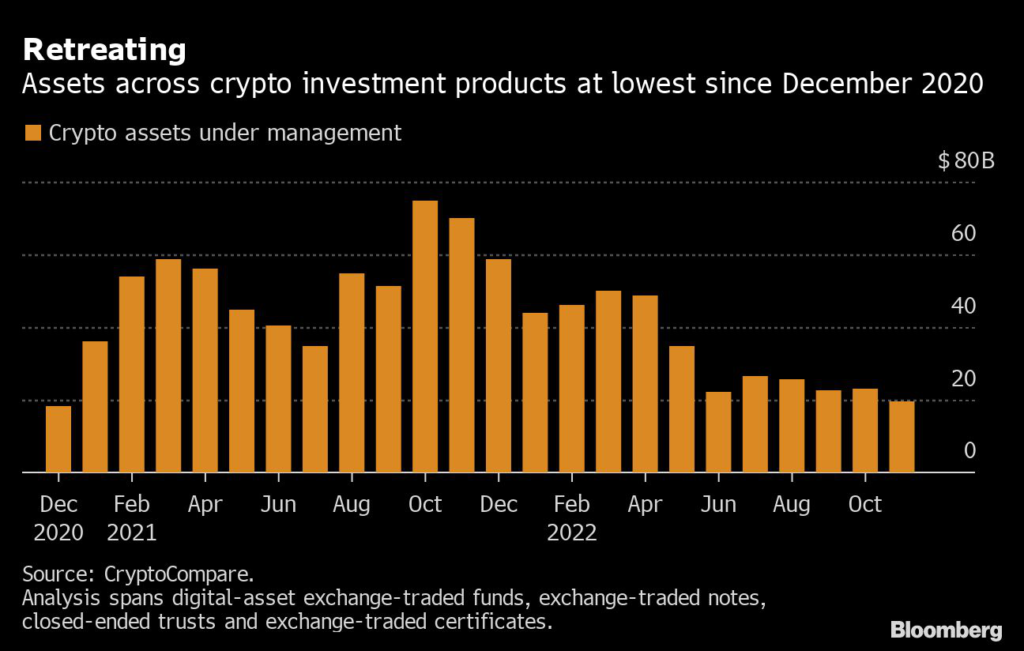

Sliding token prices and a flight from the digital-asset sector amid FTX’s collapse have sent crypto investment-product assets under management to the lowest level since December 2020. The figure dropped almost 15% to $19.6 billion in November from a month earlier, according to data from CryptoCompare. The analysis covers crypto exchange-traded funds, exchange-traded notes, closed-ended trusts and exchange-traded certificates.

(Bloomberg) — Sliding token prices and a flight from the digital-asset sector amid FTX’s collapse have sent crypto investment-product assets under management to the lowest level since December 2020. The figure dropped almost 15% to $19.6 billion in November from a month earlier, according to data from CryptoCompare. The analysis covers crypto exchange-traded funds, exchange-traded notes, closed-ended trusts and exchange-traded certificates.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.