Before it collapsed, FTX was a favorite in the world of professional crypto traders, with frenzied volumes, derivatives on steroids and a simpatico founder who got his start at storied Wall Street trading house Jane Street.

(Bloomberg) — Before it collapsed, FTX was a favorite in the world of professional crypto traders, with frenzied volumes, derivatives on steroids and a simpatico founder who got his start at storied Wall Street trading house Jane Street.

Now with millions lost on the bankrupt platform, its former fans are fighting for survival, writing off sizable chunks of their portfolios and facing an existential dilemma: Should they trust any crypto exchange at all?

Unlike stock markets where every transaction is strung together by a daisy chain of middlemen, centralized crypto exchanges like Binance Holdings Ltd.

do everything from margin loans and settlement to direct custody of client assets. This means funds must entrust platforms not only with the assets they trade, but also the collateral they put up for leverage to juice returns.

For many traders who saw their holdings evaporate in a matter of days on FTX, that’s now become too big of an ask.

To avoid another catastrophe, some survivors have started seeking alternatives to the current infrastructure in crypto markets, taking a page from Wall Street’s rulebook and demanding that separate entities, like custodians, hold their crypto instead.

“The era of posting collateral to offshore exchanges is over,” said David Fauchier, a portfolio manager at Nickel Digital Asset Management, which oversees about $200 million and has a partly-insured 6% exposure to FTX.

“We’re refusing to post collateral directly to almost all venues, meaning we can’t trade there despite a great opportunity set, which is super frustrating. We’re hammering them every day to implement some form of off-exchange settlement solution.”

While there have long been calls for change, Fauchier says there might finally be some momentum, after FTX appeared to have lost the majority of customer assets in its care, with the 50 largest unsecured creditors losing everything from $21 million to $226 million.

It’s one irony of the whole saga: While FTX founder Sam Bankman-Fried spent his last months as a billionaire trying to make the old-school futures market more like crypto, he might end up making crypto look more like Wall Street.

With the tagline ‘built by traders, for traders,’ his platform appealed to the pro set with its easy lending and products ranging from three-times leveraged bets to tokenized Tesla stock.

At its peak this year, it processed more than $45 billion in a day, CoinGecko data show.

Now, the exchange’s collapse has dealt a blow to a sweeping swath of the budding crypto fund industry, including Kevin Zhou’s Galois Capital, Travis Kling’s Ikigai Asset Management and CoinShares.

CMS Holdings, which also invested in FTX, has about 15% of its assets frozen on the exchange, according to a person familiar with the matter who declined to be identified because the information is private.

Many crypto hedge funds are now looking at writing off the exposure and sidepocketing it, meaning they’ll carve out the illiquid assets to a separate share class that will receive any future distributions from the claim.

Some are considering selling the claim now, which will allow them to raise cash rather than hold onto a distressed asset through the winding bankruptcy process — though claims are now priced at just 9% to 11.5% of their value, according to the broker Cherokee Acquisition.

“It doesn’t wipe out the industry,” said George Zarya, chief executive officer at crypto prime brokerage Bequant.

“But it’s a punch below the waistline and it really hurts.”

FTX’s collapse is the latest blow in an already rough year. A Bloomberg index of crypto-hedge fund returns has plunged 43% this year as of October as Bitcoin lost more than 60% and waning retail sentiment killed the easy trading opportunities of 2021.

Under the status quo, exchanges match buyers and sellers, safeguard assets, extend trading credit and also settle profits and losses, making it necessary for them to see and access users’ collateral directly, the argument goes.

Critics say this has given exchanges outsize power over client assets and created a concentration of risk.

While FTX’s shocking demise has prompted many exchanges to release a proof of reserves, that still falls short of revealing all their liabilities, leading users to yank millions from online platforms.

This structure is a far cry from what the crypto world calls TradFi, or traditional finance, where the role of intermediaries from custodians to brokers and exchanges is regulated and trades are settled on an independent centralized clearinghouse.

Some of these middlemen exist in crypto, but few have been able to chip away at the exchanges’ power.

One solution offered by the custodian Copper Technologies Ltd. allows clients to trade without transferring assets to the exchange’s wallets. But so far none of the five largest trading platforms ranked by Coinmarketcap are plugged into it.

FTX had signed onto that offering, but never implemented it, says Copper, adding that it expects to announce more exchange integrations in the coming months.

