Long maligned as the debt-addicted corporate raiders of Wall Street, private equity firms are resorting to an unusual maneuver to get deals done as borrowing costs spiral. They’re taking the leverage out of leveraged buyouts.

(Bloomberg) — Long maligned as the debt-addicted corporate raiders of Wall Street, private equity firms are resorting to an unusual maneuver to get deals done as borrowing costs spiral. They’re taking the leverage out of leveraged buyouts.

Francisco Partners, Thoma Bravo and Stonepeak Partners are among those that announced new acquisitions in recent weeks without debt financing in place, effectively backstopping the entire purchase price — in some cases worth north of $2 billion — with cash from their own funds.

Though likely temporary, the all-equity move is a dramatic departure for an industry famously hooked on leverage and constantly on the hunt for ever-more creative ways to boost returns.

Some of the firms held lending discussions with banks and private credit providers, but they ultimately deemed the terms they were offered unattractive, according to people with knowledge of the matter, who asked not to be identified because they’re not authorized to speak publicly.

The sponsors may ultimately replace some of the equity with loans or bonds at a later date. Yet the fact big-name private equity firms have been willing to underwrite leverage-free buyouts underscores how these stressed times are forcing debt-guzzling financiers on Wall Street to adapt their playbook.

“Sponsors want maximum flexibility,” said Richard Farley, a partner at Kramer Levin Naftalis & Frankel LLP who works on buyout financings. “They don’t want to be locked into very expensive debt if they think they are going to have access to the debt market at more attractive rates in a short period of time.”

Representatives for Francisco, Thoma Bravo, TPG and Stonepeak declined to comment.

Read more: Brightspeed Debt-Sale Failure Slams Banks Anew After Citrix Flop

Interest rates are rising relentlessly and big banks are failing to offload the tens of billions of dollars worth of sinking buyout debt that’s still stuck on their own books. Even capital-rich private credit funds, long-heralded as the savior of LBO financing, have cut back on new commitments.

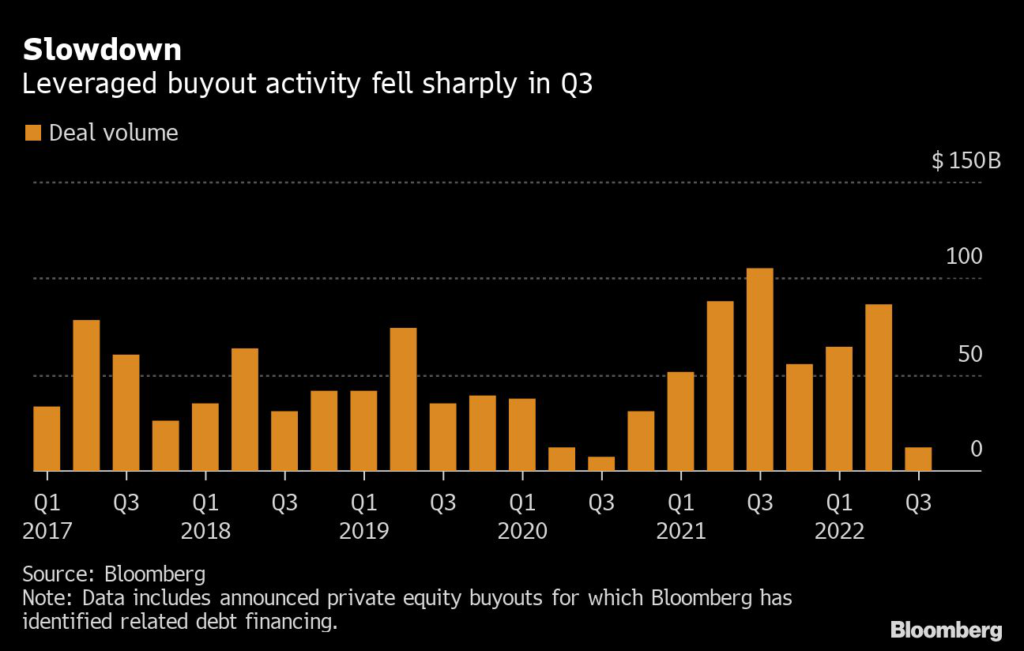

After a boom in 2021 and during the first half of this year, private equity buyout activity slowed significantly in the third quarter, with only $12 billion of deals announced globally, according to data compiled by Bloomberg. The likes of Apollo Global Management Inc. to Blackstone Inc. have pointed to a more difficult financing environment ahead.

Financing deals with 100% equity isn’t entirely new. When debt markets were wide open and M&A volumes were at a record last year, some firms used the tactic as a way to sweeten their offers when bidding for companies in particularly competitive sales processes. That allowed some eager managers to move quickly, beating out rivals who needed time to speak with lenders and seek approvals from committees. TPG used that playbook to prevail over other sponsors in the competition to buy LifeStance Health in 2020, one of the people said. A representative for TPG declined to comment.

The buyers almost always replaced some of their equity with debt before closing. For now with interest rates sharply on the rise and banks unable to offer commitments at attractive levels, some private equity firms are finding even more reasons to go all-equity when they submit their bids.

Francisco Partners agreed earlier this month to purchase benefits technology firm bswift from CVS Health Corp. only with an equity commitment, according to people with knowledge of the transaction. It was the firm’s willingness to use the so-called equity backstop that allowed it to beat out competitors that were struggling to find financing, the people said, though it intended to ultimately replace some of the equity with debt.

Thoma Bravo similarly signed up its $2.3 billion acquisition of ForgeRock Inc., a maker of identity-verification software, with 100% equity even after holding discussions with some private credit firms about potential debt financing, according to a person with knowledge of the deal. Last month, Stonepeak used all-equity for its $2.4 billion acquisition of Intrado Corp.’s safety unit, according to people with knowledge of that deal. The company, once part of West Corp., provides telecommunications services used by 911 emergency responders and has traditionally supported elevated debt levels.

Private equity sponsors can easily replace some of the equity with debt before their deals close or whenever credit markets improve, the people said.

Pitfalls

For sponsors, paying entirely with equity comes with key pitfalls. If they actually have to fund the commitments it by definition becomes a drag on the returns of their funds, which typically rely on leverage to deliver the kind of double-digit returns their investors are promised. While the commitment is in place, it also ties up equity that the fund could be using to make other investments. Making large equity investments into a single company may also require special approval from a fund’s ultimate investors.

All that creates a strong incentive for them to add debt back to their investment at a later date.

“It’s a temporary fix,” said Farley at Kramer Levin. “It’s not a new normal.”

–With assistance from Paula Seligson and Michael Hytha.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.