Good morning. Here’s what you need to know today:

- Ramaphosa backs Godongwana following energy transition comments.

- Twitter will begin a mass firing spree today.

- The Bank of England raised interest rates by the most in 33 years.

It’s all about Eskom, as Ramaphosa backs his finance minister on energy mix

President Cyril Ramaphosa backed Enoch Godongwana during a non-stop three-hour presidential Q&A in parliament on Thursday. The finance minister has been under the spotlight lately not because of the recent release of his medium-term budget but because of comments, he made on Monday where he described SA’s future energy mix as including “old technologies” – “some gas” and “some nuclear” – for a reliable energy supply. Ramaphosa reiterated that Godongwana supports the just energy transition plan set out by government while on questions of job security for Eskom’s leadership he deferred such decisions to the power utility’s board. (Daily Maverick)

Elon Musk announces Twitter mass layoffs to begin Friday

Twitter will begin the process of mass layoffs today following an internal company email that was sent out on Thursday. Those that are keeping their jobs will receive an email to their work account while those being axed will get an email sent to their personal account. It’s speculated that as much as 50% of the workforce will be sent packing, which could mean that thousands lose their jobs as Twitter had more than 7,000 employees by the end of 2021. (The Guardian)

Bank of England announces biggest UK rate hike in 33 years

On Thursday, the Bank of England raised its interest by 75 basis points to 3% – the highest it’s been in 14 years. The aggressive rate hike was the largest in 33 years, but the central bank warned against market expectations for the future scale of increases, which it said would push the economy into a two-year recession. The Monetary Policy Committee voted 7-2 to lift the interest rate and said in comments released after the meeting that the November hike will “reduce the risks of a more extended and costly tightening later.” (News24)

Here’s what else we’re reading:

SA Business

- Chicken Licken can’t be the only restaurant with soul, appeals court rules in souvlaki case – Business Insider

- Calls intensify for audit of South African tailings dams after Jagersfontein disaster – Engineering News

- Bolt can’t claim drivers can make up to R6,000 per week, ad regulator rules – Business Insider

Global Business

- G7 coalition has agreed to set fixed price for Russian oil – Source – SABC

- Cheerios maker General Mills pauses advertising on Twitter – Reuters

- Canada to set up tax credits for clean tech, launch growth fund – Reuters

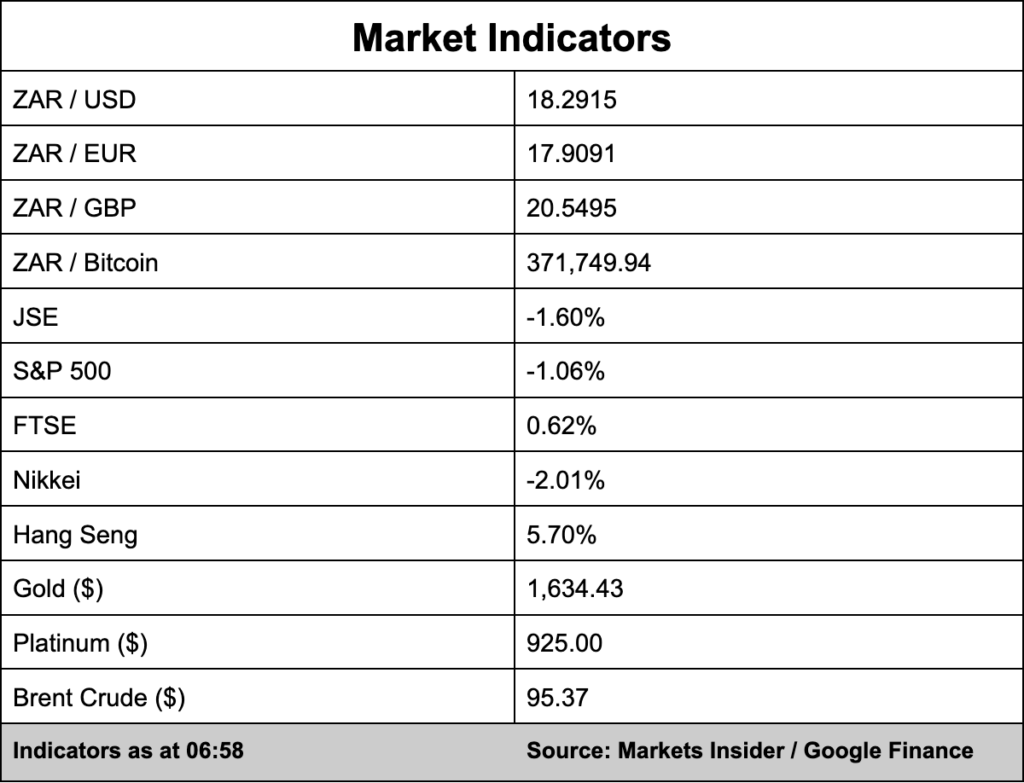

Markets