US equity futures slipped on Friday, reflecting a generally cautious mood on world markets ahead of a crucial monthly jobs report that could offer clues on how much further the Federal Reserve might raise interest rates.

(Bloomberg) — US equity futures slipped on Friday, reflecting a generally cautious mood on world markets ahead of a crucial monthly jobs report that could offer clues on how much further the Federal Reserve might raise interest rates.

Contracts on the S&P 500 and Nasdaq 100 edged lower, with both underlying indexes still set for a second week of gains. Premarket US trading reflected concern over the impact of higher rates on company earnings, especially in the tech sector, where shares in cloud security company Zscaler Inc. and chipmaker Marvell Technology Inc. declined after downbeat outlook reports. Europe’s Stoxx 600 index was steady, on course for a seven-week rising streak.

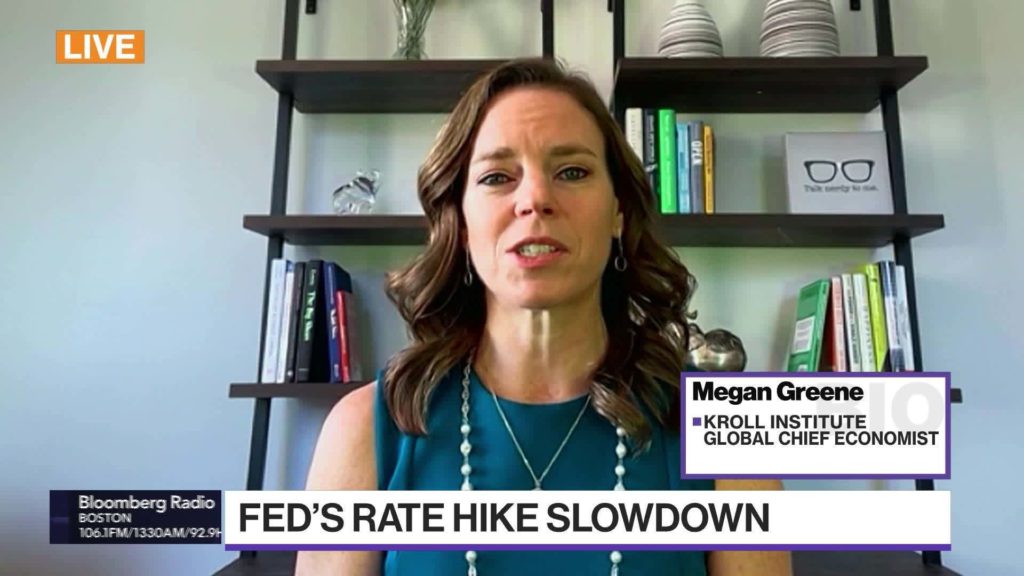

Stocks got a boost this week from a softening in China’s stringent Covid zero stance and signals from Fed Chair Jerome Powell of a downshift in the pace of rate hikes. Bets on where the US central bank’s rate will peak have now dropped below 4.9%, according to swap markets. The current benchmark sits in a range between 3.75% and 4%.

However, many economists reckon Friday’s employment report may fall short of the turning point Fed officials are seeking in their battle to beat back inflation. The median projection in a Bloomberg survey calls for payrolls to rise 200,000 in November, cooling only slightly from the previous month. Other market watchers point to signs that steep rate hikes will tip more economies into a downturn.

“Consensus is that recession is coming but equities cannot bottom before it starts, inflation won’t fall quickly so central banks can’t blink, China reopening will be a messy process, and Europe remains tricky,” Barclays Plc strategist Emmanuel Cau wrote in a note.

The ebbing rate hiking bets pushed the dollar lower for the fourth straight day against a basket of currencies, allowing lower-yielding G-10 currencies such as the yen and euro to extend gains. Ten-year Treasury yields held just off 2-1/2-month lows, having dropped 45 basis points last month.

Recession concerns have become more pronounced after data on Thursday showed November factory activity sliding in a range of countries, with American manufacturing contracting for the first time since May 2020.

Recent company reports also hint at mounting pressure on company earnings, and companies, ranging from Amazon.com to Ford Motor Co., have announced thousands of job cuts.

Bank of America Corp. strategists highlighted the labor market cooldown as one reason to prefer bonds to equities. They join others including JPMorgan Chase & Co. and Goldman Sachs Group Inc. in pointing to equity declines early next year amid the specter of an economic recession.

“We’re selling risk rallies from here,” the BofA strategists said, warning unemployment would replace inflation as the main worry in 2023.

Elsewhere, South Africa’s rand rebounded, paring some of Thursday’s 2.6% drop. The rand has bucked this week’s upswing in emerging market currencies because of political turmoil swirling around President Cyril Ramaphosa.

Oil headed for its biggest weekly gain in almost two months, benefiting from looser Chinese curbs, calls by the Biden administration to halt sales from US strategic reserves and an OPEC producers’ group decision to cut crude supply by the most since 2020.

Key events this week:

- US unemployment, nonfarm payrolls, Friday

Some of the main moves in markets:

Stocks

- Futures on the S&P 500 were little changed as of 6:58 a.m. New York time

- Futures on the Nasdaq 100 fell 0.2%

- Futures on the Dow Jones Industrial Average fell 0.1%

- The Stoxx Europe 600 was little changed

- The MSCI World index was little changed

Currencies

- The Bloomberg Dollar Spot Index fell 0.2%

- The euro rose 0.2% to $1.0539

- The British pound rose 0.3% to $1.2280

- The Japanese yen rose 1% to 134.00 per dollar

Cryptocurrencies

- Bitcoin rose 0.4% to $16,999.05

- Ether rose 1% to $1,289.03

Bonds

- The yield on 10-year Treasuries was little changed at 3.51%

- Germany’s 10-year yield declined three basis points to 1.78%

- Britain’s 10-year yield declined five basis points to 3.05%

Commodities

- West Texas Intermediate crude rose 0.2% to $81.39 a barrel

- Gold futures fell 0.2% to $1,812.20 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Tassia Sipahutar.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.