US equity-index futures fluctuated between gains and losses as investors debated whether inflation had eased enough to encourage the Federal Reserve to slow monetary tightening.

(Bloomberg) — US equity-index futures fluctuated between gains and losses as investors debated whether inflation had eased enough to encourage the Federal Reserve to slow monetary tightening.

Contracts on the S&P 500 and Nasdaq 100 index rose about 0.1% each after Tuesday’s rally in US stocks on the back of a fifth month of decline in consumer-price growth. Treasuries rallied for a second day, while the dollar slipped. The Stoxx Europe 600 Index dropped for the second time in three days. Charter Communications Inc. declined 5.8% in premarket New York trading amid concern its capital-spending plan may crimp cash flow.

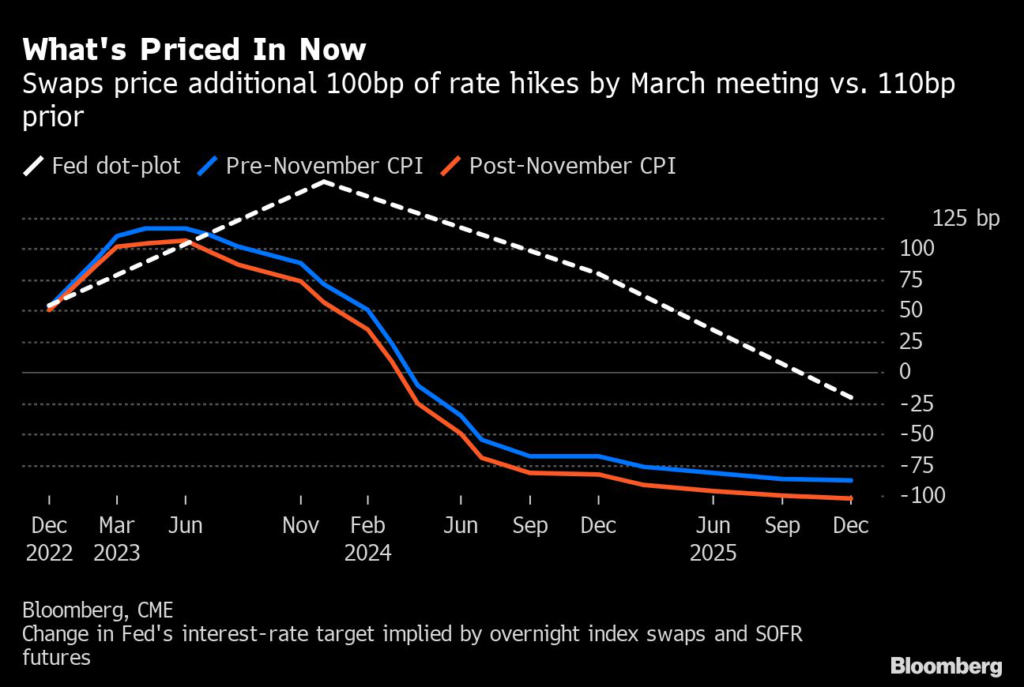

While a softer-than-expected figure for US consumer price index stoked a rally across stocks and bonds, the gains were tempered by caution that the Fed may still remain resolute on continuing rate hikes. After a 50 basis-point increase in Fed’s policy rate later Wednesday was firmly priced in, traders remained on the edge over what signals policymakers may offer on when the hikes will stop and whether a rate cut is possible next year.

“The question is, with inflation still at generational highs, will the Fed walk through that door?” Stephen Innes, managing partner at SPI Asset Management, wrote in a note. “After an initially high-spirited response, the relatively muted reaction for stocks is likely attributable to pre-risk event positioning, prevailing bearish growth sentiment, technical factors and the devil in the details.”

Europe’s equity benchmark fell after posting the biggest single-day advance since Nov. 10 as caution prevailed over Fed’s messaging later in the day as well as expectations for rate hikes by the European Central Bank and Bank of England on Thursday.

Treasuries with shorter-term maturities posted the biggest gains Wednesday. The two-year and five-year rated shed 4 basis points each. Traders are betting that the Fed, after today’s move, will opt for 50 basis points more of hikes, and then an equivalent-sized cut by the end of next year.

Charter Communications Inc., the second-largest US cable TV provider, fell in early trading after saying it will spend $5.5 billion to bring higher-speed broadband connections to customers. Higher capital expenditure and lower cash flow create near-term uncertainty, yet expanding the footprint could fuel subscriber growth, Bloomberg Intelligence analysts said.

In the UK, the pound traded near the strongest level since June. Inflation in the country fell from a 41-year high in November, raising the possibility that the worst of the cost-of-living squeeze is over. A gauge of the dollar’s strength traded 0.3% lower.

Shares in Hong Kong, Japan and Australia held advances, nudging the MSCI Asia Pacific index toward a three-month high and a close of 19% above its October low.

Jitters over Fed policy echoed in the oil market, where West Texas Intermediate futures halted a two-day advance. Traders also weighed the demand outlook amid a rapid relaxation of Covid restrictions in China against the effect of new cases on economic activity in the country.

Key events this week:

- FOMC rate decision and Fed Chair news conference, Wednesday

- China medium-term lending, property investment, retail sales, industrial production, surveyed jobless, Thursday

- ECB rate decision and ECB President Lagarde briefing, Thursday

- Rate decisions for UK BOE, Mexico, Norway, Philippines, Switzerland, Taiwan, Thursday

- US cross-border investment, business inventories, empire manufacturing, retail sales, initial jobless claims, industrial production, Thursday

- Eurozone S&P Global PMI, CPI, Friday

Some of the main moves in markets:

Stocks

- Futures on the S&P 500 were little changed as of 5:39 a.m. New York time

- Futures on the Nasdaq 100 were little changed

- Futures on the Dow Jones Industrial Average were little changed

- The Stoxx Europe 600 fell 0.6%

- The MSCI World index rose 0.1%

Currencies

- The Bloomberg Dollar Spot Index fell 0.3%

- The euro rose 0.3% to $1.0661

- The British pound rose 0.2% to $1.2395

- The Japanese yen rose 0.6% to 134.73 per dollar

Cryptocurrencies

- Bitcoin rose 0.4% to $17,824.45

- Ether rose 0.2% to $1,322.72

Bonds

- The yield on 10-year Treasuries declined one basis point to 3.49%

- Germany’s 10-year yield advanced four basis points to 1.97%

- Britain’s 10-year yield advanced one basis point to 3.31%

Commodities

- West Texas Intermediate crude rose 1% to $76.14 a barrel

- Gold futures fell 0.3% to $1,820 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Richard Henderson, James Hirai and Georgina Mckay.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.