Good morning. Here’s what you need to know today:

- Mining giant Glencore flew bags of cash to bribe officials in various African countries.

- Advertisers want to know how Twitter will prevent itself from becoming a hate speech paradise.

- The US Fed continues its aggressive interest rate hiking with more to come.

Glencore flew cash across Africa in private jets to pay bribes

JSE-listed commodity and mining company Glencore had cash delivered via private jets to officials across Africa says UK prosecutors as they explain the web of bribery and corruption orchestrated by the firm. Glencore, also listed on the London Stock Exchange, admitted to seven counts of bribery following a Serious Fraud Office investigation. The company is said to have paid more than $28 million to secure access to oil cargoes across Africa in countries including Nigeria and Cameroon. A London judge will make a ruling today on what the company will be fined. (Times LIVE)

Advertisers begin to grill Elon Musk over Twitter ‘free-for-all’

Advertisers have started to bang on new Twitter owner and CEO Elon Musk’s door over his “free speech haven” concept for Twitter. Advertisers want to know how Musk intends to safeguard the social media platform against becoming a “free-for-all hellscape” that will become a happy place for trolls and unrestricted hate speech. At least one major agency has indicated it intends to meet with Musk this week. Some of Musk’s plans for Twitter include charging for premium subscriptions and cutting down on the number of ads in the service. (Daily Maverick)

Fed delivers another steep rate hike with more to come

The US Federal Reserve raised the benchmark borrowing rate by another 75 basis points on Wednesday – the fourth consecutive hike of that size and the sixth hike this year – as the US central bank tries to tame rampant inflation not seen since the 1980s. The Fed said it was not done hiking the interest rate but did signal that it may not be as aggressive with rate hikes in the future. In a statement following the conclusion of its two-day policy meeting, it said more hikes “would be appropriate” to tamp down inflation. (AFP)

Here’s what else we’re reading:

SA Business

- Safety will not be compromised if Koeberg power plant lifespan is extended: De Ruyter – SABC News

- The bright side of load shedding: SA companies are doing pretty good on sustainability – Business Insider

- Eskom board will be visible but not interfere with day-to-day running of the entity: Chair – SABC News

Global Business

- iPhone supply chain takes hit from Xi’s Covid-Zero enforcers – Daily Maverick

- Twitter could face crypto makeover, billionaire investor hints – AFP

- White House Is Undecided on Paying Elon Musk for Twitter Blue Check – Bloomberg

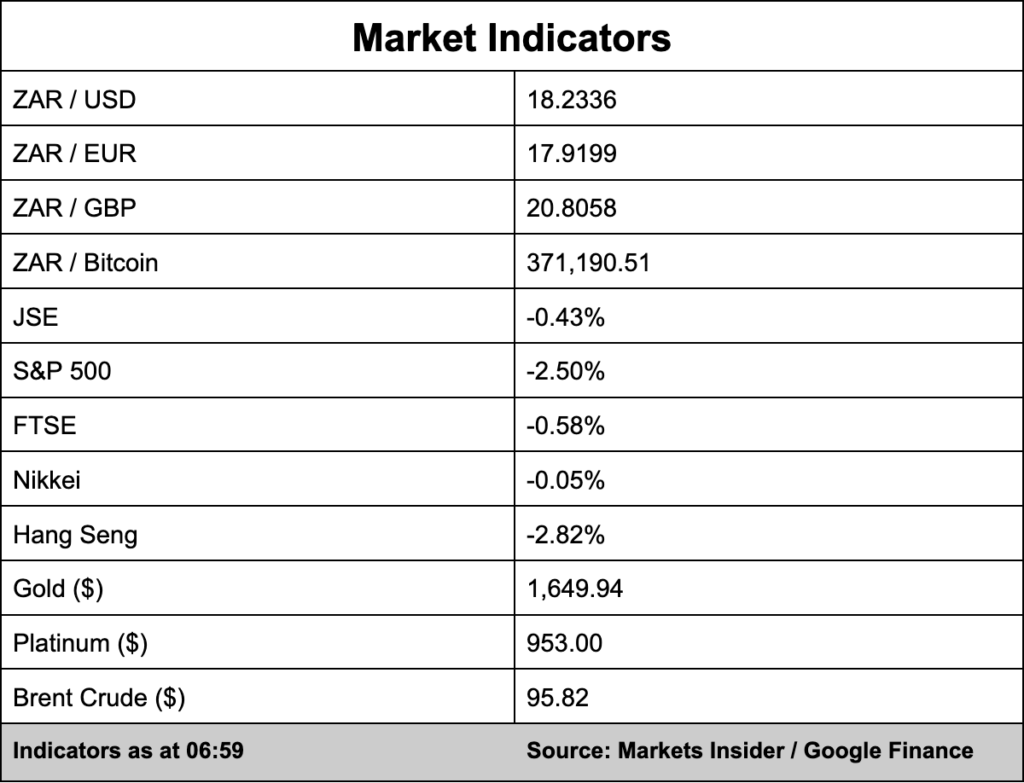

Markets