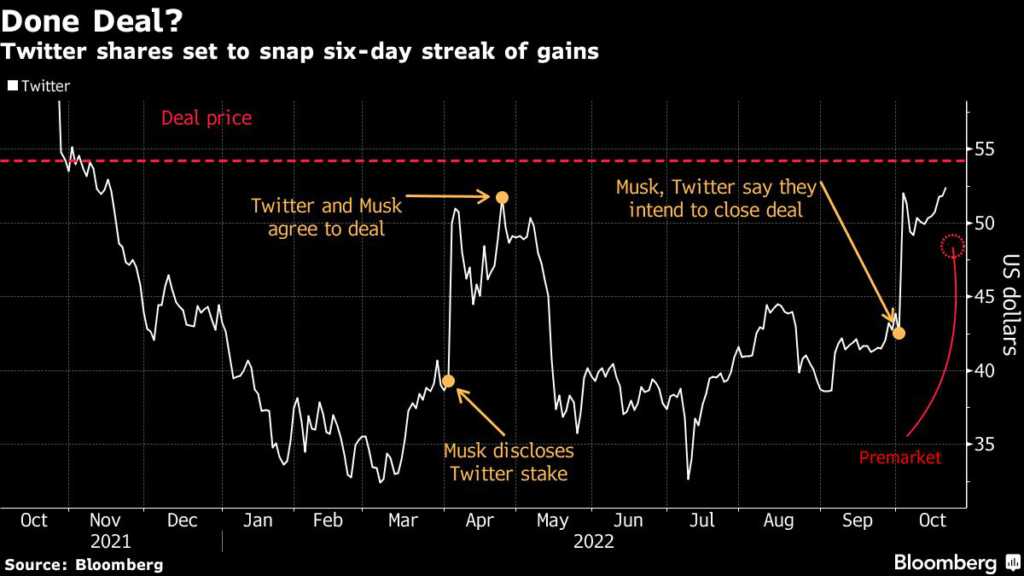

Twitter Inc. shares tumbled in premarket trading, falling further below Elon Musk’s offer price, on concern the deal may come under government scrutiny.

(Bloomberg) — Twitter Inc. shares tumbled in premarket trading, falling further below Elon Musk’s offer price, on concern the deal may come under government scrutiny.

The stock fell as much as 16% to $43.91 after Bloomberg News reported that the Biden administration is mulling whether the US should subject some of the billionaire’s ventures, including the deal for the social media company, to national security reviews.

Twitter had inched closer to Musk’s $54.20 a share offer price before the report, with Wall Street appearing increasingly confident that the deal would close. On Thursday, the arbitrage spread on the proposed takeover was at its narrowest since the deal was announced.

Both sides’ bankers and lawyers are preparing paperwork for the buyout to be completed by the Oct. 28 court-issued deadline, according to people familiar with the matter.

However, Gregory Lafitte, analyst at Tradition, says it looks hard for the Twitter deal to close on the deadline.

“Investors could be concerned about the timing of the transaction” while there is a possibility that the Delaware court could reopen the court case, he said. If premarket losses hold, Twitter will snap its six-day streak of gains.

Also weighing on social media stocks on Friday, Snap Inc. reported its slowest quarterly sales growth ever, saying a decline in advertising spending continues to drag on results.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.