US and Bahamian authorities are talking about bringing Sam Bankman-Fried to America for questioning, according to three people familiar with the matter. Meanwhile, Bankman-Fried took to Twitter Tuesday afternoon, telling his followers that he would be meeting with regulators in-person.

The tweet came a few hours after he posted on the social-media platform that FTX US had enough money to repay customers.

(Bloomberg) — US and Bahamian authorities are talking about bringing Sam Bankman-Fried to America for questioning, according to three people familiar with the matter.

Meanwhile, Bankman-Fried took to Twitter Tuesday afternoon, telling his followers that he would be meeting with regulators in-person. The tweet came a few hours after he posted on the social-media platform that FTX US had enough money to repay customers.

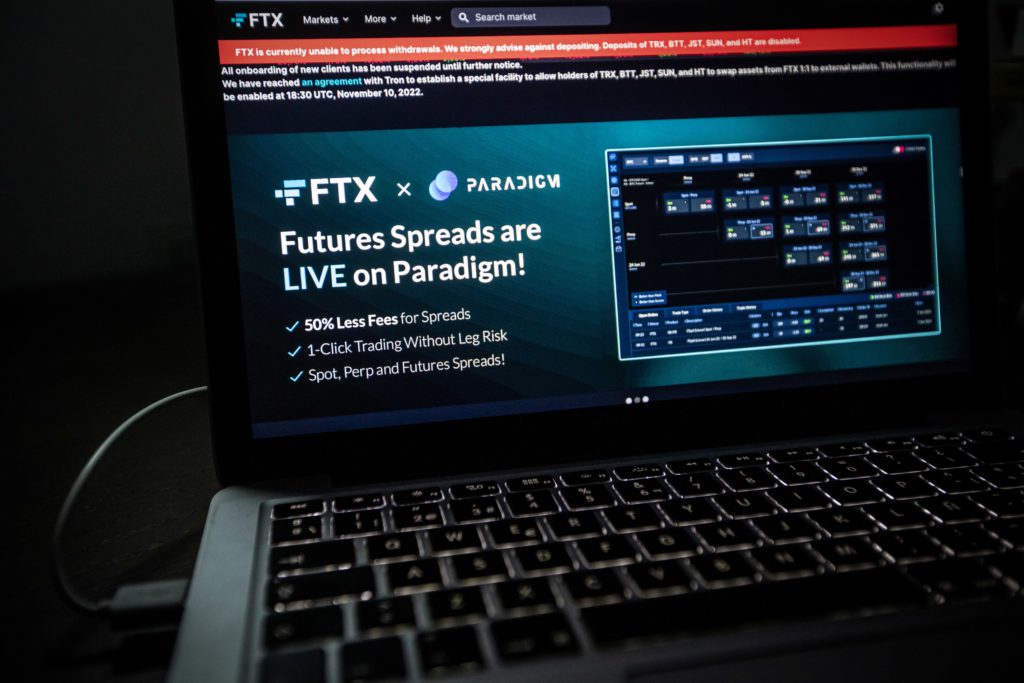

FTX Group named a slate of new independent directors as the Supreme Court of the Bahamas appointed partners from PricewaterhouseCoopers provisional liquidators to oversee FTX’s assets.

The implosion of Sam Bankman-Fried’s FTX empire has other crypto billionaires distancing themselves from the bankrupt exchange.

Bitcoin stabilized Tuesday, trading under $17,000, providing some respite from a damaging selloff triggered by the FTX crisis.

Key stories and developments:

- FTX Wrangles More Than a Million Creditors Amid Chaotic Collapse

- Crypto Billionaires With $96 Billion Loss Add Distance From FTX

- FTX Collapse Leaves Power Vacuum on Push for US Regulation

- Sam Bankman-Fried Posts Cryptic Tweets After Wealth Wipeout

(Time references are New York unless otherwise stated.)

Regulators Discuss Bringing SBF to US (3:19 p.m.)

US and Bahamian authorities have been discussing the possibility of bringing Sam Bankman-Fried to America for questioning, according to three people familiar with the matter.

The conversations between law-enforcement officials in the two countries have intensified in recent days as they probe his role in the implosion of cryptocurrency firm FTX.

Bankman-Fried has been cooperating with Bahamian authorities, said one of the people, who like the others asked not to be identified due to the sensitivity of the matter.

SBF Meeting with Regulators (2:58 p.m.)

Bankman Fried said he is meeting “in-person with regulators” to “do right by customers,” according to a tweet.

Tweet Says FTX Had Enough to Repay Customers (12:17 p.m.)

FTX US had enough to repay all if its customers “as of post-11/7,” Bankman-Fried said in a tweet.

But he acknowledged that “not everyone necessarily agrees with this.”

Crypto Lender Voyager Deal Void (11:48 a.m.)

Bankrupt crypto lender Voyager Digital Ltd. doesn’t plan to sell itself to FTX after the crypto exchange itself was forced into insolvency proceedings, according to a lawyer for Voyager.

FTX violated its contract to buy Voyager out of bankruptcy, according to Voyager’s main bankruptcy attorney Joshua Sussberg. FTX has agreed that Voyager can pursue other bids, but has not yet confirmed that the company is pulling out of the contract to buy the smaller crypto company, Sussberg said in court Tuesday.

