(Bloomberg) — Just last year, Wall Street banks were helping shepherd Coinbase Global Inc. into the public market as one of the hottest new stocks. Now, after a collapse in its share price — and pretty much everything else related to crypto — analysts are losing faith.

(Bloomberg) — Just last year, Wall Street banks were helping shepherd Coinbase Global Inc. into the public market as one of the hottest new stocks. Now, after a collapse in its share price — and pretty much everything else related to crypto — analysts are losing faith.

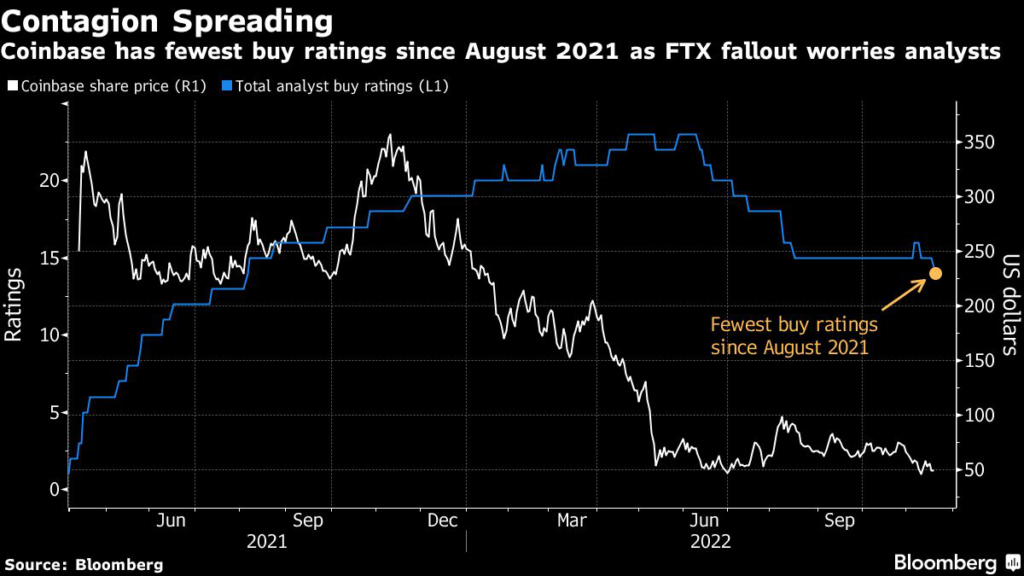

Bank of America Corp. became the latest firm to cut its rating on the cryptocurrency exchange, downgrading it to neutral from buy on Friday, citing concern about the broader fallout from the collapse of Sam Bankman-Fried’s FTX exchange. The move leaves Coinbase with 14 buy-equivalent analyst recommendations, its lowest number since August 2021, according to data compiled by Bloomberg.

“Coinbase likely faces a number of new headwinds over the near/medium-term due to the recent collapse of rival crypto exchange FTX,” Bank of America analyst Jason Kupferberg wrote in a note to clients.

Daiwa Securities cut its buy rating on the stock last week, adding to a rash of downgrades over the last few months. Analysts had been overwhelmingly bullish on Coinbase since its April 2021 direct listing, with nearly 80% buy recommendations as recently as mid-March.

Shares of the crypto firm have plunged this year, sinking more than 81%. Last week’s implosion of FTX sent the stock to a fresh record low close of $45.98 on Nov. 9. The decline has largely tracked the plunge in Bitcoin, which has tumbled below $17,000 per token from a record high of nearly $70,000 late last year.

While the downfall of FTX and the broader slump in crypto assets has shaken Wall Street’s conviction in Coinbase, not everyone is losing their nerve.

“We ultimately think Coinbase has a level of credibility as a public company and that its experience through multiple crypto cycles will make offshore exchanges like FTX look amateurish in comparison,” said Compass Point analyst Chase White.

–With assistance from Thyagaraju Adinarayan.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.