The dollar and Treasury yields fell as investors adjusted positions ahead of the Federal Reserve’s policy meeting while Chinese stocks led a rebound in equities during the Asian trading session.

(Bloomberg) — The dollar and Treasury yields fell as investors adjusted positions ahead of the Federal Reserve’s policy meeting while Chinese stocks led a rebound in equities during the Asian trading session.

Chinese stocks roared back from a rout on unconfirmed social media posts speculating that a committee was being formed to assess scenarios on how to exit Covid Zero.

A gauge of Hong Kong-listed technology companies surged more than 9%.

European and US equity futures advanced after the S&P 500 declined, weighed down by big tech. US energy shares had whipsawed on news that President Joe Biden would call on Congress to consider tax penalties for producers accruing record profits.

Australian government bond yields reversed earlier gains and the nation’s stocks rallied to a seven-week high after the central bank raised interest rates by a quarter point as expected.

The small increase in Australia’s policy rate contrasts with projections for another jumbo hike from the Federal Reserve on Wednesday.

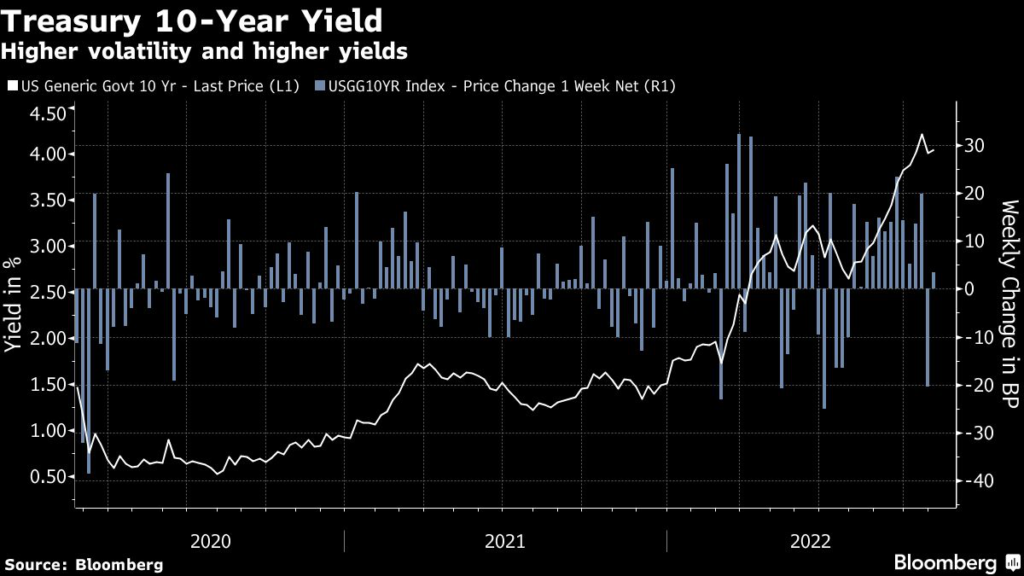

While Treasury yields slid, they remained elevated. Swap markets are pricing in a 75-basis-point hike this week amid the Fed’s most-aggressive tightening campaign in four decades.

The strong reaction in China’s markets on the reopening report “shows how much anticipation there has been for the reopening in the market,” said Hao Hong, partner at Grow Investment Group.

Meanwhile, strategists including JPMorgan Chase & Co.’s Marko Kolanovic believe the Fed’s aggressive hiking is nearing an end, providing the prospect of relief for markets.

The US will likely raise rates by 50 basis points in December and pause after one more 25-basis-point hike in the first quarter, he said.

Indicators such as the inversion of the yield curve between 10-year and three-month Treasuries “all support a Fed pivot sooner rather than later,” wrote Morgan Stanley’s Michael Wilson.

Looking ahead, Bespoke Investment Group said November has historically been one of the strongest months of the year for US stocks.

The S&P 500 has experienced an average gain of 0.82% with positive returns 69% of the time, according to data going back to 1983. Over the last 10 years, the gauge saw a median advance of 1.26% and gains nine out of 10 times.

The Bloomberg Dollar Index snapped a three-day rising streak and the offshore yuan extended a gain.

The yen strengthened while remaining within reach of the 150 level versus the dollar.

Japan spent a record 6.3 trillion yen ($42 billion) in October to counter the yen’s sharp slide against the dollar, as it tried to limit speculative moves adding to pressure on the currency.

Elsewhere, oil advanced toward $88 a barrel after losing around 3% over the previous two sessions.

Gold rose.

Key events this week:

- US construction spending, ISM manufacturing index, Tuesday

- EIA crude oil inventory report, Wednesday

- Federal Reserve rate decision, Wednesday

- US MBA mortgage applications, ADP employment, Wednesday

- Bank of England rate decision, Thursday

- US factory orders, durable goods, trade, initial jobless claims, ISM services index, Thursday

- ECB President Christine Lagarde speaks, Thursday

- US nonfarm payrolls, unemployment, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.6% of 6:44 a.m.

in London. The S&P 500 fell 0.8% on Monday

- Nasdaq 100 futures rose 0.7%. The Nasdaq 100 fell 1.2%

- Euro Stoxx 50 futures rose 0.8%

- Japan’s Topix index rose 0.5%

- South Korea’s Kospi index rose 1.8%

- Hong Kong’s Hang Seng Index rose 5.7%

- China’s Shanghai Composite Index rose 2.4%

- Australia’s S&P/ASX 200 Index rose 1.7%

Currencies

- The Bloomberg Dollar Spot Index fell 0.5%

- The euro rose 0.5% to $0.9931

- The Japanese yen rose 0.5% to 147.92 per dollar

- The offshore yuan rose 0.6% to 7.2920 per dollar

Cryptocurrencies

- Bitcoin rose 1.1% to $20,637.64

- Ether rose 2% to $1,596.55

Bonds

- The yield on 10-year Treasuries declined three basis points to 4.02%

- Yields on Australia’s 10-year bonds were little changed at 3.76%

Commodities

- West Texas Intermediate crude rose 1.4% to $87.73 a barrel

- Spot gold rose 0.7% to $1,644.91 an ounce

–With assistance from Jeanny Yu and Charlotte Yang.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.