PwC Named Liquidators (9:35 a.m.)

The Supreme Court of the Bahamas approved partners from PricewaterhouseCoopers, also known as PwC, as provisional liquidators to oversee the assets of crypto exchange FTX.

The Bahamas Securities Commission wrote in a statement that it “moved swiftly to use its regulatory powers” to further protect clients.

Scaramucci Sees Zhao’s Sale as Retaliation (9:28 a.m.)

Scaramucci, in whose company FTX owns a 30% stake, accompanied Bankman-Fried on a recent fundraising trip to the Middle East, he said at the Bloomberg New Economy Forum on Tuesday.

During some of those meetings, Bankman-Fried appears to have made unspecified remarks about Zhao, Scaramucci said.

“I think what happened frankly is he said something about CZ, the founder of Binance, in possibly one or two of those meetings, that got back to CZ and he got super upset about it,” Scaramucci said.

He said ‘OK, we are in a divorce, we are not gonna make love,’ that was the Twitter comment. He hit him with $500 million worth of FTT tokens.”

After Zhao’s Nov. 6 tweet announcing the sale of FTT tokens worth roughly $530 million at the time, concerns around FTX’s financial health spiraled into a panic and clients yanked some $5 billion from the platform in a day.

FTX quickly unraveled, filing for bankruptcy last week.

“FTX’s problems arose from mismanagement of their user funds and their highly leveraged business,” a Binance spokesperson said in an emailed response to questions about Scaramucci’s remarks.

Binance decided to sell its holding of FTT after a Nov. 2 CoinDesk article called into question the health of the balance sheet of Alameda Research, Bankman-Fried’s trading house, the spokesperson said.

“CZ’s tweet came only after the community asked questions about the movement of a large amount of FTT which is transparent on the public blockchain,” the Binance spokesperson said.

A representative for FTX didn’t immediately reply to a request for comment.

Binance will submit evidence to UK lawmakers on its decision making around the sale of FTT, Daniel Trinder, the company’s vice president of government affairs in Europe, said at a hearing with the UK Parliament’s Treasury Committee on Monday.

Charlie Munger Calls Crypto ‘Delusion’ (7:33 a.m.)

Berkshire Hathaway Inc.’s Charlie Munger doubled down on his criticism of digital assets in the wake of FTX’s collapse.

“It’s partly fraud and partly delusion,” Munger, vice chairman of Berkshire Hathaway said on CNBC Tuesday.

“That’s a bad combination. I don’t like either fraud or delusion. And the delusion may be more extreme than the fraud.”

Scaramucci Says His Due Diligence ‘Not Enough’ (Tuesday, 5:05 p.m.

HK)

Anthony Scaramucci, whose SkyBridge Capital was caught up in the implosion of FTX.com, said he did a thorough background check on its founder Sam Bankman-Fried, but it wasn’t enough to protect himself from “misrepresentations.”

“I was doing a lot of due diligence on him, but clearly not enough,” Scaramucci said at the Bloomberg New Economy Forum on Tuesday.

He added that FTX’s stake in SkyBridge can’t be transferred to anybody “without my permission.”

Binance to Submit Evidence on FTX Deal (Tuesday, 4:20 p.m. HK)

Binance said it will submit evidence to UK lawmakers regarding discussions held about FTX.com when the two were in deal talks, as well as on its decision-making around the sale of FTX.com’s native token FTT.

Daniel Trinder, Binance’s vice president of government affairs in Europe, said the company would provide the information to members of the UK Parliament’s Treasury Committee as part of the crypto exchange’s appearance as a witness in a cryptoasset inquiry.

Trinder was grilled by lawmakers on Monday over the firm’s decision to announce a planned sale of more than $500 million in FTT on Nov.

6 — a move that caused trading volumes for the token to spike to their highest in more than a year. It was also part of the chain of events that led to FTX eventually filing for bankruptcy.

SBF Posts Cryptic Tweets (Tuesday, 2:05 p.m.

HK)

Former FTX chief Sam Bankman-Fried in a series of cryptic tweets over the last 24 hours spelled out the words “What HAPPENED.” He finished with the message: “NOT LEGAL ADVICE. NOT FINANCIAL ADVICE.

THIS IS ALL AS I REMEMBER IT, BUT MY MEMORY MIGHT BE FAULTY IN PARTS.”

The bizarre sequence sparked hot debate — and not a little anger — on Twitter as users tried to second guess what would come next.

FTX Talking With ‘Dozens’ of Regulators (Tuesday, 1:10 p.m.

HK)

FTX Group named a slate of new independent directors to oversee the collapsed crypto empire and is speaking with the US Attorney’s Office and “dozens” of US and international regulatory agencies, according to new bankruptcy court papers.

“Questions arose about Mr.

Bankman-Fried’s leadership and the handling of FTX’s complex array of assets and businesses under his direction,” lawyers for the crypto company wrote. FTX plunged into bankruptcy court after facing “a severe liquidity crisis that necessitated the filing of these cases on an emergency basis.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.