The stock market has been roiled by Britain’s stubborn inflation and an interest rate crisis deepened by tax cuts from Liz Truss’s new government. Now, investors are seeking places to hide.

(Bloomberg) —

The stock market has been roiled by Britain’s stubborn inflation and an interest rate crisis deepened by tax cuts from Liz Truss’s new government.

Now, investors are seeking places to hide.

Worries about the mortgage market have crushed real estate and construction firms, while also taking down retailers. On the flip side, investors see pockets of safety in the biggest exporters such as pharma giant GSK Plc, oil company Shell Plc, cigarette maker British American Tobacco Plc, as well as financial companies that can ride volatility, like London Stock Exchange Group Plc.

Others simply flag the discounts on offer in London.

“If you look at the average UK stock it’s becoming embarrassing how cheap they are getting,” said Peter Toogood, chief investment officer at Embark Group Ltd.

Indeed, take the FTSE All-Shares Index, it trades at 8.4 times forward earnings.

That’s far cheaper than 13.3 times for a global stocks gauge, the MSCI All-Country World Index.

The FTSE Local Index of businesses that generate at least 70% of sales domestically is down 12% since the budget through yesterday’s close.

The FTSE 100, meanwhile, has fallen just 3.7%. And with the UK’s fiscal and monetary policymakers apparently moving in different directions, more volatility is expected.

“There’s a lot of chaos — a lot of difficult times ahead,” Embark’s Toogood told Bloomberg TV on Friday.

Here’s a look at some of the most-impacted sectors.

Banks

Lenders such as Barclays Plc, Lloyds Banking Group Plc and NatWest Group Plc have slumped following the bond yield spike over the past week.

That’s slightly counterintuitive, as they make more money from lending when rates rise. The problem is, surging mortgage rates will hurt demand for loans, and even spur some defaults. Mortgage rates close to 6% could “trigger asset quality problems,” Morgan Stanley analyst Alvaro Serrano wrote in a note.

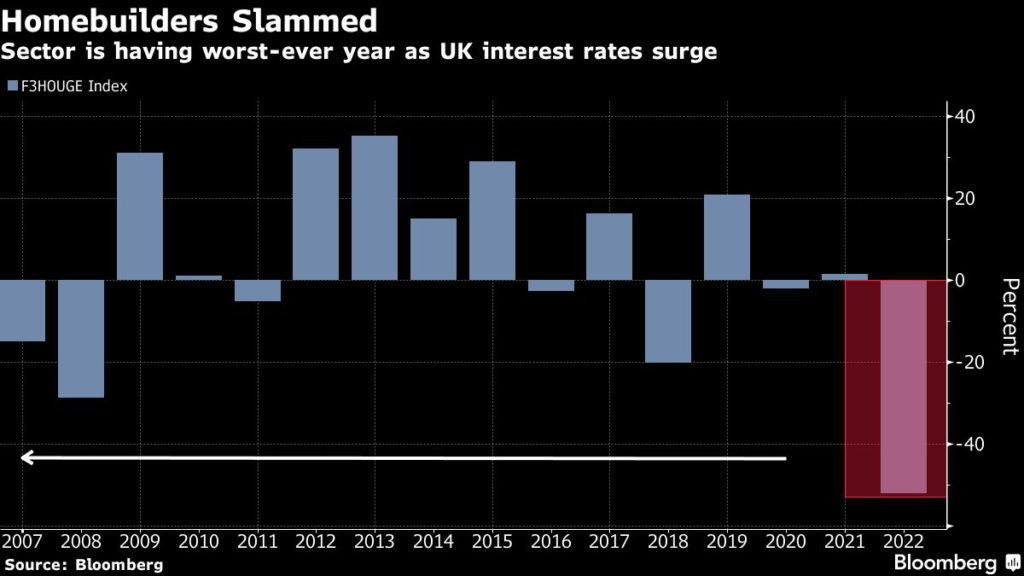

Homebuilders

A FTSE index tracking companies like Persimmon Plc and Taylor Wimpey Plc has fallen by 14% since Kwarteng announced his mini-budget on Sept.

