The dollar and Treasury yields fell as investors awaited the Federal Reserve’s policy meeting. Stocks and US equity futures rallied.

(Bloomberg) — The dollar and Treasury yields fell as investors awaited the Federal Reserve’s policy meeting.

Stocks and US equity futures rallied.

US-listed Chinese stocks soared in premarket trading, tracking an earlier rally in Chinese markets on speculation that the country’s policymakers are looking to gradually unwind its stringent Covid policy, even as the country’s Foreign Ministry said it was unaware of such a plan.

Mining shares led gains in Europe, as copper rebounded amid signs of global supply tightness and iron ore rose after six days of declines.

Gold and oil also gained, while BP Plc climbed after announcing a further $2.5 billion buyback.

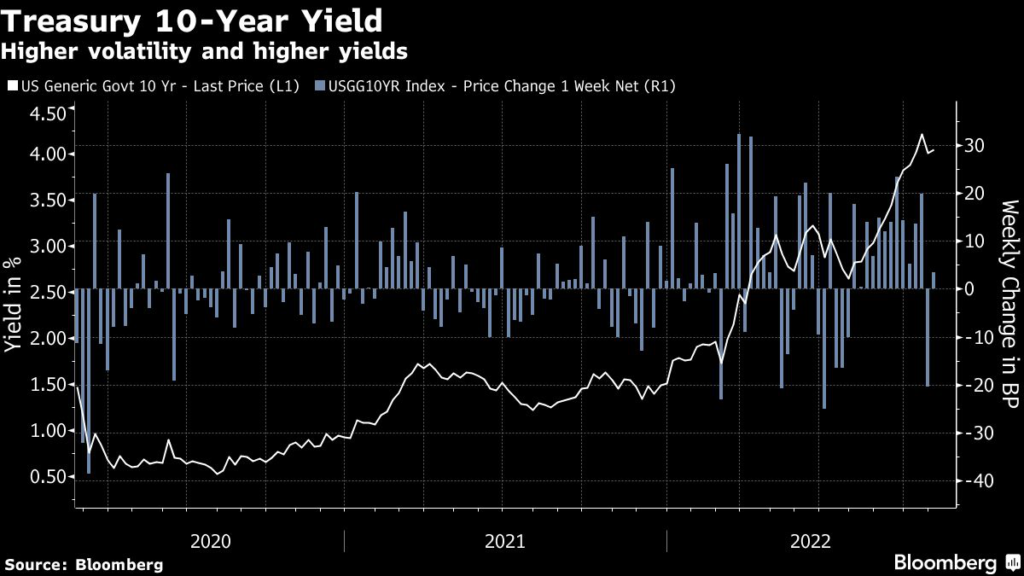

The Bloomberg Dollar Index snapped a three-day rising streak and Treasury yields fell below 4%. Swap markets are pricing in a 75-basis-point hike this week amid the Fed’s most-aggressive tightening campaign in four decades.

Still, strategists including JPMorgan Chase & Co.’s Marko Kolanovic believe the Fed’s aggressive hiking is nearing an end, providing the prospect of relief for markets.

The US will likely raise rates by 50 basis points in December and pause after one more 25-basis-point hike in the first quarter, he said.

Indicators such as the inversion of the yield curve between 10-year and three-month Treasuries “all support a Fed pivot sooner rather than later,” wrote Morgan Stanley’s Michael Wilson.

“If the Fed does give us some indication that there is light at the end of the tunnel, we are very close if not already past peak dollar,” Mark Matthews, head of Asia research at Julius Baer said on Bloomberg TV.

“Then all the currencies which have declined like the euro will rebound.”

The euro and pound rose on Tuesday. Meanwhile, the UK government said it’s inevitable that all Britons, especially the richest, will have to pay more tax to restore stability to the public finances and the Bank of England is set to become the first major central bank to sell off assets accumulated during a 13-year-old stimulus program.

Among other moves, shares in European online retailers and food delivery firms rallied on Tuesday as Ocado Group Plc jumped after its deal with South Korea’s Lotte Shopping Co.

Chinese stocks pared gains after the Foreign Ministry said it was unaware of any plans to ease restrictions.

But the strong initial reaction to an unverified social media post “shows how much anticipation there has been for the reopening in the market,” said Hao Hong, partner at Grow Investment Group.

Australian government bond yields reversed earlier gains and the nation’s stocks rallied to a seven-week high after the central bank raised interest rates by a quarter point as expected.

The yen strengthened, while remaining within reach of 150 versus the dollar.

Japan spent a record 6.3 trillion yen ($42 billion) in October to counter the currency’s sharp slide, as it tried to limit speculative moves adding pressure.

Key events this week:

- US construction spending, ISM manufacturing index, Tuesday

- EIA crude oil inventory report, Wednesday

- Federal Reserve rate decision, Wednesday

- US MBA mortgage applications, ADP employment, Wednesday

- Bank of England rate decision, Thursday

- US factory orders, durable goods, trade, initial jobless claims, ISM services index, Thursday

- ECB President Christine Lagarde speaks, Thursday

- US nonfarm payrolls, unemployment, Friday

Some of the main moves in markets:

Stocks

- Futures on the S&P 500 rose 0.8% as of 5:55 a.m.

New York time

- Futures on the Nasdaq 100 rose 1.1%

- Futures on the Dow Jones Industrial Average rose 0.6%

- The Stoxx Europe 600 rose 1.2%

- The MSCI World index fell 0.4%

Currencies

- The Bloomberg Dollar Spot Index fell 0.6%

- The euro rose 0.5% to $0.9931

- The British pound rose 0.6% to $1.1533

- The Japanese yen rose 0.8% to 147.47 per dollar

Cryptocurrencies

- Bitcoin rose 0.9% to $20,593.87

- Ether rose 2.2% to $1,598.68

Bonds

- The yield on 10-year Treasuries declined nine basis points to 3.96%

- Germany’s 10-year yield declined seven basis points to 2.07%

- Britain’s 10-year yield declined seven basis points to 3.45%

Commodities

- West Texas Intermediate crude rose 1.3% to $87.63 a barrel

- Gold futures rose 0.7% to $1,652.40 an ounce

–With assistance from Tassia Sipahutar, Ken McCallum and Brett Miller.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.