The European Union proposed a new package of sanctions on Moscow that would ban European companies from shipping Russian oil to third countries above an internationally set price cap.

(Bloomberg) — The European Union proposed a new package of sanctions on Moscow that would ban European companies from shipping Russian oil to third countries above an internationally set price cap.

European Commission President Ursula von der Leyen said the EU will propose a “sweeping” new import ban on Russian products that would cost Moscow 7 billion euros ($6.7 billion) in revenue, as well prohibit the sale of key technologies that could benefit its military.

“We are determined to make the Kremlin pay for this further escalation,” she said.

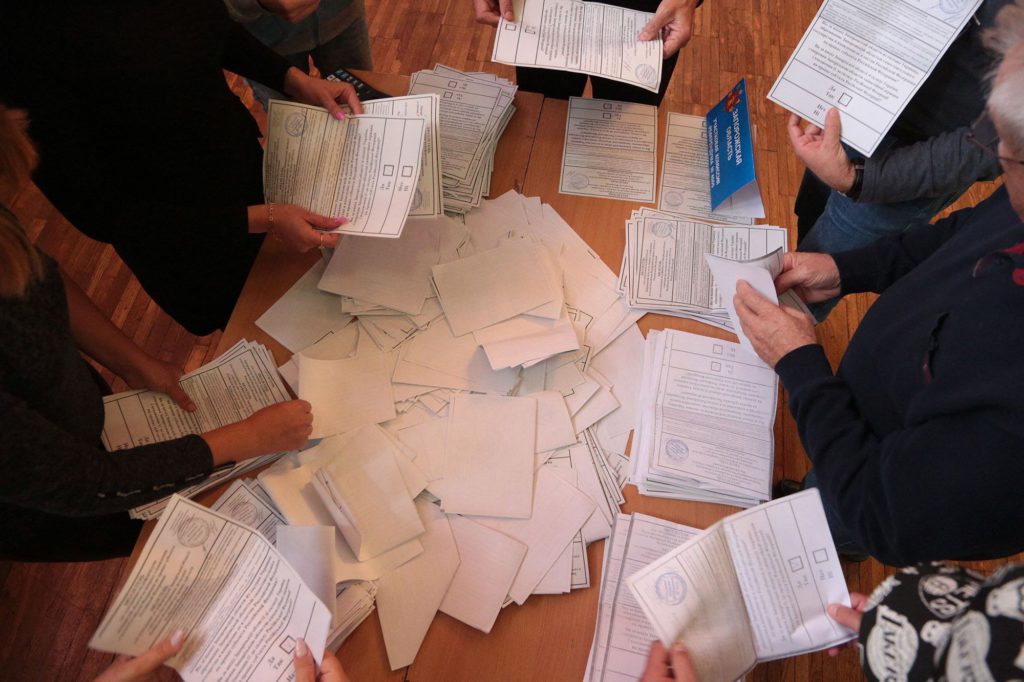

The announcement came after Russia announced a partial mobilization and staged widely condemned referendums on annexation in Ukrainian territory it’s occupying.

Von der Leyen said the bloc aims to ban EU nationals from holding high-paying roles in Russian state-owned companies. While no specific individuals would be targeted, the measure, if backed by member states, would likely impact former German Chancellor Gerhard Schroeder. The erstwhile German leader is the chairman of the shareholders’ committee of Nord Stream AG, a joint project to transport Russian gas via pipeline which is majority-owned by the energy giant Gazprom PJSC, according to German media.

The EU is proposing to sanction a range of individuals and entities, including senior Russian ministry officials and individuals involved in staging the recent referendums, the bloc’s top diplomat, Josep Borrell, said.

The commission plan aimed to restrict access to aviation items, electronic components and specific chemical substances to “deprive the Kremlin’s military complex of key technologies.”

In her recent State of the Union speech in September, von der Leyen pointed to the bloc’s sanctions as part of the reason Russia’s military was under strain to take semiconductors from ordinary household appliances to fix their military hardware.

The bloc has imposed multiple rounds of sanctions on Russia, including parts of its energy sector, since Moscow’s invasion of Ukraine. Sanctions need to be approved unanimously by the EU’s 27 member states.

The new sanctions also would work to restrict the transfer of Russian wealth via digital assets like Bitcoin, prohibiting European firms from providing crypto wallet, account or custody services to Russian nationals and entities established in Russia, according to a person familiar with the matter.

The package would also extend the ban on steel products as well as paper, jewelry and precious stones, said the person, who asked not to be identified because the proposal is private.

Price Cap

The new package would add a ban on shipping Russian oil, but carve out an exemption for oil priced at or under a level set by a coalition of the Group of Seven and other countries, according to the person.

To allow for an oil price cap, the bloc will have to change its current legislation. In June, EU nations agreed to a full ban on insurance and financial services for seaborne oil, while shipping was spared from the restrictions. Most of those prohibitions are due to kick in Dec. 5 alongside a ban on EU purchases of Russian crude.

“We are laying the legal basis for this oil price cap,” von der Leyen said.

The G-7, which endorsed a cap earlier this month, has said it wants an agreement in place before that date.

“The oil price cap will lead to lower prices for Russian oil,” Andrzej Sados, Poland’s ambassador to the EU, told reporters. “The sheer threat of such a move has already caused a drop.”

The EU also said it plans to crack down on people who try to circumvent sanctions.

“We will be able to list individuals if they circumvent our sanctions,” von der Leyen said. “So for example, if they buy goods in the European Union, bring them to third countries and then to Russia — this would be a circumvention of our sanctions, and those individuals could be listed. I think this will have a major deterring effect.”

(Updates with crypto measures in the 10th paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.