Franklin Templeton Investments and Eastspring Investments are joining a growing list of money managers snapping up Chinese stocks on bets that Beijing’s pivot away from Covid Zero will bring significant gains.

(Bloomberg) — Franklin Templeton Investments and Eastspring Investments are joining a growing list of money managers snapping up Chinese stocks on bets that Beijing’s pivot away from Covid Zero will bring significant gains.

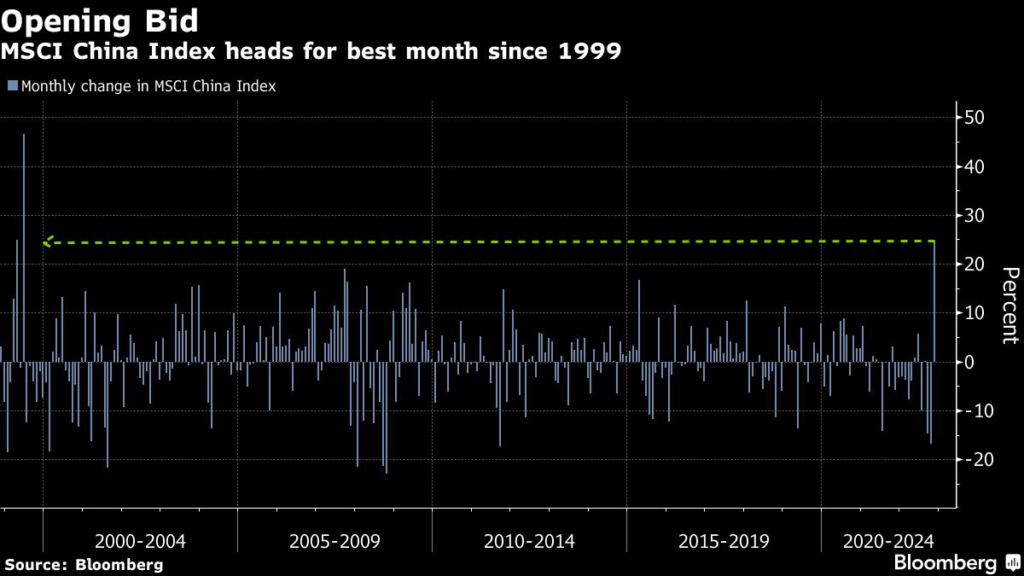

China’s world-beating rally this month has solidified convictions that recent losses are a thing of the past as a property rescue plan and easing on virus controls bolster sentiment. The MSCI China Index has gained more than 24% in November, while a gauge of global shares has advanced just 5%.

“The worst is already priced in and you’ve got plenty of upside” for Chinese equities, said Bill Maldonado, chief investment officer at Eastspring in Singapore, which oversees $222 billion. “You’d be buying now and expecting things to kind of rebound on a three-to-six-month basis.”

The view is echoed by Templeton’s Manraj Sekhon, who said “it’s time to get involved in China if you haven’t already.”

The bullish take from two investment veterans — who have more than half a century of markets experience combined — coincides with calls from Fidelity International and China Asset Management, which have also expressed confidence in the nation’s assets.

Read More: Investment Giants With $2.3 Trillion Bet on More Market Turmoil

The turnaround has been a long time coming. Chinese stocks had been sliding for more than a year, with as much as $6 trillion being wiped off total market capitalization between a peak last February and a low set last month when President Xi Jinping secured a third term. The rally then began due to easing of Covid restrictions and improving Sino-US ties.

The Hang Seng China Enterprises Index has jumped 25% this month to be one of the best-performing major indexes globally, having led losses worldwide through October.

Beijing’s efforts to loosen some of its Covid restrictions are a step in “the right direction,” said Templeton’s Sekhon, whose firm oversees $1.3 trillion. Along with thawing US-China relations that have “set a floor on market sentiment,” local equities are now at an inflection point that present a chance to buy, he said.

For Eastspring’s Maldonado, the opportunities includes companies linked to the electronic vehicle boom, green technology and the semiconductor industry.

“Valuations had gotten very cheap and earnings expectations had gotten very, very low,” he said.

–With assistance from Tassia Sipahutar.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.