Wall Street is also looking to familiar names like BNY Mellon and Nasdaq, which are working on their own custody services.

“Asset manager and market makers are demanding integration of the solution as they will no longer be able to lure in investors regardless of promised returns if they park assets on any exchange,” Copper head of research Fadi Aboualfa wrote in an email.

At Cumberland, the crypto offshoot of Chicago trading giant DRW, the over-the-counter trading desk saw record volumes and an uptick in onboarding requests this month as liquidity on exchanges thinned out, says global head Chris Zuehlke.

Wintermute, one of the largest crypto market makers, has cut “a lot” of exposure to centralized exchanges, according to founder Evgeny Gaevoy. His ideal: either executing on decentralized exchanges entirely or adopting a model more like CME Group Inc., where trading and custody are separated.

The elephant in the room is Binance, the largest exchange by far that’s now grabbing even more market share from its disgraced rival.

It has unveiled a custody solution of its own that would allow clients to keep their assets in segregated wallets while trading on the platform.

Still, it is doubtful institutions will accept a self-enforced separation within the same corporate group, said Larry Tabb, head of market structure research at Bloomberg Intelligence.

“The larger institutions will either self-custody in their own wallets or look for third-party custodians to hold their coins,” he said.

“That’s going to very much disrupt the current business model of some of these larger crypto establishments.”

Then there’s decentralized finance, the solution those most faithful to the crypto vision are championing.

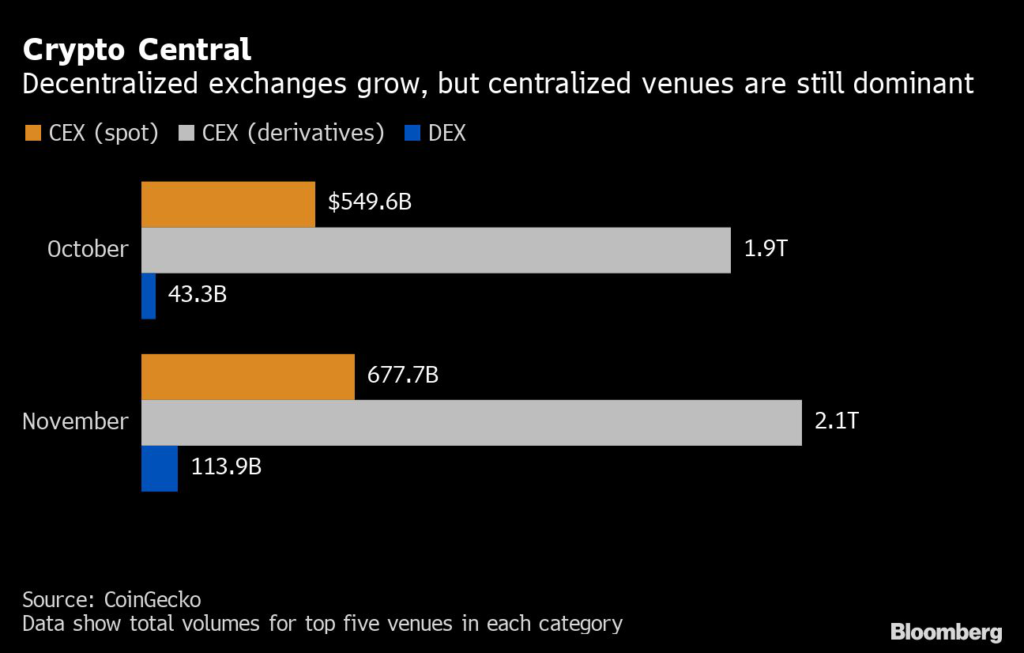

On platforms like Uniswap and dYdX, users trade through software while retaining control of their assets. While volumes on the five largest Dexes more than doubled from October to $114 billion this month, that’s still just 4% of the total for centralized platforms, CoinGecko data show.

DeFi is also not practical at scale for many regulated firms for now because it presents money-laundering and other compliance risks.

“We’re trading on chain when we can, but liquidity is not where it is on Binance, so it’s difficult when you have a bit of size,” said Felix Dian, a former Morgan Stanley trader who now runs MVPQ Capital, a crypto hedge fund with 2% assets lost to FTX.

“The way forward is spreading your exposure, though to be honest it’s difficult because there are not many counterparties left.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.