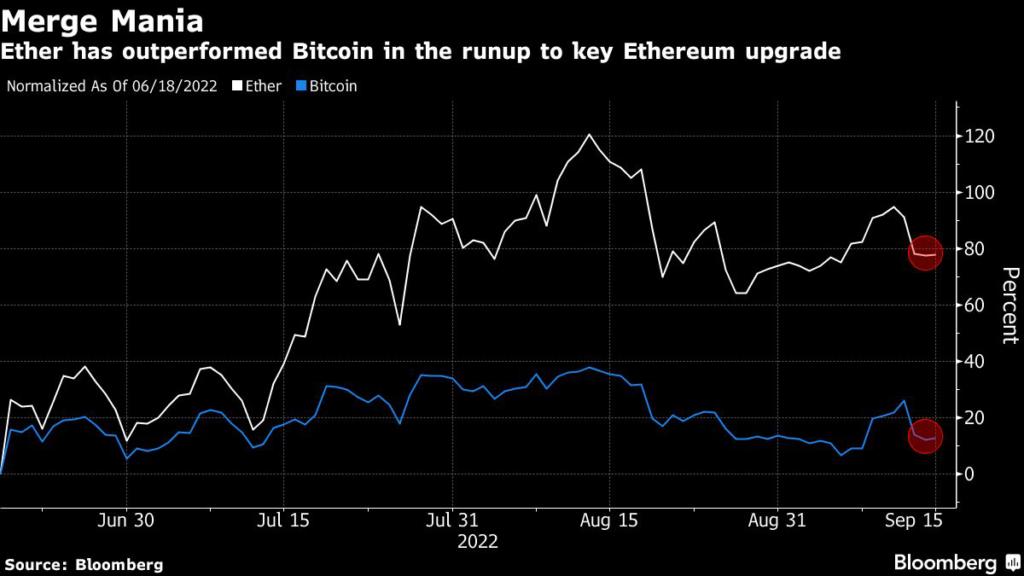

Ether has climbed about 80% since a mid-June low, far outstripping Bitcoin, partly on Merge hype. That rally is cooling and another market risk is that investors will take profits, judging the narrative has played out for now.

The funding rate for Ether perpetual futures contracts was the most negative since at least the onset of the pandemic, according to data from CryptoQuant. That’s an indication of investors paying a bigger premium to short Ether.

After the Merge there may be “a short-lived rally and short squeeze” but “it is hard to see the end of the bear market with the hawkishness of the central banks to continue rate hikes to combat inflation,” said Cici Lu, chief executive officer of Venn Link Partners Pte.

Both Bitcoin and Ether are down more than 50% in 2022, hurt by rising interest rates that sucked liquidity from global markets.

The medium and longer term Ether outlook is brighter, according to Stefan Rust, chief executive of blockchain development house Laguna Labs.

In a note, he said Ether could top $3,000 by the end of this year and possibly achieve the so-called “flippening” in time, referring to the idea that its market value might overtake Bitcoin’s.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.