Global stocks struggled for direction after two days of losses triggered by realization that the Federal Reserve and other major central banks see no reason to pause their rate-hiking cycles any time soon.

(Bloomberg) — Global stocks struggled for direction after two days of losses triggered by realization that the Federal Reserve and other major central banks see no reason to pause their rate-hiking cycles any time soon.

European equities opened higher, though they were on track to snap a four-week rising streak. US index futures swung between losses and gains, a day after markets were knocked lower by hawkish comments from St. Louis Fed President James Bullard, who said interest rates needed to rise at least to 5%-5.25% to curb inflation. The MSCI World Index stabilized, paring its weekly loss to 1%.

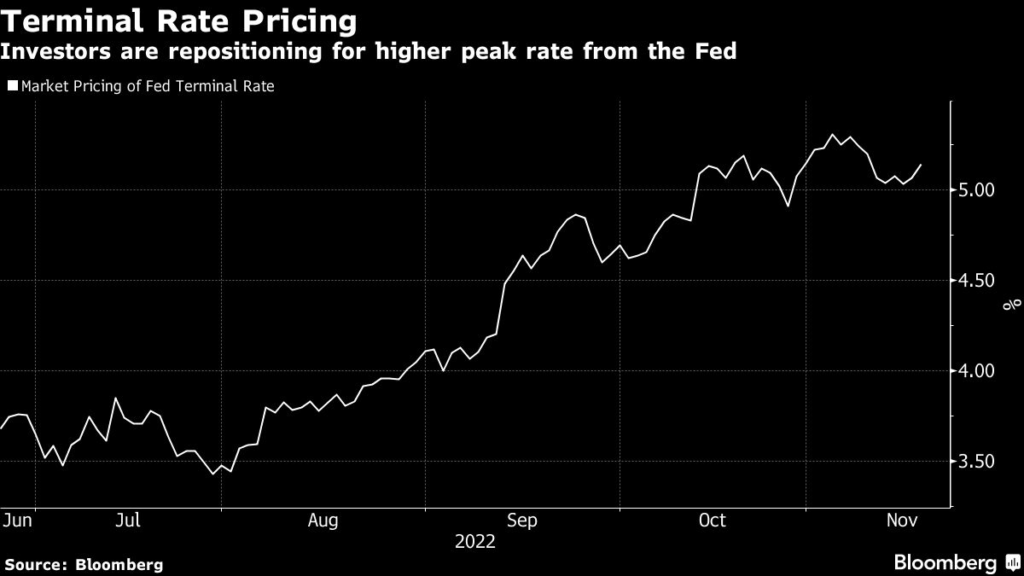

The dollar and Treasury yields were little changed, having jumped Thursday in the wake of Bullard’s comments. But Bullard is only the latest policymaker to warn markets that while inflation appears to be easing off multi-decade highs, policy needs to be tightened further to tame price pressures. Markets dialled up their expectations on Thursday for where US rates might peak, and pared the likelihood of rate cuts next year.

“The fact of inflation having peaked is not a reason for the Fed to turn and cut rates,” Paul Christopher, head of global market strategy at Wells Fargo Investment Institute, said on Bloomberg Radio. “That’s the fundamental disconnect that still exists between the Fed and the market.”

Fears are also mounting that relentlessly rising rates will hit economic growth, with a critical segment of the Treasury yield curve at the most steeply inverted in four decades — historically such an inversion has flagged recession in the world’s largest economy. Oil was poised for a weekly loss, pressured by concerns over a worsening demand outlook.

Ellen Hazen, chief market strategist at F.L.Putnam Investment Management, said that if the Fed kept increasing rates at the current pace, “by the time they get the information that they’ve been successful in slowing the economy and slowing inflation, it might be too late.”

“It’s just too soon to know exactly how this is going to play through the economy and that’s the biggest risk,” she told Bloomberg Television.

Elsewhere, the dollar’s retreat allowed other major currencies to strengthen, with the Japanese yen getting some additional impetus from data showing inflation at 40-year highs. The pound attempted to recoup Thursday’s losses as investors assessed the fallout from the government budget on an economy that’s already in recession.

Earlier, Hong Kong’s benchmark Hang Seng Index enjoyed a third straight week of gains, thanks to China’s steps to support the property sector and ease Covid restrictions. On Friday, the benchmark’s tech gauge touched a two-month high, led by Alibaba, which missed second-quarter revenues but upsized share buybacks.

Bitcoin was on course for a weekly gain even as the collapse of Sam Bankman-Fried’s FTX empire continues to rattle the crypto market.

Key events this week:

- US Conference Board leading index, existing home sales, Friday

Some of the main moves in markets:

Stocks

- The Stoxx Europe 600 rose 0.4% as of 8:42 a.m. London time

- Futures on the S&P 500 fell 0.1%

- Futures on the Nasdaq 100 fell 0.1%

- Futures on the Dow Jones Industrial Average fell 0.2%

- The MSCI Asia Pacific Index rose 0.1%

- The MSCI Emerging Markets Index was little changed

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro fell 0.1% to $1.0351

- The Japanese yen was little changed at 140.07 per dollar

- The offshore yuan rose 0.2% to 7.1311 per dollar

- The British pound rose 0.2% to $1.1886

Cryptocurrencies

- Bitcoin rose 0.2% to $16,710.71

- Ether rose 0.5% to $1,211.12

Bonds

- The yield on 10-year Treasuries advanced one basis point to 3.78%

- Germany’s 10-year yield advanced three basis points to 2.05%

- Britain’s 10-year yield advanced four basis points to 3.25%

Commodities

- Brent crude rose 0.3% to $90.02 a barrel

- Spot gold rose 0.1% to $1,763.06 an ounce

This story was produced with the assistance of Bloomberg Automation.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.