Bank of England policy makers led by Governor Andrew Bailey set out their outlook for the UK economy as inflation soared to its highest level in 41 years.

(Bloomberg) — Bank of England policy makers led by Governor Andrew Bailey set out their outlook for the UK economy as inflation soared to its highest level in 41 years.

Bailey along with Deputy Governor Ben Broadbent and policy makers Catherine Mann and Swati Dhingra are testifying to the Treasury Committee in Parliament.

They spoke after inflation jumped 11.1% after soaring energy and food prices delivered the tightest squeeze on living standards in memory and started to push the UK into recession.

Key Developments:

- Brexit is adding to headwinds for the UK economy

- Britain’s reputation with investors hit by Truss budget program

- Broadbent says recession may be shorter than BOE expects

- Dhingra sees risk that rate rises will worsen recession

- UK housing market may be weakening, Bailey says

(All times UK)

Bailey Says No Systemic Threat From FTX Bankruptcy (4:30 p.m.)

Bailey said the bankruptcy of Sam Bankman-Fried’s FTX crypto currency exchange isn’t a risk to the finanical system at the moment, but regulators are examining the issue carefully.

“We are doing a lot of work on it,” Bailey said. “Our view generally is that it’s not large enough to be systemic, but it has the potential to be so. There is ownership of crypto in this country. It’s not something we can be relaxed about it, and we’re not relaxed about it. I don’t think there’s a systemic fallout from FTX.”

Forex Intervention Isn’t on BOE Agenda, Bailey Says (4:08 p.m.)

Bailey said intervening in foreign exchange markets to prop up the value of the pound probably wouldn’t work.

“I would not intervene in exchange market,” he said. “It’s not a not got a happy record in that sense.”

Food Inflation More Due to War Than Pound, Broadbent Says (4:04 p.m.)

Broadbent said that food prices are rocketing mainly because of the war in Ukraine and not so much because of the decline in the value of the pound.

The UK currency has fallen 12% against the dollar so far this year but 5.5% on a trade-weighted basis.

“The currency is not the big story here,” Broadbent said.

Bailey said core goods price inflation is starting to ease.

“Far more of the shocks we’re dealing with are global” than UK-specific things like Brexit and the value of the pound, Bailey said.

Bailey Says Truss Budget Damaged UK Reputation (3:56 p.m.)

Bailey said the UK’s reputation as a stable economy has “taken a knock” as a result of the budget program Liz Truss introduced during her short term a prime minister.

“People said to me they didn’t expect this to happen in the UK,” he said in response to a question. “We have to rebuild our reputation.”

“We have damaged our reputation internationally because of what happened. And it will take longer to rebuild that reputation that it will be to correct the guilt curve.”

Bailey and Broadbent said the market impact of the ill-fated budget measures has mostly dissipated since most of the measures have been reversed.

Companies Should Wait Before Locking in Energy Price, Mann Says (3:40 p.m.)

When asked about firms facing pressure to sign into pricey new energy contracts, Mann said she’d advise them not to sign into any new energy contracts today in anticipation of prices coming down.

“The futures price is quite downward sloping,” Mann said. “If you could wait and not sign a contract today — that’s a strategic decision and for an individual firm to make. But small firms can sometimes band together and work with that contract through that channel.”

Bailey Says BOE Hasn’t Seen Fiscal Plan (3:37 p.m.)

Bailey said the BOE hasn’t yet seen details of what’s coming in Chancellor of the Exchequer Jeremy Hunt’s fiscal statement on Thursday. He said whatever the Treasury is planning isn’t embedded in the BOE’s forecasts that were published earlier this month in the Monetary Policy Report.

“Everything coming tomorrow is not in our MPR,” he said.

Housing Market is Weakening With Higher Rates (3:10 p.m.)

Bailey said the UK housing market is showing signs of weakening, noting a report from the Office for National Statistics on Wednesday showed no growth.

