Vanguard Group Inc. is preparing its debt funds for a recession, using selloffs in the world’s beleaguered credit markets to buy higher-quality assets at a discount.

(Bloomberg) — Vanguard Group Inc. is preparing its debt funds for a recession, using selloffs in the world’s beleaguered credit markets to buy higher-quality assets at a discount.

“Ironically, the worse returns get, the better bonds should look in the future,” the asset manager’s fixed-income head, Sara Devereux, and others wrote in a report. “The risk-reward profiles of various market sectors — including Treasuries, corporates, emerging markets, and long-term municipals — are more attractive than they were six months ago.”

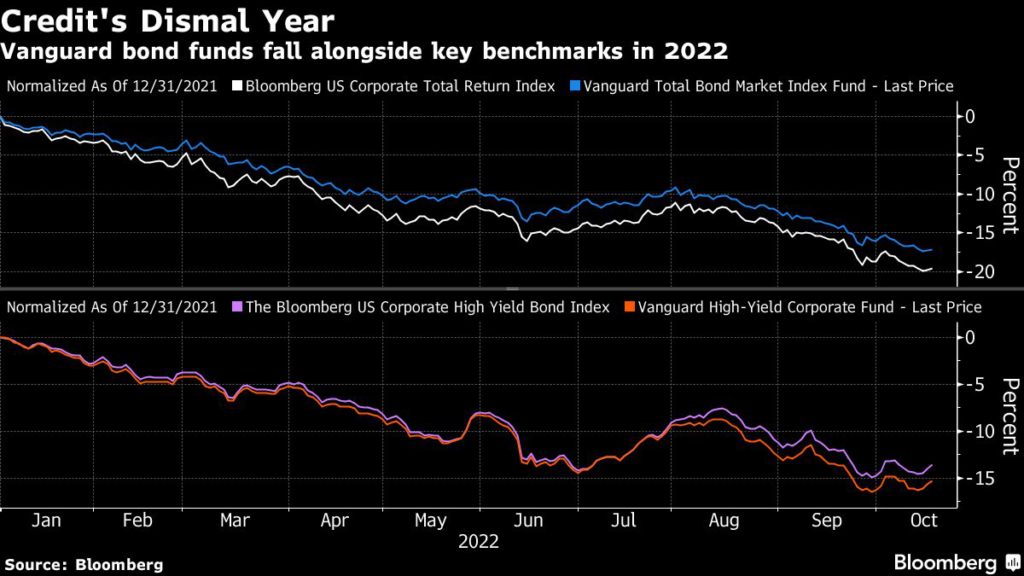

It’s a stance that reflects growing risk of a recession as the Federal Reserve fights the hottest inflation in 40 years with aggressive policy tightening. Risk-averse investors have sent US investment-grade bonds down about 20% this year, while high-yield debt has fallen, on average, roughly 14%.

But for Vanguard, which managed $6.7 trillion as of Sept. 30, a likely recession in 2023 means there’s opportunity to hunt for debt from defensive corporate issuers that can withstand an economic downturn. Securities rated BB, the highest tier of junk, are especially attractive, they wrote.

The group also likes sovereign debt from better-quality emerging markets, they wrote. Vanguard is also buying higher-quality municipal bonds at “attractive levels,” adding to sectors such as water and sewer, toll roads, and better-scored state, city and local general obligation debt.

Of course, investors wading into the weakest end of the credit spectrum will have to do so cautiously. A chorus has emerged on Wall Street warning of an uptick in defaults in the year ahead. Fitch Ratings this week forecast a high-yield default rate as high as 3.5% by end-2023, with delinquencies likely concentrated in consumer-focused industries such as retail, telecommunications and media.

Even Vanguard said it was underweight in the B rated portion of corporate debt and urged caution on CCC scored issues. The extra yield investors demand to hold risky CCC debt over US Treasuries, on average, has risen to 11.15 percentage points, well above the 10 percentage points threshold typically associated with distress. That’s just off the highest risk premium since mid-2020, according to data compiled from a Bloomberg index.

Still, “higher yields mean bonds look better going forward,” Devereux’s team wrote. “For investors who have added new, more esoteric positions in search of yield or uncorrelated assets such as private credit, it seems a good time to reconsider old-fashioned long-term asset allocation.”

(Updates with low-grade spreads, chart in penultimate paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.