Prices in the cryptoasset market slumped across the board on Thursday, after data showing US inflation at a 40-year high further eroded fading demand for riskier assets.

(Bloomberg) — Prices in the cryptoasset market slumped across the board on Thursday, after data showing US inflation at a 40-year high further eroded fading demand for riskier assets.

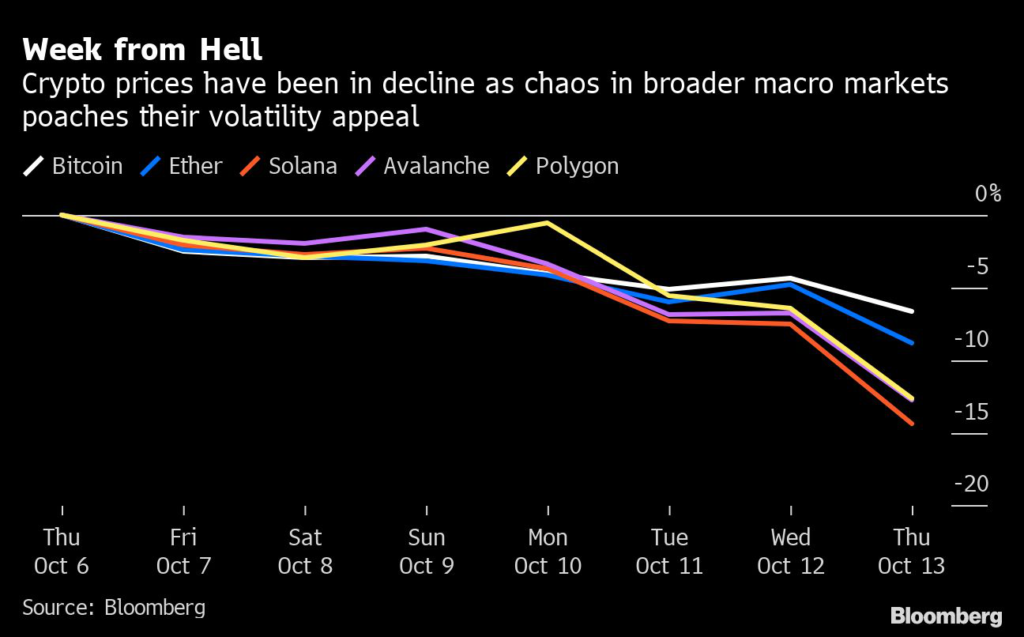

Bitcoin, the largest cryptocurrency by market value, fell as much as 5.1% on Thursday in New York to $18,201, its lowest in about three weeks. The September low was the least since prices tumbled in June after crypto lender Celsius collapsed. Ether fell as much as 8.2%, with both coins trending toward the lower end of their respective ranges. Each are down more than 60% this year.

“The crypto markets are dumping right now,’ said Garry Krugljakow, founder of 0VIX and GOGO Protocol, an open-source DeFi protocol for asset management and savings. He added that the market selloff in Bitcoin “will be continuous leading up” to the next Federal Reserve meeting in November.

Minutes from the Fed’s September meeting on Wednesday showed officials were committed to raising interest rates to curb inflation, a touchstone for crypto activity where Bitcoin has moved largely in tandem with risk assets. The core consumer price index, which excludes food and energy, increased 6.6% from a year ago, the highest level since 1982, Labor Department data showed Thursday.

Meanwhile altcoins including Solana, Avalanche, Polygon and Cardano all tumbled more than 9%. As interest rates have risen this year, traditional markets like US Treasuries and corporate bonds have outpaced yields among decentralized finance protocols where returns are diminishing.

Volatility has also been absent from crypto in recent months, with fiat currencies taking its place as the new hotspot for traders seeking to profit off price differences across exchanges. The T3 Bitcoin Volatility Index is down 6.7% since the start of September, while the JPMorgan Global FX Volatility Index is up 13.4%.

“Altcoins have been trading above their trendlines,” said Fadi Aboualfa, head of research at crypto custodian Copper. “It could be markets are giving things their last test to see if things can hold, but they can certainly fall much lower with ETH testing just under $1k, and Solana around $27.”

Some market-watchers had noticed in recent days that Bitcoin had been behaving in a less-volatile way than stocks. Since the start of September, the coin is been down less than the S&P 500, for instance.

But the coin’s — and Ether’s — relative strength over the past few months has been an “illusion,” said John Roque at 22V Research.

“Many had pointed out that Bitcoin, especially, had been showing remarkable chutzpah over the last few months as it held firm in the face of equity deterioration,” he wrote in a note, adding that he sees Bitcoin falling to $10,000 and Ether dropping to the $420 level.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.