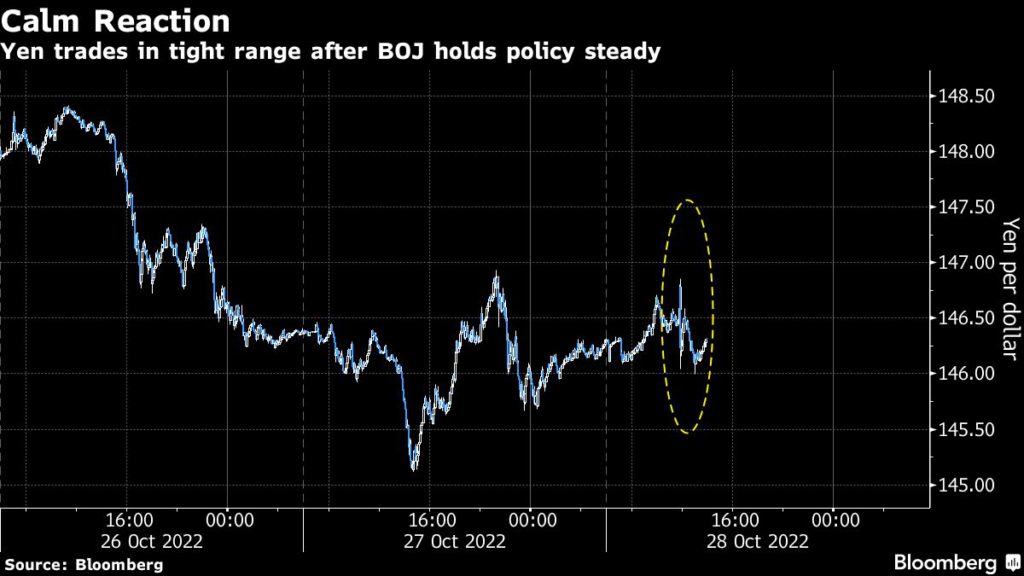

Shares dropped in Asia following declines on Wall Street as investors contended with disappointing results from tech giants. The yen swung between gains and losses after the Bank of Japan kept monetary policy unchanged.

(Bloomberg) — Shares dropped in Asia following declines on Wall Street as investors contended with disappointing results from tech giants. The yen swung between gains and losses after the Bank of Japan kept monetary policy unchanged.

A gauge of Asian equities slid as China stocks extended losses. Hong Kong-listed technology stocks tumbled more than 5%. Shares of miners and steelmakers in the region declined amid weakness in iron ore prices and a downbeat outlook for the sector.

Japan’s government bonds advanced after the central bank maintained ultra-low interest rates and projected inflation will cool below 2% next year. The 10-year bond gained for the first time since early this month. Traders are now awaiting Governor Haruhiko Kuroda’s post-decision briefing later Friday.

US equity futures fell, with Nasdaq futures dropping as much as 1%, following Amazon.com Inc.’s plunge after hours as its sales forecast trailed estimates. Shares of Apple Inc. rose slightly in postmarket trading following a volatile afternoon.

Chinese assets also remained in focus, with foreign investors dumping a record amount of mainland China stocks this week and sending Hong Kong equities to a 13-year low. President Xi Jinping’s tightening grip on power hasn’t had the same impact domestically, with mainland investors hunting for bargains in Hong Kong.

Bond yields fell in Australia and New Zealand while Treasury yields held most of their recent drop, with the 10-year remaining well below 4%.

Gross domestic product data showed that the US economy rebounded after two quarterly contractions, but also highlighted that consumer spending remains under pressure because of inflation.

Elon Musk completed his $44 billion acquisition of Twitter Inc., according to people familiar with the matter. Holders will be paid $54.20 per share and the social network will now operate as a private company.

Economists still expect the Fed to hike by three-quarters of a percentage point for the fourth time in a row when it meets next week. But with recent data highlighting the effects of sharp rate hikes on the economy, investors expect the FOMC to slow the pace of tightening after November’s meeting.

Read: Bond Bulls Bet on Plateau in Rates as Dovish Signals Grow

“We feel that inflation is still really too hot at the moment. So for us to get to a point where there is really an easing signal from the Fed, I think we’re still very long way off,” Julia Wang, global market strategist at JPMorgan Private Bank, said on Bloomberg Radio. “So we’ll be very wary of chasing this hopeful tone in the market for too much.”

Elsewhere, oil headed for a weekly gain, supported by tightness in petroleum product markets, robust US exports, and a weakening dollar. Gold was set for its second weekly climb and Bitcoin traded above $20,000.

Key events this week:

- US personal income, personal spending, pending home sales, University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

- Futures on the S&P 500 fell 0.6% as of 6:34 a.m. London time. The S&P 500 fell 0.6%

- Nasdaq 100 futures dropped 1%. The Nasdaq 100 fell 1.9%

- Japan’s Topix index declined 0.2%

- South Korea’s Kospi index lost 0.6%

- Hong Kong’s Hang Seng Index tumbled 3.1%

- China’s Shanghai Composite Index slumped 1.3%

- Australia’s S&P/ASX 200 Index declined 0.9%

- Euro Stoxx 50 futures slipped 0.8%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro rose 0.2% to $0.9985

- The Japanese yen was steady at 146.26 per dollar

- The offshore yuan climbed 0.3% to 7.2415 per dollar

- The British pound weakened 0.1% to $1.1556

Cryptocurrencies

- Bitcoin fell 0.6% to $20,268.07

- Ether dropped 1.2% to $1,509.06

Bonds

- The yield on 10-year Treasuries advanced three basis points to 3.94%

- Australia’s 10-year bond yield fell 10 basis points to 3.73%

Commodities

- West Texas Intermediate crude fell 1.2% to $88 a barrel

- Spot gold was little changed at $1,662.18 an ounce

–With assistance from Toru Fujioka and Sumio Ito.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.