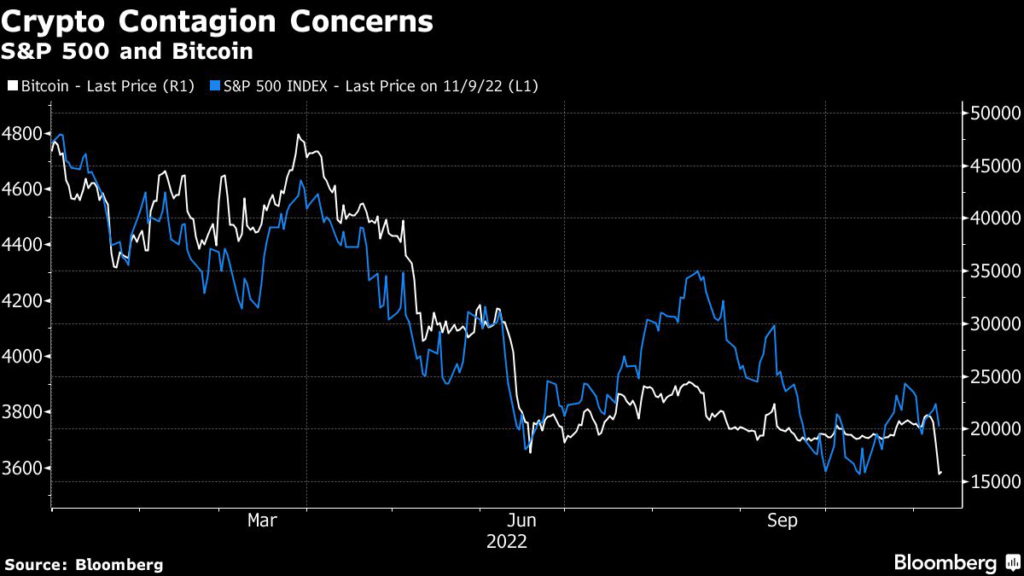

Asian stocks weakened after US shares fell and cryptocurrencies arrested a sharp decline that sapped risk appetite ahead of crucial inflation data due Thursday.

(Bloomberg) — Asian stocks weakened after US shares fell and cryptocurrencies arrested a sharp decline that sapped risk appetite ahead of crucial inflation data due Thursday.

Shares in Japan, China and Australia fell.

US equity futures inched higher after the S&P 500 slumped Wednesday to end a three-day advance. The dollar treaded water after a Wednesday rally and bond yields fell in Australia and New Zealand, following Treasuries.

Bitcoin climbed above $16,000 after tumbling by the biggest margin since March 2020 Wednesday as Binance scrapped plans to acquire embattled exchange FTX.com, which may face bankruptcy.

The action weighed on crypto-linked companies across the region after similar declines in the US. Japan-listed Monex Group and Remixpoint dropped and South Korea’s Hanwha Investment fell.

US voters delivered a mixed verdict in midterm elections.

Republicans headed for control of the House by smaller margins than forecast while the race for Senate continued.

A divided congress “would likely block further bold fiscal moves,” Mark Haefele, chief investment officer at UBS Global Wealth Management, said in a note.

For markets, however, “Federal Reserve policy, rather than fiscal policy, will remain the main driver.”

October inflation data will offer clues on the path of Fed tightening. JPMorgan Chase & Co.

analysts said a hot print could send US stocks 6% lower in Thursday trade.

Oil traded flat after its worst day in nearly a month as US stockpiles grew and Covid outbreaks in China threatened growth.

Key events this week:

- US CPI, US initial jobless claims, Thursday

- Fed officials Lorie Logan, Esther George, Loretta Mester speak at events, Thursday

- US University of Michigan consumer sentiment, Friday

Stocks

- Futures on the S&P 500 rose 0.3% as of 2:18 p.m.

Tokyo time. The S&P 500 fell 2.1%

- Nasdaq 100 futures climbed 0.5%. The Nasdaq 100 fell 2.4%

- Japan’s Topix Index fell 0.6%

- Australia’s S&P/ASX 200 Index fell 0.5%

- The Hang Seng Index fell 1.8%

- The Shanghai Composite Index fell 0.6%

- Euro Stoxx 50 futures fell 0.7%

Currencies

- The Bloomberg Dollar Spot Index fell 0.2%

- The euro rose 0.2% to $1.0033

- The Japanese yen rose 0.2% to 146.13 per dollar

- The offshore yuan rose 0.4% to 7.2483 per dollar

Cryptocurrencies

- Bitcoin rose 5.2% to $16,553.76

- Ether rose 7% to $1,182.88

Bonds

- The yield on 10-year Treasuries declined three basis points to 4.07%

- Australia’s 10-year yield declined 15 basis points to 3.71%

Commodities

- West Texas Intermediate crude was little changed

- Spot gold rose 0.2% to $1,710.74 an ounce

–With assistance from Stephen Kirkland.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.