Stocks in Asia slipped as traders digested disappointing earnings from chipmakers that may foreshadow a wider decline in corporate profits. Uncertainty also increased ahead of US monthly payrolls data.

(Bloomberg) — Stocks in Asia slipped as traders digested disappointing earnings from chipmakers that may foreshadow a wider decline in corporate profits. Uncertainty also increased ahead of US monthly payrolls data.

The MSCI Asia Pacific Index dropped for the first time in four days, with tech shares the biggest losers. Samsung Electronics Co. reported a decline in profit for the first time since late 2019, underscoring the depth of a global PC and memory-chip downturn. Advanced Micro Devices Inc. slid in late US trading after worse-than-expected preliminary results.

US equity contracts fluctuated following declines for a second day on Thursday, with the S&P 500 and tech-heavy Nasdaq 100 both ending near session lows.

The Japanese yen weakened against the dollar toward levels that triggered direct market intervention last month, as traders test authorities’ tolerance for a depreciating currency. Treasuries and the dollar were both little changed.

The US jobs report is forecast to show employers added another 255,000 workers in September. That would be the fewest jobs added in a month since a decline in late 2020.

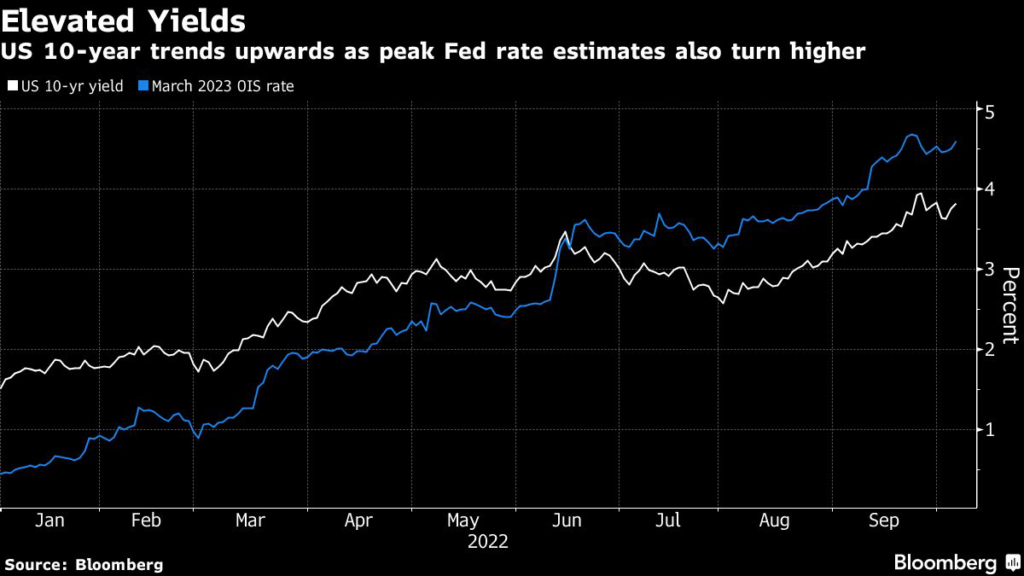

The drumbeat of hawkish comments from Federal Reserve officials kept stocks on the back foot for much of the US session Thursday, thwarting brief attempts to rebound.

Read more: VIX Surge to 150 Is Day’s Biggest Options Bet for ‘Fear Gauge’

Chicago Fed President Charles Evans said the benchmark rate will probably be at 4.5% to 4.75% by next spring as officials fret over high core inflation. Rates markets currently price a peak around 4.6% in the first half. Minneapolis Fed’s Neel Kashkari said the central bank is “quite a ways away” from pausing its campaign of rate increases, while Cleveland Fed chief Loretta Mester said the US is in an unacceptably high inflation environment.

“There’s so much money out in the system chasing little supply,” Mariann Montagne, portfolio manager at Gradient Investments, said on Bloomberg Radio. “And what really needs to happen is we need more manufacturing in the US, more dependable sources of parts. We need more manufacturing goods available so that we can have a better economy.”

Elsewhere, China’s foreign exchange reserves at the end of September fell to the lowest since 2017.

Oil topped $88 a barrel and gold fell. Bitcoin traded around $20,000.

Key events this week:

- US unemployment, wholesale inventories, nonfarm payrolls, Friday

- BOE Deputy Governor Dave Ramsden speaks at event, Friday

- Fed’s John Williams speaks at event, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures added 0.1% as of 12:03 p.m. Tokyo time. The S&P 500 fell 1%

- Nasdaq 100 futures climbed 0.2%. The Nasdaq 100 fell 0.8%

- Japan’s Topix index dropped 0.6%

- South Korea’s Kospi index rose 0.2%

- Hong Kong’s Hang Seng Index slumped 1.1%

- Australia’s S&P/ASX 200 Index decreased 0.6%

Currencies

- The Bloomberg Dollar Spot Index was down 0.1%

- The euro strengthened 0.2% to 0.9809 per dollar

- The British pound rose 0.2% to 1.1186 per dollar

- The Japanese yen surged 0.2% to 144.92 per dollar

- The offshore yuan slipped 0.1% to 7.0916 per dollar

Bonds

- The yield on 10-year Treasuries fell almost one basis point to 3.82%

- Australia’s 10-year yield advanced seven basis points to 3.85%

Cryptocurrencies

- Bitcoin fell 0.1% to $20,024

- Ether fell 0.5% to $1,356

Commodities

- West Texas Intermediate crude was at $88.50 a barrel

- Gold was at $1,712.51 an ounce

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.