(Bloomberg) — The stocks of three junior lithium explorers tumbled after Canada’s government ordered their Chinese investors to divest under tougher foreign investment rules around the nation’s critical minerals sector.

(Bloomberg) — The stocks of three junior lithium explorers tumbled after Canada’s government ordered their Chinese investors to divest under tougher foreign investment rules around the nation’s critical minerals sector.

Shares of Power Metals Corp. sunk as much as 21% on the TSX Venture Exchange in Toronto, its biggest intraday decline since April 2020. Ultra Lithium Inc. fell as much as 25%, while Lithium Chile Inc. slid as much as 10% before recovering.

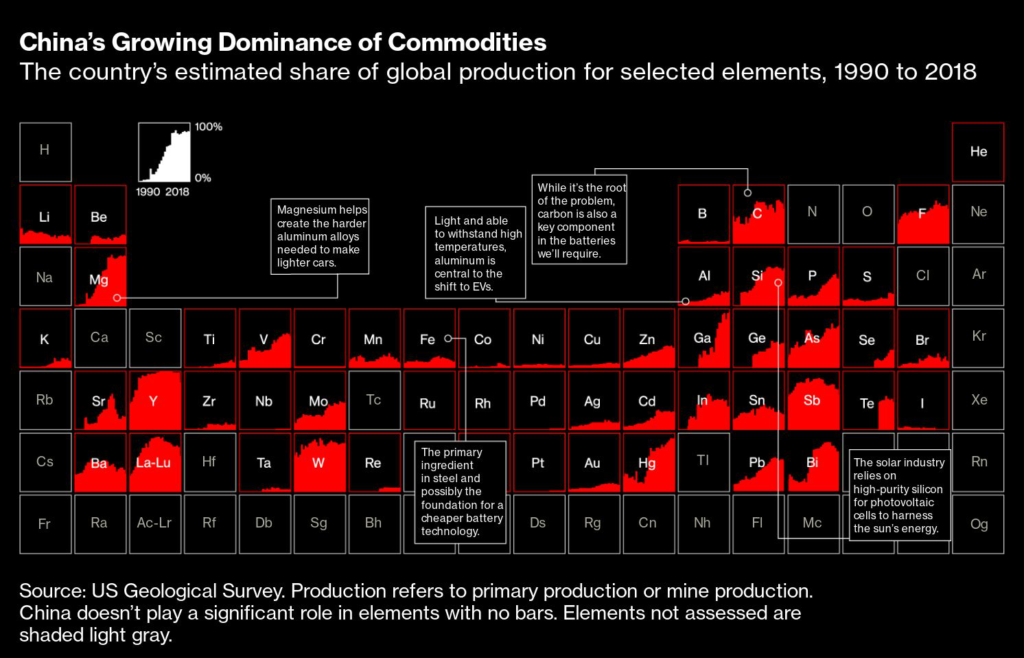

The plunge came after Canada’s government said in a Wednesday statement that it ordered three Chinese firms to divest from the trio due to strengthened guidelines to protect the country’s minerals wealth. The decision comes as Canada, the US and their allies are increasingly concerned about China’s dominance of metals that are the building blocks for a global push to transition to cleaner energy sources.

Sinomine (Hong Kong) Rare Metals Resources Co. Ltd. is required to divest in Vancouver-based Power Metals, while Zangge Mining Investment (Chengdu) Co. Ltd. was ordered to divest from Ultra Lithium, also based in Vancouver, and Chengze Lithium International Ltd. was told to exit from Calgary-based Lithium Chile, Canada’s federal government said in Wednesday’s statement.

Canada’s actions caught Lithium Chile “totally by surprise,” Chief Executive Officer Steven Cochrane said Thursday in an interview.

Chinese companies are among the biggest investors in the global lithium industry and banning state-owned firms from financing projects will be felt throughout the industry, he said, adding that there hasn’t been little investment coming from Europe, the US or Canada. Lithium Chile, which has a market value of C$135 million ($98 million), has exploration projects in Argentina and Chile.

“Our sector has often relied on money from China to fuel these projects,” Cochrane said. “So the impact is going to be felt by everybody.”

The move follows updated guidelines from Canada’s government, released Friday, which make it harder for foreign state-owned companies to pursue deals and investments that target critical minerals including lithium, nickel, copper and uranium in the resource-rich country. Transactions by foreign state-owned firms will now only be approved “on an exceptional basis.”

“Though the divestiture order is not likely to affect the business operations of those three Chinese firms in the near term because all three lithium mining projects are still under early-stage exploration status, the latest attitude from Ottawa underscores the global competitions for critical battery minerals,” Susan Zou, senior analyst at RystadEnergy, said in a note to clients.

Sinomine Resource and Zangge Mining said the matter won’t have big impacts on their performance in 2022 and beyond respectively, according to separate filings to Shenzhen stock exchange Thursday.

Meanwhile, Beijing urged Ottawa to stop “unreasonable suppression” of Chinese enterprises and said Canada’s practice will hurt the stability of the supply chain, state broadcaster CCTV reported, citing Foreign Ministry spokesman Zhao Lijian at a briefing.

Canada’s order against the Chinese investors was made after “rigorous scrutiny” of foreign firms by Canada’s national security and intelligence community, Canadian Industry Minister Francois-Philippe Champagne said in Wednesday’s statement.

“The government’s decisions are based on facts and evidence and on the advice of critical minerals subject matter experts, Canada’s security and intelligence community, and other government partners,” he said.

–With assistance from Annie Lee.

(Adds CEO comment from fifth paragraph)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.