Bailey said housing market indicators “are all showing a weakening, both in activity and price numbers.” The latest figures are “the weakest in a year or more.”

He added that, “interestingly, we’ve seen rather more of a shinkage in the buy-to-let market in the past year than expected.”

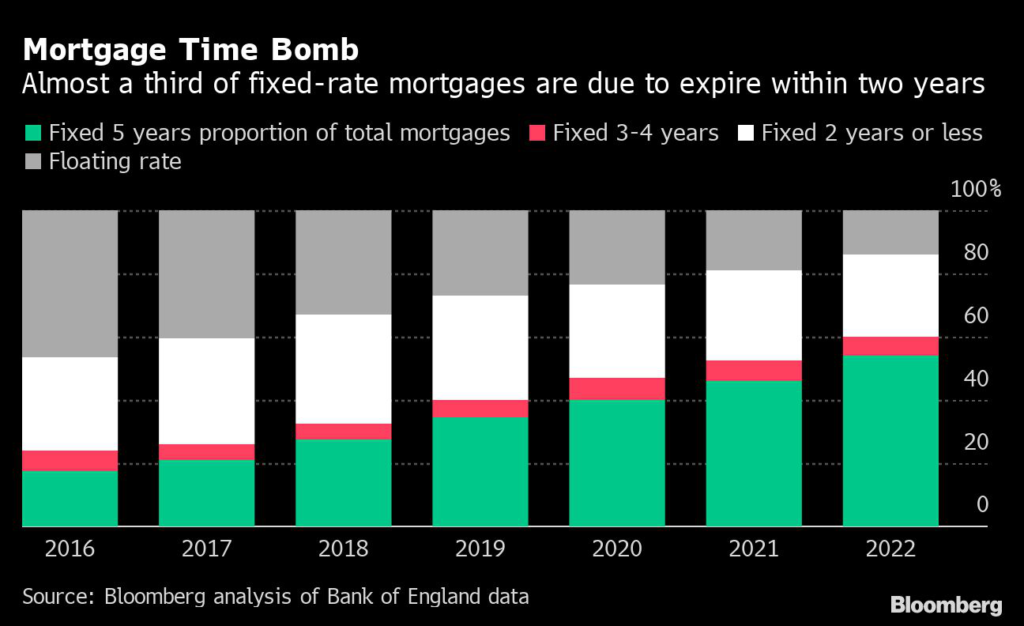

Rate Rises Won’t Hit UK Homeowners Immediately (3:08 p.m.)

Bailey said that the mortgage market is experiencing a lag in effects of rate movements, given around 80% of UK mortgages are now on fixed rates.

“One of the consequences of the shift to fixed rate mortgages is that they are priced off the current market curve,” Bailey said. “They’re not priced directly off our our official rate.”

Though further removed from the BOE’s direct influence, Bailey said that fixed rates are now coming back down.

“Lenders were quick to increase mortgage rates following the mini-budget on the 23rd of September, but have been slower to reduce them in lines with falls. But new fixed mortgage rates are beginning to come down which is what I would have expected to happen.”

Brexit Is Adding to Headwinds and Inflation for UK (3:05 p.m.)

Britain’s decision to exit the European Union is adding to headwinds facing the UK economy. Bailey stood by the BOE’s view that Brexit has permanently reduced trade, saying there’s been nothing lately to change that view.

Dhingra, a trade economist, said “it’s undeniable” that “we’re seeing a much, much bigger slowdown in trade in the UK compared to the rest of the world” and “we’re definitely performing below trend in terms of the exports numbers in terms of the inputs, even probably a bit bigger than that.”

Mann said Brexit is increasing inflation. That’s because “the small firms are the ones that are most damaged, because the cost of the paperwork and so forth, is a barrier. It’s not just small firms in the UK who want to export, but it is also small firms in Europe who were suppliers and provided competition in the UK.”

