Australia’s central bank said money markets are a better guide to the trajectory of interest rates after an assessment of pandemic-era forward guidance found its use presented “substantial” communication challenges.

(Bloomberg) — Australia’s central bank said money markets are a better guide to the trajectory of interest rates after an assessment of pandemic-era forward guidance found its use presented “substantial” communication challenges.

“Forward guidance can be used to help inform the public and markets, but it is best to avoid being too prescriptive,” the Reserve Bank said in its review of the communications tool released Tuesday.

“Most of the time, the better approach is to leave it to the market to work out expected timing by combining forecasts of the economy with the board’s decision-making framework.”

Underscoring the new-found flexibility, in minutes of November’s policy meeting released concurrently with the review, the RBA said rates were expected to rise further, adding that it didn’t rule out resuming 50 basis-point moves or indeed pausing.

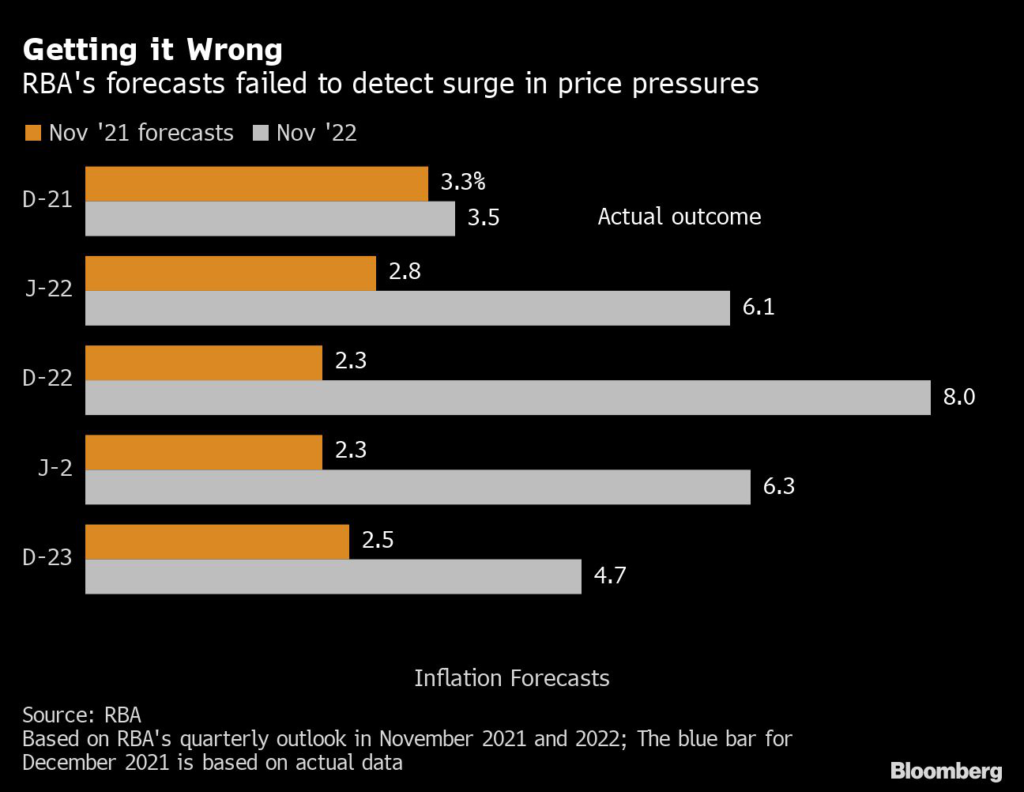

The central bank faced criticism over Governor Philip Lowe’s comments that, based on wages and inflation forecasts, rates were unlikely to rise before 2024, a line he stuck with until September last year. That brought sharp questions over accountability given the RBA began hiking in May and is delivering its most aggressive tightening cycle in a generation.

The evaluation of forward guidance is part of a series of internal assessments the RBA has conducted of its pandemic-era policies and comes ahead of an independent, government-ordered review. The latter is considering everything from a board shakeup to amending the central bank’s objectives, with the three-member panel’s final report due in March.

Lowe delivered the 2024 forward guidance when the RBA first responded to the Covid outbreak as he sought to instill confidence in the community at a time when Australia’s economy was sliding into its first recession since 1991.

“Together with other policy measures, the RBA’s stronger forward guidance worked to lower funding costs and support the economy early in the pandemic,” the review found. “The policy response helped shore up confidence during a period of significant uncertainty and disruption.”

The criticism, though, is how long the governor stuck with time-based guidance. Lowe was still delivering the 2024 message in September last year — when markets and some economists were predicting rate rises in the period ahead. By mid-December, Lowe had conceded a little and amended his view to no hike in 2022.

Yet less than five months later the RBA was tightening, with the cash rate hitting 2.85% this month from a record-low 0.1% in May as the bank raced to contain soaring prices.

“The time-based element of the guidance was very prominent in media and market commentary, and came to dominate the interpretation of the forward guidance,” the review showed. “The RBA attracted extensive criticism when the cash rate was increased much earlier.”

Greens Senator Nick McKim has called on the governor to resign for inducing “hundreds of thousands of Australians” to take out mortgages on the basis that rates wouldn’t rise until 2024.

In minutes of the Nov. 1 meeting, the RBA concluded that the case to raise its cash rate by 25 basis points was stronger than resuming 50 basis-point increases following hotter than expected third-quarter inflation.

“Acknowledging the uncertainty, members did not rule out returning to larger increases if the situation warranted,” the RBA said. “Conversely, the board is prepared to keep rates unchanged for a period while it assesses the state of the economy and the inflation outlook. Interest rates are not on a pre-set path.”

The RBA raised rates by 50 basis points at four consecutive meetings before downishifting to 25 basis points in the past two months

Earlier this year, the central bank released findings of an internal assessment of its yield target policy. It concluded that a disorderly exit from that program damaged the central bank’s credibility.

The message about the likely timing of future cash rate increases “was complicated” by the three-year yield target at 0.1%, today’s review said.

“The time-based element of guidance and the term for the yield target were mutually reinforcing. Neither were well suited to respond to the unprecedented global events.”

(Updates with minutes, additional details.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.