Bitcoin has shed more than half its value this year, and yet the selling may not yet be over.

(Bloomberg) — Bitcoin has shed more than half its value this year, and yet the selling may not yet be over.

That’s according to digital-assets researcher CryptoCompare, which pointed to a number of gauges and historical data, including the token’s maximum drawdown in past bear markets as well as its current volatility, as evidence it hasn’t yet hit a floor.

Earlier bear markets, which began in 2013 and 2017, “suggest we could still experience a further decline,” CryptoCompare analysts wrote in a report released Thursday. The world’s largest digital token during those two instances saw declines of 83% and 87%, which lasted 364 and 406 sessions, respectively.

This time around, Bitcoin has fallen 73% and we’re at 357 days as of Oct. 31, meaning that it hasn’t been as “acute” in terms of time frame and severity as those prior declines. That leaves “room for 2022 to become the worst drawdown in Bitcoin’s history,” they wrote.

Meanwhile, during the last bear market, average annualized volatility for Bitcoin was 79%, a measure that’s right now hovering around 63%. “Under the context of the current market, we believe it’s possible for a high-stress event to take place in the traditional financial system, which would cause sell-side pressure across major asset classes, leading to a spike in volatility and a potential move downwards,” CryptoCompare said.

While all manner of riskier assets have been stuck in the gutter this year as central banks around the world raise interest rates to tamp down inflation, cryptocurrencies have been hit especially hard. Bitcoin has been hovering around $20,000, way off its 2021 highs of nearly $69,000. Ether and others have also suffered. In this environment, retail investors have been more reticent to step into the space in the same way they had over the first two pandemic years, while high-adrenaline traders have found it harder to partake in trades that in the past had worked much better.

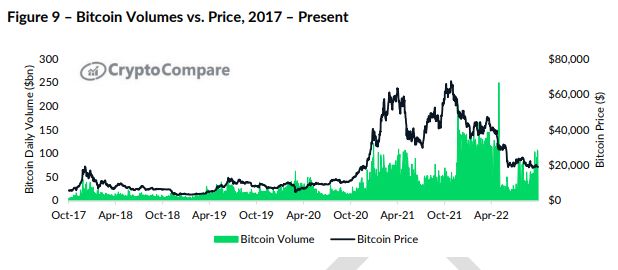

However, CryptoCompare points out that volumes haven’t deflated as much as they had in the rout that started in 2017, when they dropped more than 60% from peak to trough. In 2022, they’ve fallen 35% since their top last year.

“This may suggest volumes have become stickier despite the downturns — or we are due for further decline in activity,” the report said.

The researchers also noted that Bitcoin’s market dominance has in the past been used as a gauge of figuring out the stage of the market cycle. In earlier instances, analysts considered that the coin’s dominance would fall during a bull market as smaller projects gained attention. During a drawdown, however, it was thought that the opposite would happen, though that hasn’t been the case this time around. Many crypto fans have already turned their attention to other projects.

“It is possible that we are not yet in the final stages of the bear market, suggesting smaller projects will continue to lose value and may lead to a rise in Bitcoin’s dominance in the short to medium-term,” the report said.

–With assistance from Eva Szalay.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.