Months after an announcement that China will build and largely finance an $8 billion nuclear power plant outside Buenos Aires, the deal is hung up over Argentina’s demand that its engineers be permitted to manufacture the reactor fuel domestically.

(Bloomberg) — Months after an announcement that China will build and largely finance an $8 billion nuclear power plant outside Buenos Aires, the deal is hung up over Argentina’s demand that its engineers be permitted to manufacture the reactor fuel domestically.

Becoming the first nation licensed to make fuel for China’s Hualong One reactor would greatly advance Argentina’s atomic program. It would also signal that China is willing to license technology to trading partners, following a commercial pathway blazed by US nuclear manufacturers.

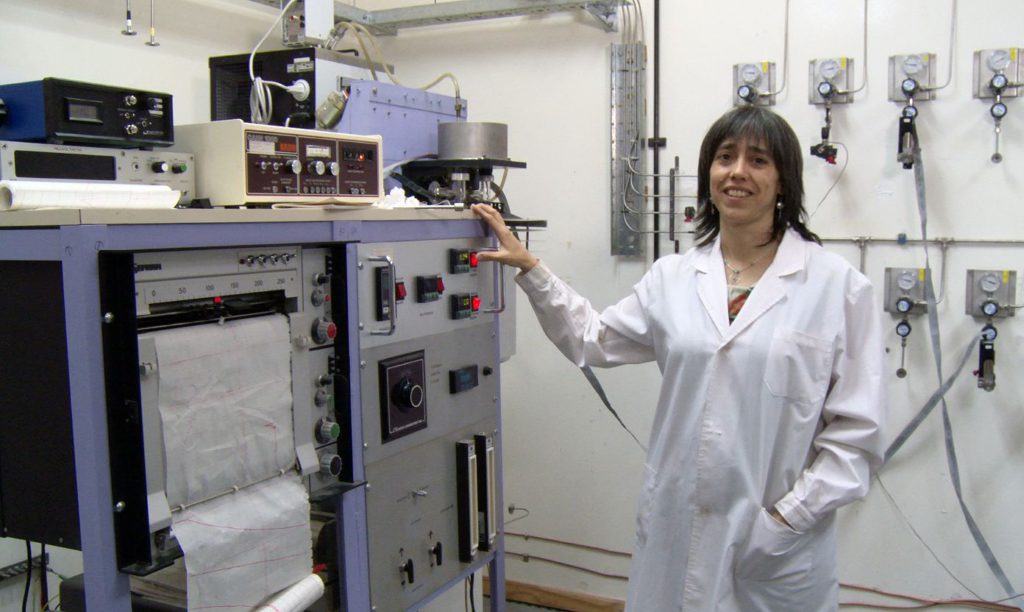

“We are trying to establish the best conditions to transfer the knowledge for making the fuel,” said Adriana Serquis, a physicist and president of Argentina’s National Atomic Energy Commission, in an interview. “The commercial balance for us is very important. We are also hoping that the Chinese understand that a deal with us is also a win for them because that opens more possibilities.”

Licensing fuel technology could help China to sell more reactors overseas by creating more procurement options, she said, adding, “We’ve been paying attention to what’s happening in Europe.”

Diversifying nuclear fuel manufacturing has become a big concern in the wake of Russia’s war in Ukraine. More than 100 million Eastern Europeans rely on nuclear power generated by old Soviet reactors and their fuel supplies are almost completely monopolized by Rosatom. Ukraine still relies on Russian fuel and will require years to fully diversify away from Kremlin-controlled suppliers.

Serquis is traveling to Vienna for the Sept. 26 International Atomic Energy Agency general conference, where she’ll be meeting with senior officials from China and around the globe. Climate change and skyrocketing power prices are focusing more attention on the solutions that zero-emission nuclear energy can offer.

Argentine engineers have been working with Chinese counterparts for months in preparation for a formal agreement, which includes Argentina refurbishing a research reactor in the Chinese city of Qinshan.

“It’s a way of gaining mutual trust,” Jose Luis Antunez, president of nuclear utility Nucleoelectrica SA, said in an interview with Dialogo Chino earlier this year. The sides are discussing different scenarios, which include Beijing supplying enriched uranium to Argentina, where, under Chinese supervision, it could be turned into reactor fuel by Conuar SA.

Nuclear fuel differs from gas and coal because it requires precision-engineered assemblies that conform to safety requirements. Sharing the technology with other countries could cement China’s growing role in nuclear markets, said Mark Hibbs at the Carnegie Endowment for International Peace.

Read More: China Finds a New Way to Dominate the US in South America

“Beijing will obtain strategic leverage where Chinese nuclear firms do business,” said the Berlin-based analyst. “Chinese success in exporting nuclear equipment, technology and materials will open the road for China to replicate the success of the US in spreading its influence into the foreign, energy, and technology policies of China’s nuclear partners and clients.”

The growing nuclear cooperation between Beijing and Buenos Aires, which follows billions of dollars worth of Chinese investment in Argentine infrastructure, is raising alarm bells in Washington. Argentine media reported that State Department officials warned counterparts at an April meeting in Buenos Aires that the Hualong One’s safety systems may not meet international safety standards.

Deputy Assistant Secretary of Nonproliferation Policy Ann Ganzer, who led the US mission to Argentina, declined to comment.

The deal would give Argentina a new reactor at a fraction of the price paid for similar technologies the US and Europe can offer. The pact also opens up the possibility to expand its role on international markets. Argentina is already a top supplier of research reactors to Australia, Algeria, the Netherlands and Saudi Arabia.

Argentina wants to begin selling small-modular reactors after 2025, and the China deal will help. The country’s light-water Carem technology runs on uranium enriched to the low levels needed by China’s Hualong reactors. Buenos Aires is in talks to supply its Carem reactor to Indonesia.

“It’s important we continue building these fuel capacities,” Serquis said. “It’s important for the future of Carem.”

The Argentine Council on Foreign Relations, a private research group, listed fuel-manufacturing capacity as the top strategic priority for the country’s nuclear program. “Technological innovation aimed at the development of nuclear reactors, accelerators and the nuclear fuel cycle” including “the development and production of nuclear fuels,” is critical, says a Council report published late last year.

Serquis said that while Argentina confronts the financing difficulties faced by poor countries, its nuclear-science advances over 70 years often surpass those of richer economies. Communicating Argentina’s capabilities has been one of the biggest challenges in negotiations with China.

“We are not claiming to be in an equal position,” Serquis said. “We are a small economy dealing with one of the world’s biggest. Still, they don’t have to teach us the basics.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.