US stocks advanced and short-term Treasuries gained as investors await the Federal Reserve’s rate decision and commentary from Chair Jerome Powell for further policy clues.

(Bloomberg) — US stocks advanced and short-term Treasuries gained as investors await the Federal Reserve’s rate decision and commentary from Chair Jerome Powell for further policy clues.

The S&P 500 and the tech-heavy Nasdaq 100 rose. The policy-sensitive two-year Treasury yield dropped, hovering around 4.18%. The dollar slipped for a second day.

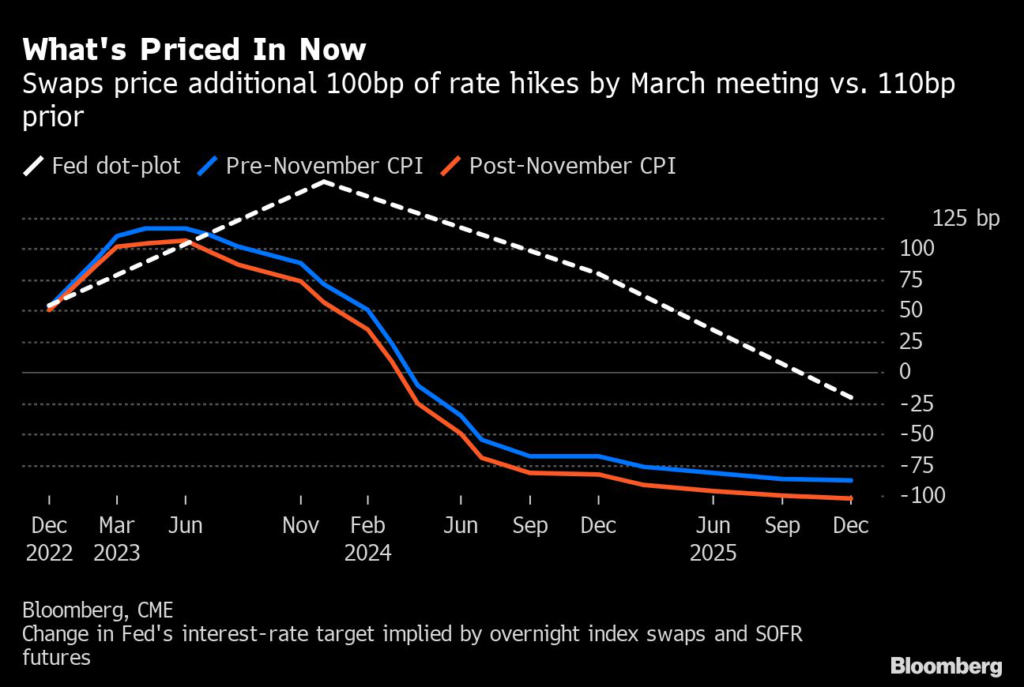

The Fed is largely expected to raise rates by 50 basis points, validated further by Tuesday’s softer US consumer price index reading. The central bank’s decision will be announced at 2 p.m. in Washington and Powell will hold a press conference 30 minutes later. Traders remain on the edge over what signals he may offer on when the hikes will stop and whether a rate cut is possible next year. Powell is likely to emphasize the Fed will remain steadfast in battling inflation.

“The whole concept that the Fed is going to pivot to us is way overdone,” said David Spika, president and chief investment officer of GuideStone Capital Management. “The bottom line is that inflation is still running over 7%, the Fed is going to have to continue to raise interest rates — Powell is going to make that very clear today.”

If Powell highlights how perplexed he is that markets have eased since the last meeting, that would be interpreted as a hawkish signal, George Goncalves, head of US macro strategy at MUFG Securities Americas Inc., said in a note.

“Markets are priced to a dovish outcome,” he said. “Anything short of it could still end up viewed as disappointing.”

In the UK, two-year gilts advanced. Inflation in the country fell from a 41-year high in November, raising the possibility that the worst of the cost-of-living squeeze is over.

Europe’s equity benchmark fell after posting the biggest single-day advance since Nov. 10 as caution prevailed over Fed’s messaging later in the day as well as expectations for rate hikes by the European Central Bank and Bank of England on Thursday.

West Texas Intermediate contracts rose for a third day and traded around $76 a barrel. Traders also weighed the demand outlook amid a rapid relaxation of Covid restrictions in China against the effect of new cases on economic activity in the country.

Key events this week:

- FOMC rate decision and Fed Chair news conference, Wednesday

- China medium-term lending, property investment, retail sales, industrial production, surveyed jobless, Thursday

- ECB rate decision and ECB President Lagarde briefing, Thursday

- Rate decisions for UK BOE, Mexico, Norway, Philippines, Switzerland, Taiwan, Thursday

- US cross-border investment, business inventories, empire manufacturing, retail sales, initial jobless claims, industrial production, Thursday

- Eurozone S&P Global PMI, CPI, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.6% as of 11:14 a.m. New York time

- The Nasdaq 100 rose 0.6%

- The Dow Jones Industrial Average rose 0.6%

- The Stoxx Europe 600 was little changed

- The MSCI World index rose 1.1%

Currencies

- The Bloomberg Dollar Spot Index fell 0.2%

- The euro rose 0.2% to $1.0649

- The British pound rose 0.3% to $1.2409

- The Japanese yen rose 0.5% to 134.87 per dollar

Cryptocurrencies

- Bitcoin rose 1.8% to $18,082.13

- Ether rose 1.2% to $1,336.01

Bonds

- The yield on 10-year Treasuries declined two basis points to 3.48%

- Germany’s 10-year yield was little changed at 1.93%

- Britain’s 10-year yield advanced three basis points to 3.33%

Commodities

- West Texas Intermediate crude rose 1.9% to $76.86 a barrel

- Gold futures fell 0.1% to $1,823.30 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Srinivasan Sivabalan and Isabelle Lee.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.