There’s a “budding uptrend” taking shape in the cryptocurrency market as the macroeconomic backdrop improves, the dollar weakens and more digital-asset adoption gets underway.

(Bloomberg) — There’s a “budding uptrend” taking shape in the cryptocurrency market as the macroeconomic backdrop improves, the dollar weakens and more digital-asset adoption gets underway.

That’s according to Cumberland, the crypto offshoot of Chicago-based trading giant DRW, which says the dollar’s “inexorable-seeming rally” earlier this year seems to have topped out after helping to suppress sentiment across major asset classes. Plus, disruptions at the start of 2022 — including Russia’s attack on Ukraine and supply-chain issues — “have reached a state of choppy equilibrium,” the company tweeted on Monday. “In the absence of new geopolitical developments, a reduction in volatility should result in higher asset prices.”

Meanwhile, the crypto space could see “a less adversarial environment” in Washington DC should Republicans notch wins during the midterm elections, potentially creating a deadlock with different parties controlling the executive and legislative branches.

Finally, Cumberland points to certain crypto adoption milestones that in the past might have fueled “spectacular rallies.”

“With all of this going on, prices are essentially unchanged since midsummer (roughly equivalent to the 2017 cycle highs) and do not yet reflect the shifting macroeconomic, political, geopolitical, and micro/fundamental winds,” the Cumberland tweet said.

Crypto market watchers have been looking for green shoots all year as prices for coins remain mired in a prolonged bear market. Several have pointed to signs, using historical precedent or data, of a bottom forming for Bitcoin. Even relatively smaller rallies have recently spurred optimism that the worst is likely over.

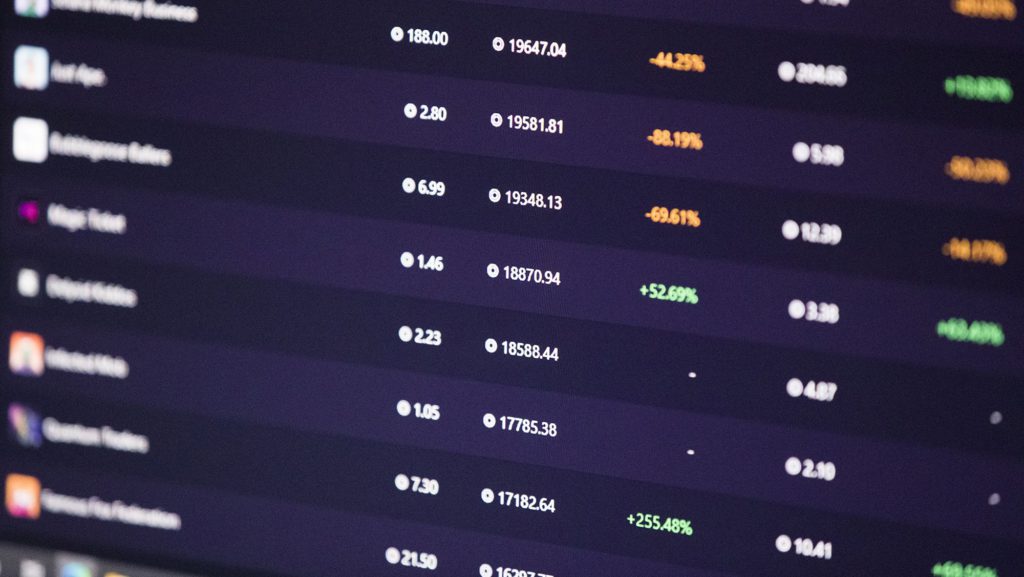

Still, the token is down 55% this year and has largely been hovering around $20,000 for weeks. Others say the selling is not over yet, with digital-assets researcher CryptoCompare pointing to historical data as proof the market could see further declines.

And while institutions may be more invested than they’ve been in the past, their embrace hasn’t been a catalyst to push prices higher, according to Leah Wald, chief executive officer of digital-asset investment firm Valkyrie Investments.

“Institutions have a longer time horizon. They also, as a fiduciary, cannot just jump in with a strategy,” Wald said on a recent episode of Bloomberg’s “What Goes Up” podcast. “There’s a lot of other hurdles that institutions have — whether it’s risk parameters, among others, and also just generally the vehicle that they need in order to buy it.”

Bitcoin fell as much as 2.5% on Monday to trade around $20,597. Other tokens also declined, with Binance Coin and Solana losing more than 6% each at one point.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.