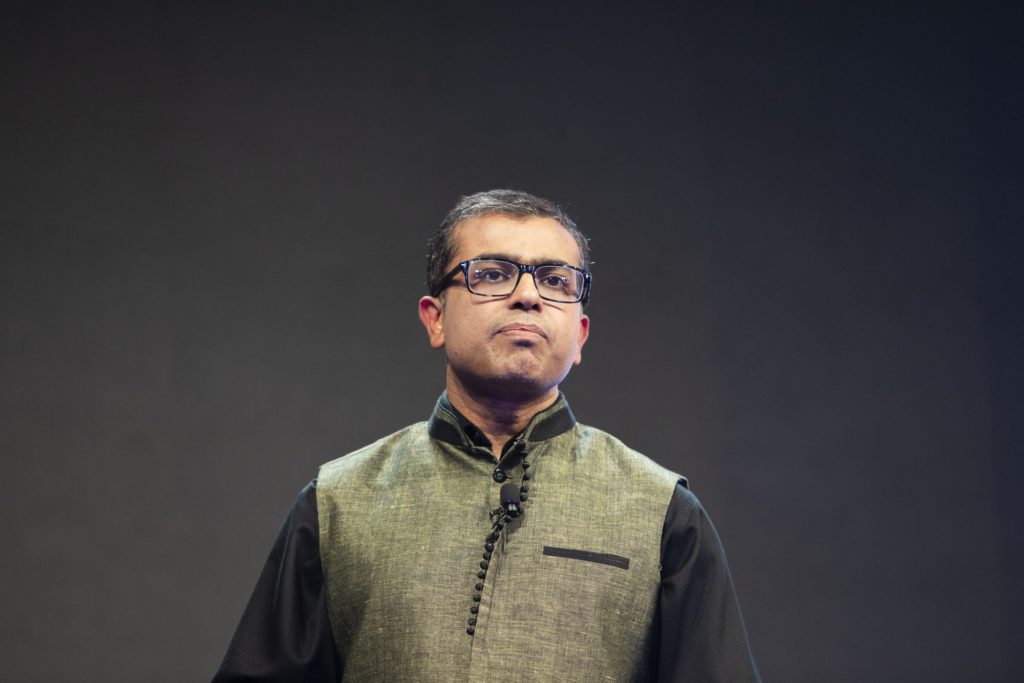

Coinbase Global Inc., the largest US crypto exchange, said Chief Product Officer Surojit Chatterjee agreed to step down amid a reorganization of its product, engineering and design teams.

(Bloomberg) — Coinbase Global Inc., the largest US crypto exchange, said Chief Product Officer Surojit Chatterjee agreed to step down amid a reorganization of its product, engineering and design teams.

Chatterjee’s departure will be effective Nov. 30 and he will continue to serve as an adviser through at least Feb. 3, 2023, the company said in a filing on Wednesday.

“Coinbase is grateful for Mr. Chatterjee’s contributions throughout his employment at Coinbase, including his leadership in building Coinbase’s product organization and launching products in aim of increasing economic freedom in the world,” the firm said in a filing.

Under Chatterjee’s tenure, Coinbase launched its NFT platform, but the long-awaited debut arrived when the NFT hype was already cooling down.

After years of aggressive expansion and hiring, Coinbase has reset its strategy in recent months to reign in costs. In May, Chatterjee told employees the firm will focus “on critical revenue-generating products” and refocus on core products while seeking improvements in developer productivity.

Chatterjee joined Coinbase in February 2020 after three years at Alphabet Inc.’s Google, where he led the company’s shopping platform during his second stint at the search giant.

Read More: Google Executive’s 2020 Move to Coinbase Worth $646 Million

The crypto industry has seen a series of C-suite shuffling, restructuring and layoffs. Galaxy Digital is exploring cutting as much as 20% of jobs, while crypto conglomerate Digital Currency Group laid of 10% of staff.

On Thursday, Coinbase is expected to report $649 million in third-quarter revenue, with retail and institutional trading revenues both shrinking, according to the average estimate of analysts surveyed by Bloomberg. That would be a 20% drop from the second quarter and at about half of the level from a year ago. Monthly transacting users is estimated to fall to 7.8 million from around 9 million. Adjusted net loss is expected to be $521 million, compared with a $1.1 billion net loss in the second quarter.

Coinbase’s stock has plummeted by 76% so far this year, more than the 56% decline in the price of Bitcoin.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.