The JSE faced lower Asian markets following the US Federal Reserve’s decision to hike its benchmark rate by a further 75 basis points to clamp down on rising inflation while locally the South African Reserve Bank hiked the repo rate by the same margin on Thursday.

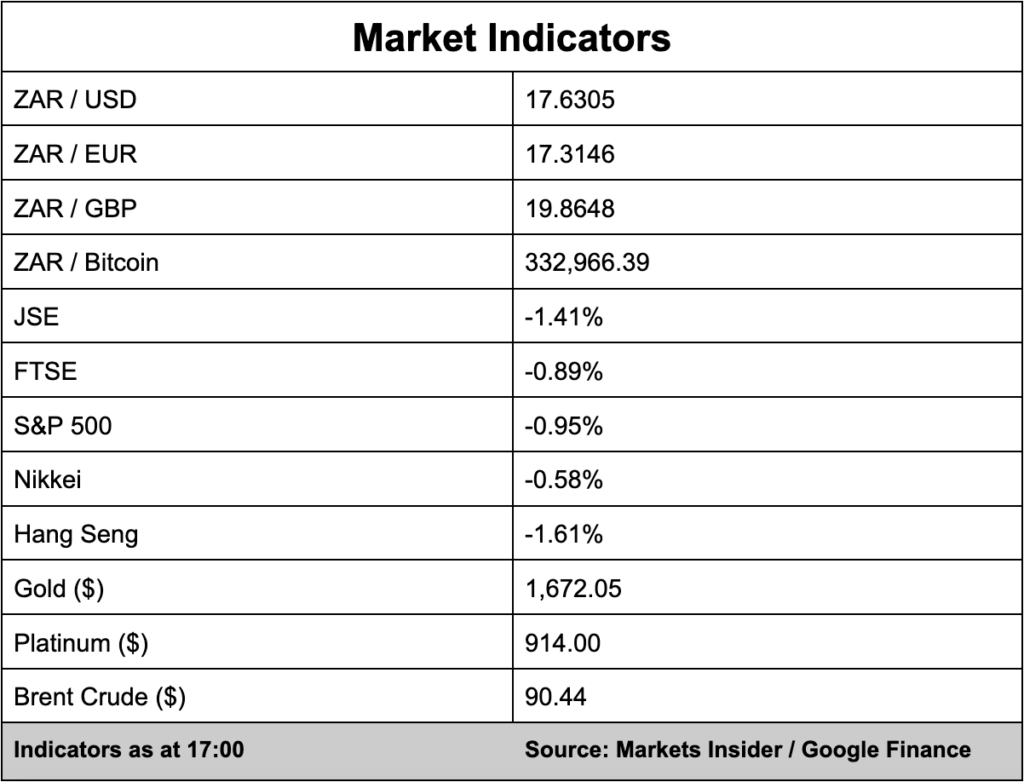

The local bourse traded 1.41% lower to see the All Share Index close on 65,277 points.

Following the conclusion of its Monetary Policy Committee (MPC) meeting, Reserve Bank governor Lesetja Kganyago announced that the MPC members were split in their decision to hike the interest rate with three wanting a 75 bps hike and two members opting for a full percentage point hike.

Fed chair Jerome Powell vowed the central bank would continue to hike the benchmark rate until the “job is done” and the US contains inflation to just 2% – it’s currently at 8.3%.

Global stocks are close to a two-year low while Japan unilaterally intervened in forex markets for the first time since 1998 as the yen hit a 24-year low. The move came just hours after the Bank of Japan decided to maintain super-low interest rates despite other central banks’ more hawkish position.

In the currency markets, the rand traded stronger against the dollar with the greenback 0.64% weaker against the local unit. The rand is currently trading at R17.63/$.