European natural gas jumped as traders weighed potential supply curbs this winter against unseasonably warm weather and muted demand.

(Bloomberg) — European natural gas jumped as traders weighed potential supply curbs this winter against unseasonably warm weather and muted demand.

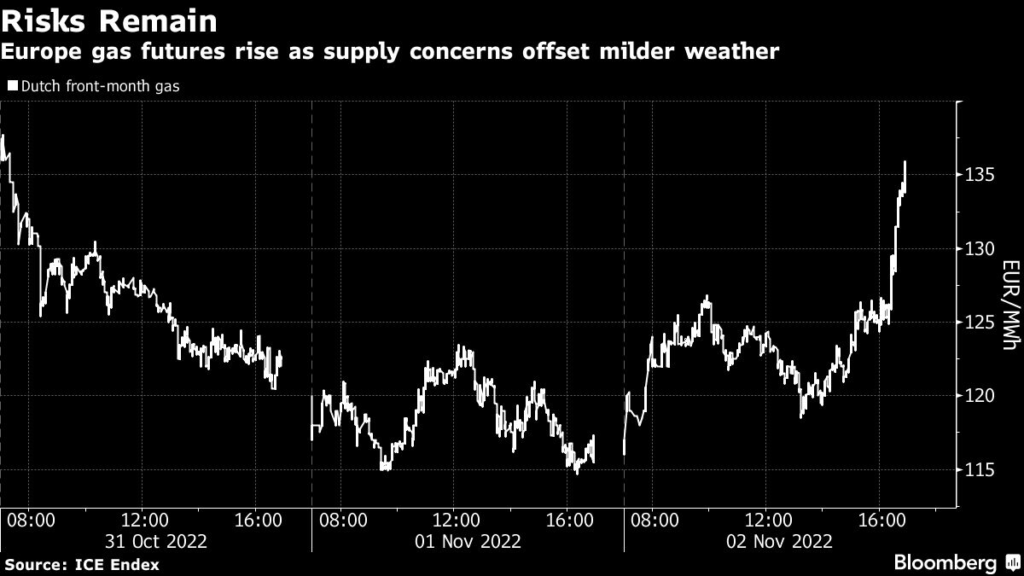

Benchmark futures closed more than 8% higher, rebounding to levels seen on Monday. Liquefied natural gas flows from the US are in focus. Freeport LNG in Texas, hobbled by a fire earlier this year, has yet to submit a restart plan to federal regulators, stoking speculation that it won’t resume operations this month as planned.

That’s keeping the market nervous about a thin cushion of global supply after Russia’s gas cuts, which may support prices when temperatures inevitably drop.

Dutch front-month gas, Europe’s benchmark, surged as much as 17% before settling 8.3% higher at €125.863 per megawatt-hour. The UK equivalent went up 9.2%.

For now, temperatures are expected above seasonal norms in most of western Europe for the next two weeks, with cooler conditions limited to the southeast of the continent, according to forecaster Maxar Technologies LLC. Europe’s gas storage sites are almost 95% full, providing a buffer for when the weather turns colder.

Delayed heating demand and reduced gas consumption by industries have provided some respite. At least four LNG vessels bound for the UK are delaying their unloadings amid mild weather, ship-tracking and port data show.

“Europe should be able to get through this winter,” Vontobel Asset Management AG said in a note. “That said, while LNG imports have alleviated immediate supply concerns, even inventories filled to the brim will hardly be enough to prevent some rationing.”

Politicians are weighing more steps to safeguard markets from potential risks in colder months.

Germany is expanding aid to consumers struggling with rising energy bills. The UK is testing its blackout emergency plans, the Guardian reported, citing documents that warn of a “reasonable worst-case scenario” in which energy sectors could be “severely disrupted” for up to a week.

The European Union has said it’s working on ways to cap price spikes, but there’s no agreement on details yet, while top suppliers warn against direct interventions. Limiting prices may both slow down much needed demand destruction and divert gas flows away from Europe if there are other regions willing to pay more.

Click here for the Europe Energy Crunch blog

“Europe should be looking for long-term contracts with fixed prices that give security of supply, and then you can actually design an economic policy knowing what those prices will be,” Mathios Rigas, chief executive officer of Mediterranean-focused gas producer Energean Plc, said in an interview on the sidelines of an industry conference in Abu Dhabi this week.

–With assistance from Verity Ratcliffe and Anna Shiryaevskaya.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.