With US inflation remaining stubbornly high, the Federal Reserve is widely expected to hike interest rates by 75 basis points for a third successive meeting this week

Markets fell Monday as traders extended last week’s rout across risk assets, with expectations high that the Federal Reserve will this week announce another outsized interest rate hike.

With recent data showing US inflation rooted at four-decade highs, investors are increasingly pessimistic about the outlook for the global economy.

Some observers have warned of a sharp recession in many countries caused by the huge rate increases, which are hitting families in the pocket.

And with uncertainty rife owing to a range of issues, including Russia’s war in Ukraine and China’s lockdown-induced slowdown, equities are in danger of revisiting the lows they hit in June.

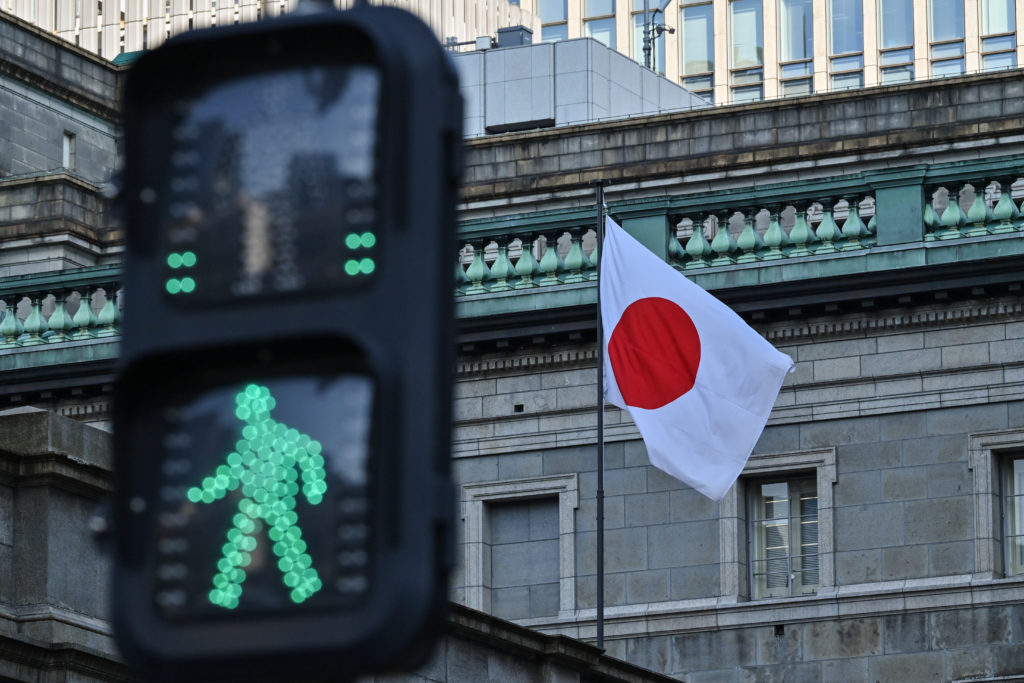

Several central banks are due to make rate announcements this week, with Japan and Britain among the biggest, although the main event is Wednesday’s Fed decision.

There had been a hope that after two 75-basis-point increases in a row, and economic data showing weakness, officials would take their foot off the pedal this month.

But last Tuesday’s disappointing consumer price figures shocked traders and ramped up bets for a third successive 75-point rise, while some have predicted a whole percentage point move.

Policymakers, including Fed boss Jerome Powell, have repeatedly said their ultimate aim is to bring inflation under control, even if that means sending the economy into recession.

“It is clear that the Fed will project hawkish messaging, once again reiterating that it will bring down inflation unconditionally,” said Vasileios Gkionakis at Citigroup.

Wall Street’s worst week since June ended with more losses after FedEx reported Thursday that it shipped fewer packages than expected over the summer owing to weakness in the global economy.

That came as CEO Raj Subramaniam said he expects a global recession.

Asian equity investors continued the selling on Monday.

Hong Kong closed down one percent, even after reports that the city’s government was considering ending mandatory hotel quarantine for incoming travellers.

Shanghai was also down despite news that megacity Chengdu was ending a two-week Covid-19 lockdown that saw 21 million people affected.

Sydney, Seoul, Singapore, Taipei, Manila and Wellington were also in the red, though Mumbai and Bangkok inched up and Jakarta was flat. Tokyo was closed for a holiday.

Frankfurt and Paris both opened lower. London was closed for the funeral of Queen Elizabeth II.

The prospect of more big Fed rate hikes is also keeping the dollar at multi-decade highs against its major peers, with the yen feeling most of the pressure as the Bank of Japan refuses to tighten policy.

“Speculative selling of the yen is readily justified by the ongoing widening in US-Japan yield differentials,” said Ray Attrill, of National Australia Bank.

“Until or unless something happens to arrest or reverse this spread widening, the yen is susceptible to additional selling pressure.”

The Japanese unit last week hit a fresh 24-year low of 144.99 to the dollar, though it has bounced slightly after comments from BoJ officials that signalled they were ready to intervene to provide support.

Oil prices dipped despite the news out of Chengdu as demand fears are fuelled by the growing fear of recession around the world.

– Key figures at around 0830 GMT –

Hong Kong – Hang Seng Index: DOWN 1.0 percent at 18,565.97 (close)

Shanghai – Composite: DOWN 0.4 percent at 3,115.60 (close)

Tokyo – Nikkei 225: Closed for holiday

Pound/dollar: DOWN at $1.1390 from $1.1423 on Friday

Euro/pound: UP at 87.60 pence from 87.00 pence

Euro/dollar: DOWN at $0.9979 from $1.0018

Dollar/yen: UP at 143.37 yen from 142.91 yen

West Texas Intermediate: DOWN 1.3 percent at $83.99 per barrel

Brent North Sea crude: DOWN 0.9 percent at $90.60 per barrel

New York – Dow: DOWN 0.5 percent at 30,822.42 (close)

London – FTSE 100: Closed for queen’s funeral