(Bloomberg) — Cryptocurrencies failed to hold onto gains Tuesday as US stocks also faltered and extended losses for a sixth straight session.

(Bloomberg) — Cryptocurrencies failed to hold onto gains Tuesday as US stocks also faltered and extended losses for a sixth straight session.

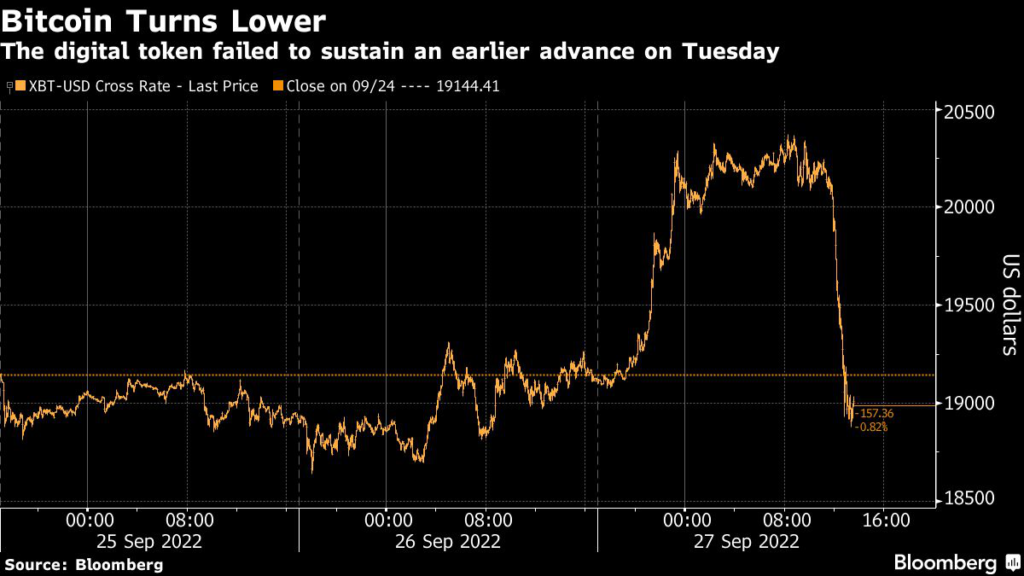

Bitcoin, the world’s largest digital asset by market value, fell as much as 1.2% to trade around $18,878, failing to sustain an earlier advance. Ether, the second-largest cryptocurrency, also dropped. Most major digital assets were posting declines as of 1:45 p.m. in New York.

The downturn occurred as US stocks turned lower, with the S&P 500 on pace for a sixth session of losses. Global financial markets have been gripped by volatility as central banks continue to promise that they’re going to keep raising interest rates to fight inflation that’s proven stickier than many had thought.

“BTC did seem to pick up the risk selloff once again today. Followers of the ecosystem have been excited to see correlations with risk-assets begin to break, meaning the ‘fast-money’ speculative crowd may be losing their influence on the space,” said Stephane Ouellette, chief executive of FRNT Financial Inc. “With today’s move, it doesn’t seem like we’re quite there yet — but consolidation at these levels continues to move in a bullish direction where loose hands sell BTC to the near cult-like ‘hodler’ community.”

Cryptocurrencies and US stocks have been trading largely in tandem throughout the year as both have been swayed by proclamations and actions by global central banks. The 60-day correlation coefficient of Bitcoin and the S&P 500 currently stands around 0.69, among the highest such readings in Bloomberg data going back to 2010 (A coefficient of 1 means the assets are moving in lockstep, while minus-1 shows they’re moving in opposite directions.)

Though crypto markets have been choppy, some investors have cheered the fact that digital tokens have held up relatively better than some other asset classes. Still, Bitcoin is down roughly 60% this year, while the S&P 500 is down more than 20% from the highs it had reached at the start of 2022.

And some investors are betting that cryptocurrencies may continue to fall. Assets under management for the ProShares Short Bitcoin ETF have been climbing, according to data compiled by Vetle Lunde, analyst at Arcane Crypto, who said that traders might be seeking to speculate on further downside.

Elsewhere in the cryptoverse, FTX US President Brett Harrison said he was stepping down and would be moving into an advisory role at the exchange. His exit is one of the latest high-profile departures from major crypto firms.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.