Norway’s central bank is poised to raise its key interest rate for the eighth time on Thursday in what could be the last increase in borrowing costs for the Nordic country teetering on the brink of a recession.

(Bloomberg) — Norway’s central bank is poised to raise its key interest rate for the eighth time on Thursday in what could be the last increase in borrowing costs for the Nordic country teetering on the brink of a recession.

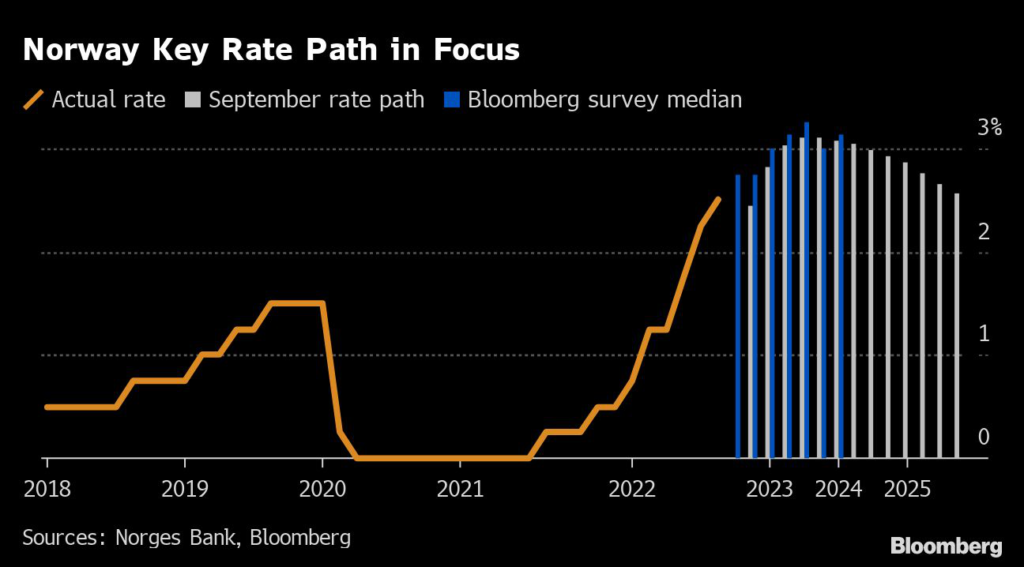

All economists surveyed by Bloomberg expect Norges Bank to raise its key rate by 25 basis points to 2.75%, the highest level since the financial crisis.

Investors will likely zero in on the outlook to see if policy makers are backtracking from their planned increase “to around 3% in the course of winter,” projected in September.

Inflation not seen since 1980s and economic growth backed by increased demand for Norway’s oil and gas have exceeded the central bank’s forecasts over the past few months and led to faster tightening over the second half of this year.

Now, policy makers may choose to cut short their planned tightening after a swathe of recent data suggests price growth has peaked and the outlook for the economy is worsening.

“I’m pretty certain that Norges Bank will deliver the expected 25 basis-point hike,” said Tina Winther Frandsen, chief economist with Jyske Bank A/S.

“Therefore the rate path will be in focus. I expect it will be lowered — but only a bit — as to show a final rate hike to 3% in the first quarter.”

Norway’s expected move will come as part of a salvo of rate announcements this week, with the Federal Reserve, the European Central Bank and the Bank of England all set to raise their key rates by 50 basis points.

Norges Bank was among the first in the rich world to start raising rates in September 2021, but its gradual moves weren’t enough to contain surging prices and it had to abandon a plan of steady 25 basis-point rate increases in June, opting instead to deliver the steepest hikes in two decades.

Inflation slowed last month from a 35-year high, while housing prices in the country that has some of the most indebted households fell for a third straight month.

The central bank’s key survey of business sentiment last week showed economic prospects are the weakest since 2009, with activity seen hit by “rapidly rising prices and costs, higher interest rates and a decline in new public sector orders.”

Several forecasters, including the central bank, expect a contraction next year in the mainland economy that excludes offshore businesses.

In contrast, the employers lobby NHO on Tuesday forecast a 0.9% expansion for 2023, and the statistics office said last week it expects growth of 1.2%. In October, the mainland economy ground to a halt due to the seasonally volatile fishing business and weaker domestic trade.

A quarter point hike is on the cards now, according to Marius Gonsholt Hov, chief economist in Oslo for Svenska Handelsbanken AB.

If policy makers publish a rate path that indicates 3% in the first quarter, they’re looking to signal that decision is dependent on data, he added. That puts the peak in the interval of 2.75% to 3%, versus previously 3% to 3.25%, he said.

“Norges Bank is likely to buy itself some time, and use the next few months to evaluate the further consequences of the tightening that has already been implemented while also retaining the option of tightening even further, if necessary,” he said.

“Norges Bank is probably not ready to shout mission fully completed.”

–With assistance from Harumi Ichikura.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.