An equity-focused hedge fund launched by a Credit Suisse Group AG veteran around the height of the coronavirus pandemic emerged as the winner from Brazil’s election swings.

(Bloomberg) — An equity-focused hedge fund launched by a Credit Suisse Group AG veteran around the height of the coronavirus pandemic emerged as the winner from Brazil’s election swings.

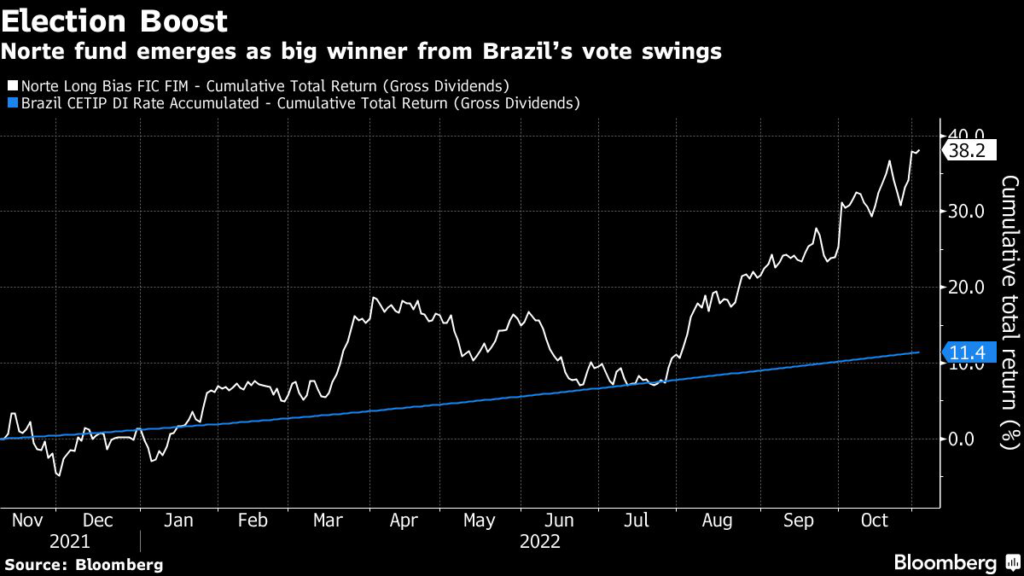

The Norte Long Bias fund, a 1.3 billion-real ($257 million) fund managed by Sao Paulo-based Norte Asset Management, had a 17% return after fees from the start of the campaign on Aug. 16 through Oct. 31, the day after Luiz Inacio Lula da Silva defeated Jair Bolsonaro in the presidential vote. That jump put it ahead of all its 205 peers, according to data compiled by Bloomberg.

Norte was created by Gustavo Salomao, a computer engineer who spent about two decades at the Swiss bank, and Rafael Furlan, a former executive at HSBC Holdings Plc’s asset management unit in Brazil. They correctly predicted a surge in Sabesp — the water utility controlled by Sao Paulo state that gained on prospects for the gubernatorial race. They also expected low-income homebuilders Direcional Engenharia SA and Cury Construtora e Incorporadora SA to climb no matter who won.

“This was a quite different electoral cycle from the one you usually get in Brazil, where markets have a clear favorite,” Salomao said in an interview. “Investors slightly favored Bolsonaro, but they were much more divided this time.”

Although Bolsonaro and Lula disagree on key issues such as the role of state-owned companies, neither of them was expected to blow up the country’s finances in the near term — which helped keep markets relatively calm for most of the race.

With the race done, many money managers expected Brazil to stand out among its main peers given some emerging markets were struggling with out-of-control inflation, more expensive imports and even exclusion from indexes.

Brazil’s Top Hedge Fund Says Attractive Prices May Lure Inflows

Shares in Brazilian shoemaker Arezzo Industria e Comercio SA, pharmaceutical firm Hypera, oil juniors 3R Petroleum Oleo e Gas SA and PetroRio SA, and electronics equipment maker Intelbras also shored up returns at Norte, according to Furlan.

The fund anticipated a tighter-than-expected race than most polls showed, so it scooped up some Petroleo Brasileiro SA call options ahead of the first-round vote. As the runoff round neared, it moved to buying put options, seeking protection for an eventual downturn. The fund is still betting on additional declines in Petrobras stock.

Petrobras Wipes Out Year’s Gains as Lula Victory Spooks Traders

Salomao, who took over as the bank’s treasurer in Brazil in 2010, and Furlan were among traders who set up their own asset-management shops as interest rates plunged to record lows and Brazilians flocked to riskier products. Their fund usually has about 70% of its risk allocated in equities, but also trades assets such as currencies and rates.

The fund was short on gilts, for instance, betting on higher rates in the UK. It cut positions after the selloff. On equities, it’s currently more negative on global markets, and bullish Brazil.

“Lula will likely be more pragmatic — not ideological,” said Salomao. “If he loses control of the economy, he won’t be able to implement the social policies he’s pursuing.”

Brazil’s ‘Lula Basket’ Jumps While Currency Leads Global Gains

The second and third best performers on the electoral period were the Solana Equity Hedge and the Mar Absoluto funds, which gained 13% and 10% after fees, respectively.

The data include only the so-called multi-market funds with more than 500 million reais in assets, and excludes those with single shareholders. Overall, the group’s average performance was positive in the span, with a 3.5% total return before fees.

–With assistance from Sebastian Krieger and Ricardo Strulovici Wolfrid.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.