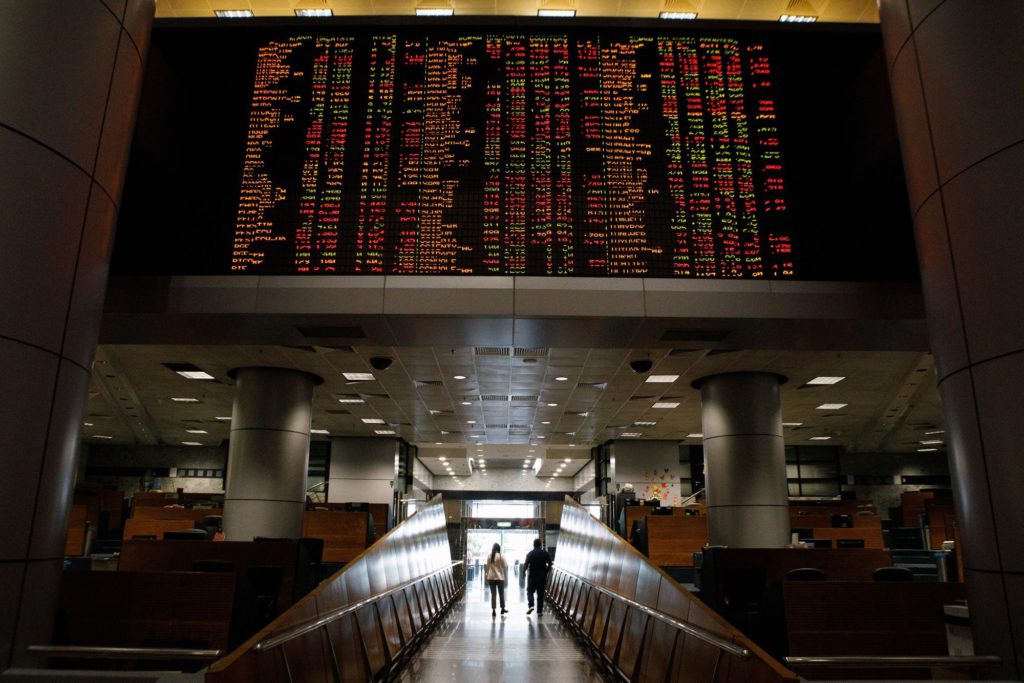

Stocks climbed after the S&P 500 breached a technical level that has triggered gains in the past, with risk appetite improving as more of UK Prime Minister Liz Truss’s unfunded tax cuts were reversed.

(Bloomberg) — Stocks climbed after the S&P 500 breached a technical level that has triggered gains in the past, with risk appetite improving as more of UK Prime Minister Liz Truss’s unfunded tax cuts were reversed.

The breadth of the rally was so strong that at one point over 99% of the US benchmark’s companies were rising, with the gauge pushing away from its 200-week moving average. The tech-heavy Nasdaq 100 outperformed. Bank of America Corp. surged on solid earnings.

This year’s equity rout has left the S&P 500 testing a “serious floor of support,” Morgan Stanley’s Mike Wilson wrote, adding he “would not rule out” a rally to about 4,150 points — suggesting a 16% upside from Friday. Thatwould “be in line with bear-market rallies this year and prior ones.”

“What is likely an extreme oversold condition in the stock market could become a catalyst for a modest rally before the year’s end,” said John Stoltzfus, chief investment strategist at Oppenheimer.

Some 86% of respondents in the latest MLIV Pulse survey expect US markets to recover first, with investors slightly favoring stocks over bonds. The result suggests the longstanding premium for equities will remain in place — and as the Federal Reserve’s peak hawkishness becomes apparent, traders will be prepared to return to Treasury markets in droves.

For now, Mark Haefele at UBS Global Wealth Management notes that historically, markets have bottomed out when investors began to contemplate materially looser policy over the next six to 12 months, when a trough for economic activity was in sight, or when valuations already fully reflected a credible “bear case” scenario.

“Today, we do not believe these conditions have been fulfilled,” Haefele added. “Despite the increased risks to growth and the rise in volatility, equity markets have neither become cheaper relative to bonds, nor yet priced in a material slowdown in growth and earnings.”

The latest recession probability models by Bloomberg economists Anna Wong and Eliza Winger forecast a higher recession probability across all timeframes, with the 12-month estimate of a downturn by October 2023 hitting 100%, up from 65% for the comparable period in the previous update.

“This isn’t a Pollyanna moment,” said Robert Teeter, a managing director of Silvercrest Asset Management. “Inflation clearly remains a problem until proven otherwise, and disappointing earnings, particularly from consumer facing- companies, could trigger another rough stretch, with recession fears at the fore.”

Key events this week:

- US industrial production, NAHB housing market index, Tuesday

- Fed’s Neel Kashkari speaks, Tuesday

- Euro area CPI, Wednesday

- EIA crude oil inventory report, Wednesday

- US MBA mortgage applications, building permits, housing starts, Fed Beige Book, Wednesday

- Fed’s Neel Kashkari, Charles Evans, James Bullard speak, Wednesday

- US existing home sales, initial jobless claims, Conference Board leading index, Thursday

- Euro area consumer confidence, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 Index climbed 2.1% to 3,660.09 as of 11:21 a.m. New York time.

- The Dow Jones Industrial Average rose 1.3%.

- The Nasdaq Composite Index gained 2.7%.

Currencies

- The euro rose 0.9% to $0.9808.

- The British pound increased 2% to $1.1397.

- The Japanese yen depreciated 0.1% to 148.80 per dollar.

Bonds

- The yield on 10-year Treasuries decreased five basis points to 3.97%.

- Britain’s 10-year yield sank 36 basis points to 3.978%.

- Germany’s 10-year yield decreased seven basis points to 2.28%.

Commodities

- West Texas Intermediate crude was little changed at $85.64 a barrel.

- Gold strengthened 1% to $1,660.76 an ounce.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.