23. That’s extended a year-to-date slump to more than 50%, knocking about £22 billion ($24.5 billion) in market value off the sector.

That’s left some homebuilders trading at 30% discounts to the amount they originally paid for the land that they own, according to Shane Carberry, an analyst at Goodbody Stockbrokers.

He questioned whether house prices will fall by that much in reality, and added that homebuilders’ balance sheets are much stronger than they were during the financial crisis.

Read More: Homebuilders Drop 50% This Year as Crisis Worsens With Truss

Exchanges

London Stock Exchange Group Plc and other exchanges benefit from rising rates via higher interest income as well as higher trading, clearing and settlement volumes, Deutsche Bank analyst Benjamin Goy said in a note.

A bigger beneficiary, however, might be TP ICAP Group Plc, the storied interdealer broker whose biggest market is bonds and which earns a big chunk of its revenue in dollars.

“Conditions have not been this good for this company for years,” Canaccord Genuity analysts Justin Bates and Portia Patel wrote in a note as they kept a buy rating on the stock.

Read More: London’s European Stock Market Crown Under Threat From Paris

Retail

UK retailers are facing a “mortgage time bomb,” with rising interest rates set to have twice the impact on consumer finances as the recent surge in utility bills, according to Deutsche Bank.

A “significant” increase in the cost of servicing home loans will reduce disposable incomes by about 5% in 2023, Matt Garland wrote in a note Thursday, adding to pressure on consumers already struggling to contend with soaring inflation.

The prediction added to investor jitters on the day that bellwether Next Plc issued its second profit warning this year and Sweden’s Hennes & Mauritz AB, which is prominent on the UK high street, reported an 86% slump in third-quarter earnings.

Technology

With a weaker pound and cheaper valuations for tech stocks following a recent selloff in growth assets, foreign capital’s appetite for UK tech is only increasing.

Tech occupies less than 2% of FTSE All-Share Index, and the weight is set to decrease further, as analysts said companies including Darktrace Plc, Kape Technologies Plc and The Sage Group Plc could also draw takeover interest.

The UK tech sector has already seen a flurry of takeover attempts from foreign buyers in recent months.

Open Text Corp.’s offer for Micro Focus International Plc nearly doubled the software company’s share price in one day, while Aveva Group Plc’s shares also benefitted from a premium in Schneider Electric SE’s offer.

Risk Arbitrage

On the theme of M&A, some investors may be using “risk arbitrage” to shield themselves from UK turbulence.

Risk arbitrage is a strategy that bets on the successful closing of an acquisition, where the difference between the offer price and the stock price reflects the risk of deal completion.

In addition to its positive correlation to interest rates, the strategy has a very low correlation to the overall market as investors are taking deal risk, not market risk.

The strategy is therefore seen as helpful in dampening the volatility of an overall portfolio.

Healthcare

UK pharmaceutical businesses are relatively insulated from recent economic woes, as investors expect their “defensive qualities” to shield earnings.

People will always need treatments and drugs.

Big pharma can also benefit from sterling’s weakness, as much of its sales are in US dollars. While the two British pharma giants GSK Plc and AstraZeneca Plc have outperformed significantly in the past 12 months — AstraZeneca shares are up 15% year-to-date — they might have further to go still.

In a Sept.

29 note, analysts at Oddo BHF tagged both firms as top picks in the sector, saying recent profit-taking after their strong 2022 “represents an opportunity,” and flagged next year will be rich in catalysts, including a data readout from a large AstraZeneca lung cancer treatment study, due in early 2023.

In terms of sector performance, much may depend on the direction of the pound.

Homebuilders, domestic banks and real estate companies tend to outperform when the pound strengthens, while health care, staple goods and telecommunications underperform, according to an analysis from Goldman Sachs Inc.

The latter sectors — which generate large sales abroad — could benefit if sterling weakens further.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.