US equity futures edged higher, and the dollar slipped for a second day, as investors awaited a speech by Federal Reserve Chair Jerome Powell for signals about the path of interest-rate increases, and assessed prospects for China’s economic reopening.

(Bloomberg) — US equity futures edged higher, and the dollar slipped for a second day, as investors awaited a speech by Federal Reserve Chair Jerome Powell for signals about the path of interest-rate increases, and assessed prospects for China’s economic reopening.

Contracts on the S&P500 and the Nasdaq 100 posted moderate gains, indicating the underlying indexes could snap a three-day losing streak. In premarket trading, US-listed Chinese stocks were among the biggest gainers, amid signs Beijing is easing some Covid Zero curbs. In Europe, shares climbed the most in more than a week as data showed eurozone inflation slowed for the first time in 1-1/2 years.

Equities in Europe as well as the US are set for a second straight month of gains, swept higher by optimism that interest rates in major economies may be nearing their peak.

Investors will keep their attention trained later on Powell’s comments on the economy and the labor market. He is widely expected to signal that the next Fed rate hike will step down to 50 basis points, though he will also likely warn that policy tightening has further to run.

Those hopes of slower interest rate rises, alongside mounting optimism over China’s reopening, pushed the dollar lower and put the greenback on track for its worst month since 2010. Benchmark Treasury 10-year yields slipped and are down more than 25 basis points in November.

A degree of caution remains among traders before the Fed chair’s remarks, given still-high global inflation and a robust jobs market.

“The market is hesitating a bit,” Societe Generale strategist Kenneth Broux said. “I would be very surprised if it is a dovish speech.” Some may hold the view that “the dollar has peaked and that the Fed Funds rate will peak at 5%, but I fear Powell will tell them it’s too soon,” he said.

In Asian trading, shares gained and the offshore-traded yuan extended Tuesday’s rally. Traders shrugged off data showing a contraction in China’s factory and services activity and focused on news that authorities were relaxing stringent lockdowns in the manufacturing hub of Guangzhou as well as in Zhengzhou, home to Apple Inc.’s largest manufacturing site in China.

“The market wants to see good news stemming from China’s gently shifting stance towards lockdowns, but the reality is that a full re-opening is still some time away and will be politically tricky to execute,” said James Athey, investment director at Abrdn.

Oil prices rose for a third day, after industry data pointed to a substantial draw in US crude stockpiles and investors counted down to an OPEC+ meeting that may see the group agree to cut production.

In US premarket trading, Crowdstrike Holdings Inc. sank after the cybersecurity company’s revenue outlook trailed analyst estimates. Hewlett Packard Enterprise Co. gained after its sales forecast surpassed expectations.

Crypto assets rose, with Bitcoin gaining as much as 3.6% to a two-week high.

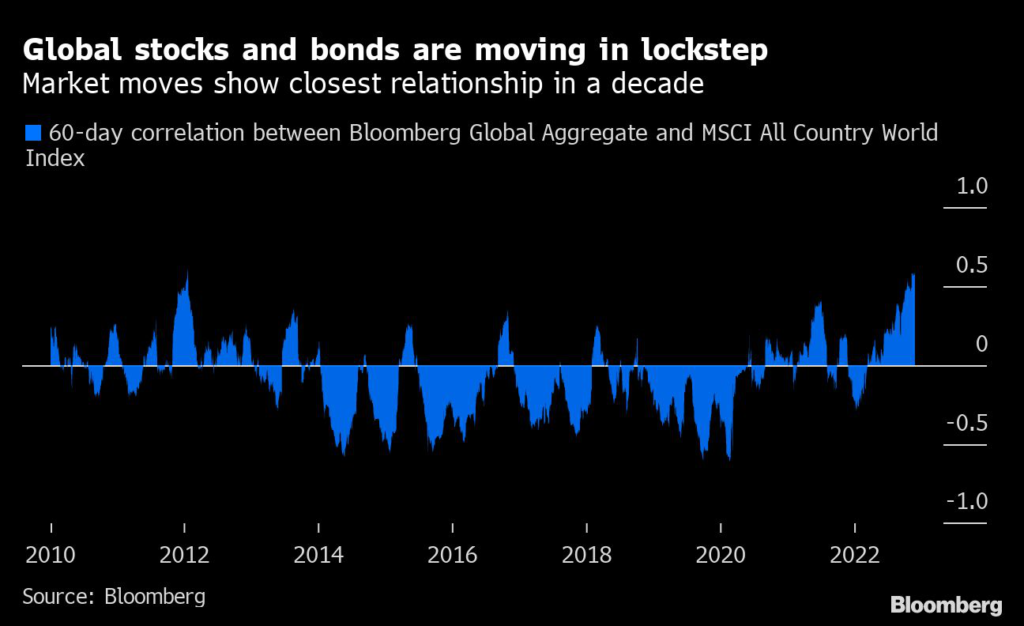

Amid all the recent bumpiness in markets, an index of global stocks was on course for a second monthly advance, while bonds were also poised for a monthly gain. The lockstep moves in stocks and bonds has taken their correlation to highest level since 2012, heaping pressure on investors seeking to hedge risk by splitting their portfolios between the two asset classes.

Key events this week:

- EIA crude oil inventory report, Wednesday

- Fed Chair Jerome Powell speech, Wednesday

- Fed releases its Beige Book, Wednesday

- US wholesale inventories, GDP, Wednesday

- S&P Global PMIs, Thursday

- US construction spending, consumer income, initial jobless claims, ISM Manufacturing, Thursday

- BOJ’s Haruhiko Kuroda speaks, Thursday

- US unemployment, nonfarm payrolls, Friday

- ECB’s Christine Lagarde speaks, Friday

Some of the main moves in markets:

Stocks

- Futures on the S&P 500 rose 0.2% as of 7:24 a.m. New York time

- Futures on the Nasdaq 100 rose 0.4%

- Futures on the Dow Jones Industrial Average were little changed

- The Stoxx Europe 600 rose 0.8%

- The MSCI World index rose 0.3%

Currencies

- The Bloomberg Dollar Spot Index fell 0.4%

- The euro rose 0.3% to $1.0362

- The British pound rose 0.4% to $1.2003

- The Japanese yen was little changed at 138.65 per dollar

Cryptocurrencies

- Bitcoin rose 2.5% to $16,872.06

- Ether rose 3.8% to $1,265.58

Bonds

- The yield on 10-year Treasuries declined two basis points to 3.72%

- Germany’s 10-year yield advanced one basis point to 1.93%

- Britain’s 10-year yield advanced three basis points to 3.13%

Commodities

- West Texas Intermediate crude rose 2.1% to $79.88 a barrel

- Gold futures rose 0.8% to $1,777.20 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Richard Henderson.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.