The US and Netherlands are expected to hold a new round of talks this month on restricting China’s access to advanced chip technologies, during which Washington will ramp up pressure on its ally to block ASML Holding NV from supplying the Asian nation.

(Bloomberg) — The US and Netherlands are expected to hold a new round of talks this month on restricting China’s access to advanced chip technologies, during which Washington will ramp up pressure on its ally to block ASML Holding NV from supplying the Asian nation.

Senior US National Security Council official Tarun Chhabra and Under Secretary of Commerce for Industry and Security Alan Estevez are slated to travel to the Netherlands for the discussions, according to people familiar with the plans, who asked not to be named as they are not authorized to speak about the upcoming meeting.

The parties will discuss expanding export controls as the US has been pressuring the Dutch government to halt Veldhoven-based ASML’s sales of a wider range of its advanced chip production machines to China, according to the people, although they do not expect an agreement to come out of the new talks. The trip is part of ongoing bilateral consultations and the two sides will also talk about other issues in the US-Dutch tech partnership, according to one of the people.

The US National Security Council, the US Department of Commerce and the Dutch Ministry for Foreign Trade and Development Cooperation all declined to comment. China’s Ministry of Foreign Affairs said the US has politicized technology, economic and trade issues, and its intention behind the “technology blockade and de-coupling” efforts is obvious. China calls on relevant parties to make independent decisions based on their long-term interests and fair market principles, the ministry said in a statement Friday.

ASML already doesn’t distribute its cutting-edge extreme ultraviolet lithography systems in China, but Washington has been pushing for that prohibition to extend into more mature tech as well.

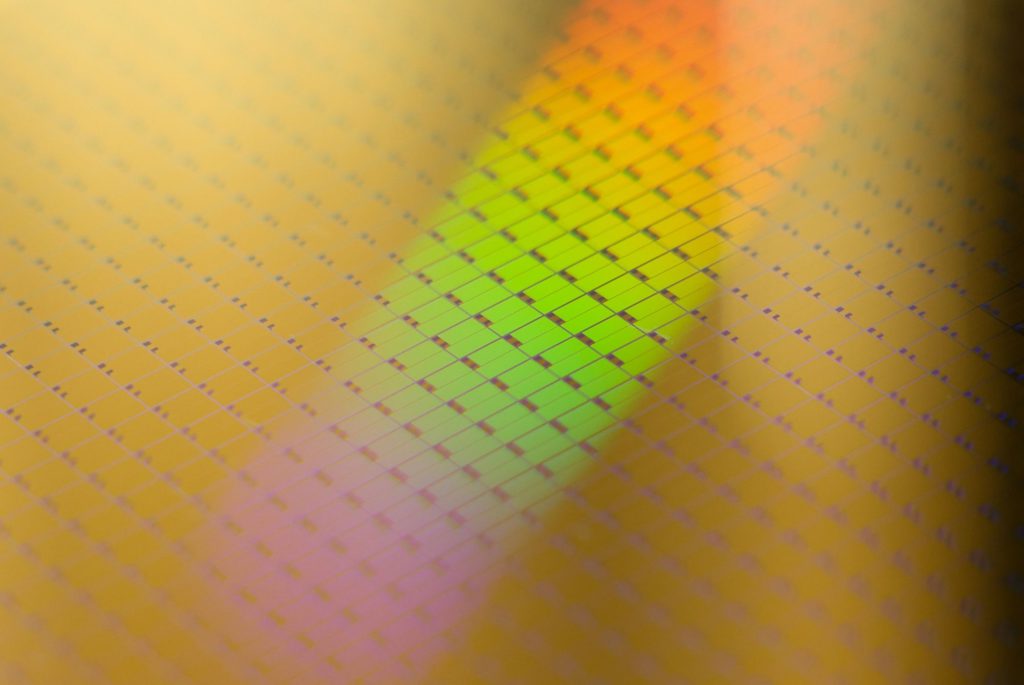

The development highlights the Biden administration’s ongoing campaign to convince allies to align with its export control policy and keep the latest chip technologies out of the reach of the Chinese military. ASML is a linchpin of the $550 billion global chip industry, a maker of one-of-a-kind machines without which most advanced semiconductors cannot be made, and Washington needs the company on board to exert maximum pressure on China.

Read: How Biden’s Chip Actions May Be Broadest China Salvo Yet

The global chip-equipment market is dominated by three American suppliers — Applied Materials Inc., Lam Research Corp. and KLA Corp. — alongside ASML and Japan’s Tokyo Electron Ltd.

All are subject to a thicket of regulations that limit what they can sell to Chinese customers, though the non-American firms have more latitude in doing business with China than their US peers. That gap has grown after Washington rolled out new rules on Oct. 7 further restricting the ability of American equipment suppliers to do business in the country.

ASML has been unable to get approval from the Dutch government to sell its most advanced EUV machines to China, but so far it can continue to sell its other products to Chinese customers and sees a smaller impact than its US peers from the new US export controls.

Read: Chip Industry’s China Crisis Hammers Lam But May Spare ASML

American officials have said that their latest round of trade restrictions will lose effectiveness over time if allies do not join the campaign. They’ve also been pushing for ASML to halt the sale of immersion lithography machines, its second most advanced product after EUV, to China, Bloomberg News reported earlier this year.

Commerce’s Estevez said last week that he expects a deal with global allies to limit shipments of chip-production equipment to China in the near term.

–With assistance from Diederik Baazil and Yujing Liu.

(Updates with comment from China’s foreign ministry in fourth paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.