Some investors are playing the long game as a fresh wave of misery engulfs European stocks and bonds, betting that gas shortages will speed up a transition to renewable energy.

(Bloomberg) — Some investors are playing the long game as a fresh wave of misery engulfs European stocks and bonds, betting that gas shortages will speed up a transition to renewable energy.

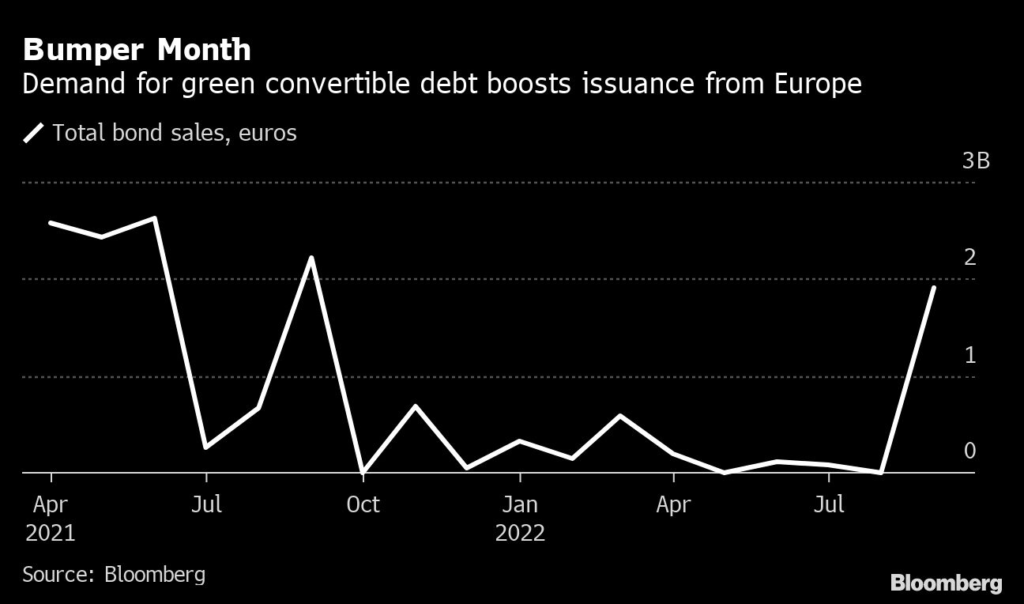

They’ve been buying up bonds linked to clean energy companies that can be converted on maturity into stocks, meaning they will receive coupon payments throughout the coming gas crunch and potentially end up with a share in a flourishing company in a few years’ time. September is shaping up to be the best month for sales of convertible bonds in a year after three renewables firms came to market, meeting with high demand at a time when many companies have had to pull sales.

Russian President Vladimir Putin’s hostage-taking of Europe’s gas supply has accelerated a trend for electrification in Europe that investors have been predicting for years, but never with so much certainty. If Russia can no longer be depended on as a reliable supplier of energy, the continent may have little choice but to make a rapid switch to clean energy that could see stocks linked to the sector surge.

“When markets are weak the convertible bonds of these companies provide solid downside protection given their solid fundamentals and a good future, especially as Europe moves toward more electric and renewable energy,” said Ute Heyward, a portfolio manager at Fisch Asset Management in Zurich.

Siemens Energy AG issued a 960 million euro ($938 million) convertible bond to finance the purchase of Siemens Gamesa Renewable Energy on Sept. 6. The next day, French renewable energy producer Neoen SA sold 300 million euros of the debt and SGL Carbon SE, a German producer of wind and solar components, came to market a week later with a 100 million euro note.

The Siemens bond matures in 2025, implying investors think the shift to renewables could start boosting clean energy stocks within three years. The other two notes convert to equity in 2027.

Until then assets of all electricity suppliers could be in for a rocky ride as the standoff wreaks havoc with energy prices and prompts governments to intervene. A Bloomberg Index of global green bonds has slumped 27% in 2022, heading for its worst year of returns since inception in 2014.

Suspected sabotage of the Nord Stream pipeline system that transports Russian gas to Europe, alongside Gazprom’s warning that Moscow may sanction Ukraine’s Naftogaz, are the clearest signals yet that the continent will have to survive the winter without any significant imports from its eastern neighbor.

Why Europe Is Crippled By a Wartime Energy Crisis: QuickTake

Market Selloff

The convertible bond market has also been hammered by the crash in bond and equity markets, with returns on an index of European equity-linked bonds down 18% so far this year.

The big risk is that the underlying stocks don’t recover in time for the bonds to be converted. That’s a lesson learned by investors who rushed to buy convertible bonds during the pandemic in the hope that stock markets would rebound, only to find themselves stuck in another downturn. Many convertible bonds sold in 2020 and 2021 are now trading at distressed levels.

Still, the recent plunge in equities makes the new notes very attractive, according to Pierre-Henri de Monts de Savasse, an investor at BlueBay Asset Management LLP. For issuers grappling with rising borrowing costs, the bonds provide a vehicle to sell debt with a lower coupon than conventional debt, he said.

Twenty-one European convertible bonds still have negative yields, including a handful from energy companies such as Schneider Electric SE, which specializes in improving home electricity efficiency. Swedish battery producer NorthVolt AB has also tapped into the demand for convertible debt, selling a 1.1 billion euro note in July to private investors ahead of a planned initial public offering.

“Converts are a great instrument for a long-term investment because it gives you that equity option, and investors see that opportunity in the renewable space,” said Lyle Schwartz, co-head of EMEA Alternative Equity Products at Goldman Sachs in London. “And because there’s a coupon, it offers some downside protection as well.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.