US stocks rose as investors recalibrate their expectations in response to Federal Reserve officials indicating that they’ll continue to raise interest rates but are open to slowing their tempo. A batch of upbeat earnings also buoyed sentiment.

(Bloomberg) — US stocks rose as investors recalibrate their expectations in response to Federal Reserve officials indicating that they’ll continue to raise interest rates but are open to slowing their tempo. A batch of upbeat earnings also buoyed sentiment.

The S&P 500 and the Nasdaq 100 rose. Best Buy Co. jumped after raising its profit forecast. Abercrombie & Fitch Co. and American Eagle Outfitters Inc. also rose after reporting results that beat estimates. Retailers clearing out their inventories with a series of sales could help reduce inflation, which could ultimately make the Fed turn dovish.

The dollar fell. US Treasury yields slipped. Oil rose after Saudi Arabia pushed back against reports of a potential OPEC+ production increase.

Fed officials have broadly maintained their steadfast stance to fight inflation. Yet San Francisco Fed President Mary Daly also said that officials need to be mindful of the lags in the transmission of policy changes, while her Cleveland counterpart Loretta Mester said she’s open to moderating the size of rate hikes. On Tuesday, the Richmond Fed Manufacturing Survey came in slightly below expectations, with data confirming the peak inflation narrative.

“We think the Fed leadership wants to get off the 75-basis-point-a-meeting hamster wheel even though it is finding it hard to do so while maintaining control of financial conditions,” Evercore ISI analyst Krishna Guha wrote in a note. “We think the Fed is still heading for a ‘hawkish slowing.’ And, for us at least, the slowing part is what matters.”

Despite hints of moderation, the Fed is likely to raise its estimate of the terminal rate as early as December, in part because inflation may prove sticky, said Sonia Meskin, head of US macro at BNY Mellon Investment Management

“I don’t know if I would read too much into the sort of daily repricing from the macro perspective at this stage, but I would be interested to see the labor market data for November and then any indication of whether this information weakening is sustained or not,” Meskin said by phone. “I think those would really be more indicative of the future of the policy trajectory.”

Thanksgiving week in the US also tends to carry a “historically bullish tone” for stocks, Craig Johnson, chief market technician at Piper Sandler, said in a note. The week has started with a dip on Monday and then improves around the Thursday holiday about 68% of the time since 1950, he said.

The bond market isn’t pushing the idea that rates are going to go up anymore, according to Chris Iggo, chief investment officer at AXA Investment Managers.

“Further increases are priced in, but the Fed seems to be okay with the market’s belief that rates will go to 5%,” he said. “I think we’re close to the Fed pausing on interest rates, although they are not going to admit that until they actually do it.”

Despite Tuesday’s rally, China’s Covid control restrictions are still weighing on investors. Shutdowns can have a negative impact on supply-chain dynamics and possibly exacerbate inflation issues across economies. These restrictions now impact a fifth of China’s economy. Chinese stocks listed in the US fell on Tuesday.

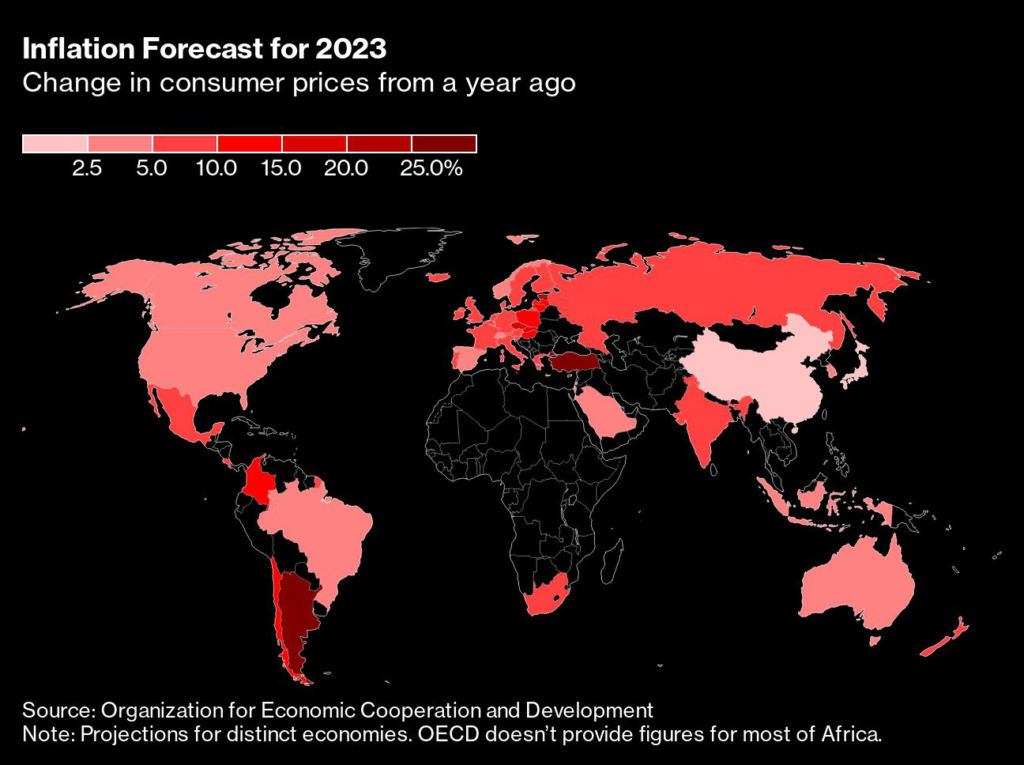

The OECD said the world’s central banks must continue to raise interest rates to fight soaring and pervasive inflation, even as the global economy sinks into a significant slowdown. The unexpected surge in prices and its impact on real incomes is hurting people everywhere, creating problems that will only worsen if policy makers fail to act, the Paris-based organization said.

Key events this week:

- Fed’s James Bullard speak, Tuesday

- S&P Global PMIs: US, Euro area, UK, Wednesday

- US MBA mortgage applications, durable goods, initial jobless claims, University of Michigan sentiment, new home sales, Wednesday

- Minutes of the Federal Reserve’s Nov. 1-2 meeting, Wednesday

- ECB publishes account of its October policy meeting, Thursday

- US stock and bond markets are closed for the Thanksgiving holiday, Thursday

- US stock and bond markets close early, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.8% as of 1:04 p.m. New York time

- The Nasdaq 100 rose 0.7%

- The Dow Jones Industrial Average rose 0.8%

- The MSCI World index fell 0.8%

Currencies

- The Bloomberg Dollar Spot Index fell 0.5%

- The euro rose 0.5% to $1.0292

- The British pound rose 0.5% to $1.1881

- The Japanese yen rose 0.6% to 141.28 per dollar

Cryptocurrencies

- Bitcoin rose 2.7% to $16,060.23

- Ether rose 2.2% to $1,117.72

Bonds

- The yield on 10-year Treasuries declined six basis points to 3.77%

- Germany’s 10-year yield declined two basis points to 1.98%

- Britain’s 10-year yield declined five basis points to 3.14%

Commodities

- West Texas Intermediate crude rose 2.3% to $81.89 a barrel

- Gold futures were little changed

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Felice Maranz, Vildana Hajric, John Viljoen and Emily Graffeo.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.