Options traders are indicating that one of China’s largest gaming companies is primed for a stock market turnaround after a long-awaited regulatory approval.

(Bloomberg) — Options traders are indicating that one of China’s largest gaming companies is primed for a stock market turnaround after a long-awaited regulatory approval.

This week, NetEase Inc.

won approval for a new game for the first time since Chinese regulators froze all licensing in 2021 as part of a crackdown to curb gaming addiction. The company had missed out on previous rounds of approvals that resumed in April, worrying investors.

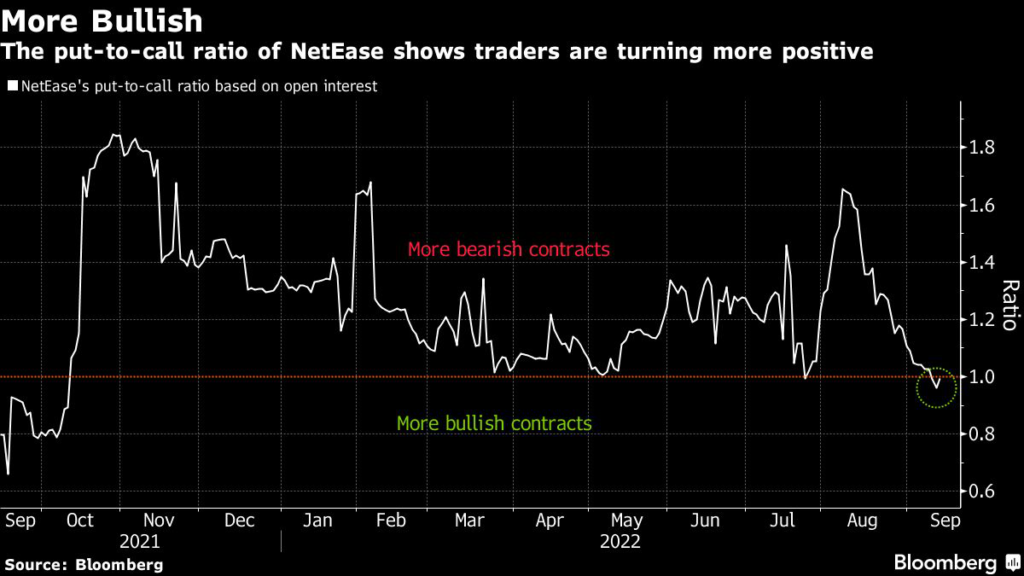

The green light prompted traders to bid up bullish options contracts, sending the put-to-call ratio to the lowest level since October, Bloomberg data showed.

That’s good news for a stock that’s tumbled 23% from its high for the year in June, with the ratio dropping as much as 42% during that period.

The global video game industry has faced a sluggish year as it deals with supply chain issues, inflation and a lack of big hits.

Interest in gaming has also cooled as pandemic measures ease. In China, where lockdowns are still commonplace under Xi Jinping’s Covid Zero, there is the added regulatory risk given the yearlong crackdown.

NetEase is considered a bellwether of China’s online gaming industry, with almost 80% of its revenue coming from the sector and more than 90% of sales from the country.

Investors say the approval is a big step toward a turnaround for its stock and broader gaming share sentiment because it signals that Beijing is easing its grip. Tencent Holdings Ltd., which was another holdout, also received an approval.

“I have no question that they will be getting more games approved,” said Ivan Su, analyst at Morningstar Inc., who puts NetEase as his top pick in the industry.

“Each of these games will make like a small contribution to the revenue, but if you combine them together, then the impact will be more material.”

Shares of the gaming giant also look attractive when it comes to valuation, according to money managers.

The stock’s so-called PEG ratio — the price-earnings multiple divided by its earnings growth rate, a measure popularized by famed investor Peter Lynch — is one of the lowest among all global peers, according to Bloomberg data.

The road ahead may be bumpy, however. NetEase’s newly approved game, the basketball-themed All Star Streetball Party, represents only a small portion of NetEase’s total revenue. The firm will need to continue offering top-grossing games that can be approved by Beijing.

“Given the absence of titles with significant grossing potential and the continued drag from macro weakness, industry revenue momentum likely will remain soft in the near term, in our view,” said Credit Suisse analyst Kenneth Fong.

Still, broader policies by Chinese authorities to stabilize markets and support growth may be a tailwind for firms like NetEase, according to Minyue Liu, investment specialist for Greater China and Asian equities at BNP Paribas Asset Management.

“We expect a number of selective names to benefit from further revenue growth from their mobile gaming business driven by new game title launches and market share gain in overseas markets,” she said.

Tech Chart of the Day

The 56% slump in Meta Platforms Inc.’s stock this year has cut the Facebook parent’s market value to $401.9 billion, dropping it further down the list of the largest publicly traded companies.

Exxon Mobil Corp., at $395.2 billion, is within striking distance of overtaking Meta in size for the first time since 2017 after a 55% surge in 2022. A year ago, Meta stood at more than $1 trillion, compared with less than $240 billion for Exxon.

Top Tech Stories

- The latest iPhone hits stores Friday, and Apple Inc.

is counting on well-heeled shoppers to make the device a hit during a year of roaring inflation and shaky technology spending.

- Texas Instruments Inc. authorized $15 billion in share repurchases and boosted its quarterly dividend by 8% to $1.24 a share, rewarding investors after a difficult year for chip stocks.

- TikTok’s parent company is offering to buy back as much as $3 billion of its own shares from investors at a valuation of about $300 billion, giving existing backers a way to cash out after plans for an initial public offering stalled.

- South Korea’s exports of its most lucrative memory chip fell by the most since 2019, indicating a deepening slump in technology demand central to global economic growth.

- Adobe Systems Inc.

spent $20 billion on its biggest acquisition ever of design software maker Figma Inc. to win the exact kind of consumers and small businesses the company has struggled to reach in recent years. Wall Street panned the half-stock, half-cash purchase as too expensive, and Adobe shares suffered their worst day since 2010.

- With crypto firms from Bitpanda GmbH to BlockFi Inc.

slashing jobs, many tech workers are finding that with the right skills, they can find themselves in demand at the heart of the finance industry.

- Chinese President Xi Jinping has a goal of turning a quiet Shanghai suburb into the country’s next Silicon Valley, but more than three years into its making, that vision is facing mounting challenges.

- A European court ruling this week that upheld a record European Union antitrust fine against Alphabet Inc.’s Google over its Android mobile operating system represents a clear “win” for regulators who confront technology giants, said EU competition chief Margrethe Vestager.

- Elon Musk is demanding Twitter Inc.

make the former head of its consumer division answer questions about spam or robot accounts on the social-media platform that are central to the billionaire’s legal fight to back out of a $44 billion buyout of the company.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.