(Bloomberg) — Changpeng Zhao moved fast when Sam Bankman-Fried’s FTX.com was on the brink, offering to take it over and stem any further crypto contagion.

(Bloomberg) — Changpeng Zhao moved fast when Sam Bankman-Fried’s FTX.com was on the brink, offering to take it over and stem any further crypto contagion.

Within hours, he was forced to reconsider.

For starters, Binance executives quickly found themselves staring into a financial black hole — a gap between liabilities and assets at FTX that’s probably in the billions, and possibly more than $6 billion, according to a person familiar with the matter.

On top of that, US regulators are circling FTX, investigating whether the firm properly handled customer funds, as well as its relationship with other parts of Bankman-Fried’s crypto empire, Bloomberg News reported Wednesday.

It makes for a tricky decision for Zhao, known in the crypto world as CZ: Follow through with rescuing his onetime top rival and shoulder the financial and regulatory burdens, or let FTX crumble and sort through the potential wreckage? Zhao himself admits there was no “master plan” to take over FTX.

His answer, at least for now, is that the financial hole appears too deep. Binance is unlikely to follow through on its takeover of FTX, according to the person familiar, who wasn’t authorized to publicly discuss the matter.

“Binance is still in early stages of conducting due diligence and will communicate further when we have something more substantive to share,” a firm spokesperson said.

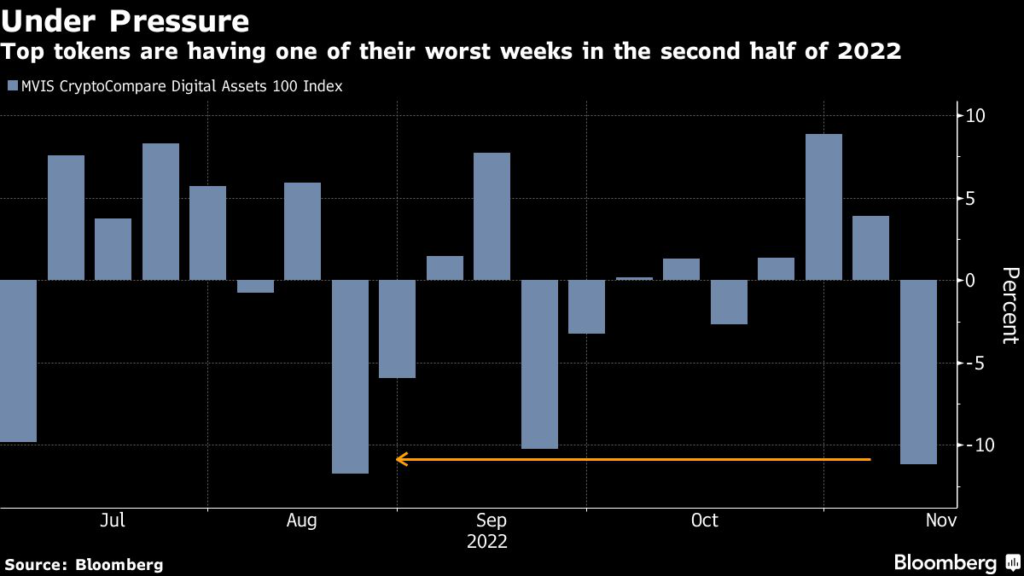

For crypto investors, the stakes are high. The downfall of Bankman-Fried, the industry’s 30-year-old wunderkind, has cast doubt about which institutions are safe in the still-loosely regulated market. Bitcoin fell below $17,000 on Wednesday to a two-year low, joining a widespread selloff in digital assets.

While Bankman-Fried is barely a billionaire anymore, Zhao remains the richest person in crypto, with a fortune estimated at $16.4 billion by the Bloomberg Billionaires Index. But even Zhao hasn’t been immune to tumbling crypto prices: His net worth peaked at $97 billion in January.

Binance has some time to make a decision. Its due diligence process could take 30 days, the person familiar said. The firm’s non-binding letter of intent allows it to fully acquire FTX, buy parts of the assets or walk away.

If the deal with Binance were to fall through, it would likely mean FTX customers would take losses, Coinbase Chief Executive Officer Brian Armstrong said Tuesday in a Bloomberg TV interview.

“That’s a not a good thing for anybody,” he said.

For Binance, an immediate issue is the way FTX valued its utility token FTT and whether it should have been marked at a lower price, the person said. The token has plunged some 70% since Zhao said his exchange would be liquidating its FTT holdings, worth $529 million at the time.

Zhao’s move followed a story from CoinDesk saying that a potentially partial balance sheet shows FTT made up about a quarter of assets at Alameda Research, a trading house owned by Bankman-Fried. The crypto news site earlier reported that Binance was leaning against its FTX takeover.

The proposed deal between Binance and FTX doesn’t involve Alameda, the person familiar said. Bankman-Fried had already said that the transaction would exclude FTX.US, a separate exchange he founded.

–With assistance from Lydia Beyoud and Olga Kharif.

(Updates with Bitcoin price starting in eighth paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.