Mann Says Drop in Value of the Pound is Fanning Inflation (3:02 p.m.)

Mann said the drop in the value of the pound over the past year has pushed up the cost of imports and consumer prices.

She noted the currency is “20% down from the beginning of the year” and that “does translate into an inflationary effect.”

Labor Market is Biggest Question and Concern for UK (2:59 p.m.)

Bailey and his colleagues described the labor market as one of the biggest concerns for UK businesses and the economy.

Mann called the number of people dropping out of the workforce “a puzzle” for policy makers. “It does come back to the labor force participation. in the UK is a dramatic outlier, compared to all of the other advanced economies.”

Bailey said the lack of available workers is the biggest thing companies want to talk to him about.

“Firms are still talking in terms of it is so difficult to hire labor now that we’re not going to get rid of them lightly,” Bailey said. “There’ll be a tendency to want to retain labor.”

Dhingra Sees Risk of ‘Overtightening’ Rates (2:52 p.m.)

Dhingra said there’s a risk of raising interest rates more quickly and higher than the economy can withstand, deepening the recession.

“You could get into a much deeper recession if rates continue to rise,” Dhingra said. “There is a risk of overtightening. There’s already about a fairly sizable chunk of the previous rate rises that have got to take effect in terms of what they do to GDP.”

She said she saw no reason to take forceful action on interest rates and that higher inflation itself is damaging the economy.

“What we buy from abroad costs a lot more, and that makes us poorer. monetary policy cannot offset that. The people at the top end of the distribution are not spending thier full salary.”

Younger people who enter the labor market in a recession often “end up with perpetually lower wages.”

Broadbent Says Recession May Be Shorter Than Forecast (2:46 p.m.)

Broadbent said there’s a chance that the recession now unfolding in the UK may be shorter than the BOE forecasts.

“I think it could quite easily turn out to be a little bit shorter or a little bit longer,” he said. “There’s a lot of uncertainty, including about the length. We could well be in another quarter of contraction right now.”

Bailey Says Labor Market Tight But Competition for Staff Easing (2:39 p.m.)

Bailey said the UK labor market remains “tight” but that worker shortages are easing, suggesting less inflationary pressure on wages than a few months ago.

“Employers have now begun to say that they are seeing some reduction and competition for hiring,” Bailey said. “As yesterday’s labor market statistics demonstrated, it’s still a very tight labor market.”

Bailey Says He Won’t Take a Pay Rise (2:33 p.m.)

Bailey said BOE staff will get pay raises less than 6% this year and that he won’t take a wage rise even if one is offered to him by the central bank’s court of directors.

“It’s not for me to decide, but I’m not going to if I were offered one, I will not accept it, and I will politely decline as I have before,” Bailey said.

Mann Focused on ‘Front Loading’ Rate Rises (2:30 p.m.)

Mann, explaining her decision to vote for sharply higher rates, said she’s focused on inflation expectations. She reiterated her desire to see sharper rate rises earlier in the cycle.

“Taking more forceful action earlier on, as I say the research identifies a front loaded policy strategy as potentially having superior outcome with regard to inflation.”

Bailey Says Question for BOE’s Judgments About Labor Market (2:23 p.m.)

Bailey says questions about the BOE’s handling of the economy should focus on its judgments about the labor market, which he described as one of the “shocks” buffeting the economy.

“There were things that would have been different, like the one I asked myself, and I’ve said this in speeches, the question is about is the labor force because I don’t think we could foresee that Russia was going to invade Ukraine.”

Bailey Says UK Economy Facing Supply Shocks (2:20 p.m.)

Bailey said inflation has jumped past target because of “sequence of supply shocks.

“The economy was hit by a huge shock in terms of the pandemic. What we’ve had since then is a series of supply shocks, which have reduced the supply capacity of the economy relative to demand. There was a supply chain shock in the recovery from Covid. We see some evidence of that shock coming off.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.